- United Kingdom

- /

- Construction

- /

- LSE:BBY

Does Balfour Beatty's (LON:BBY) Share Price Gain of 38% Match Its Business Performance?

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Balfour Beatty plc (LON:BBY) share price is 38% higher than it was a year ago, much better than the market return of around 29% (not including dividends) in the same period. So that should have shareholders smiling. The longer term returns have not been as good, with the stock price only 12% higher than it was three years ago.

See our latest analysis for Balfour Beatty

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Balfour Beatty actually saw its earnings per share drop 77%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We doubt the modest 0.5% dividend yield is doing much to support the share price. Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

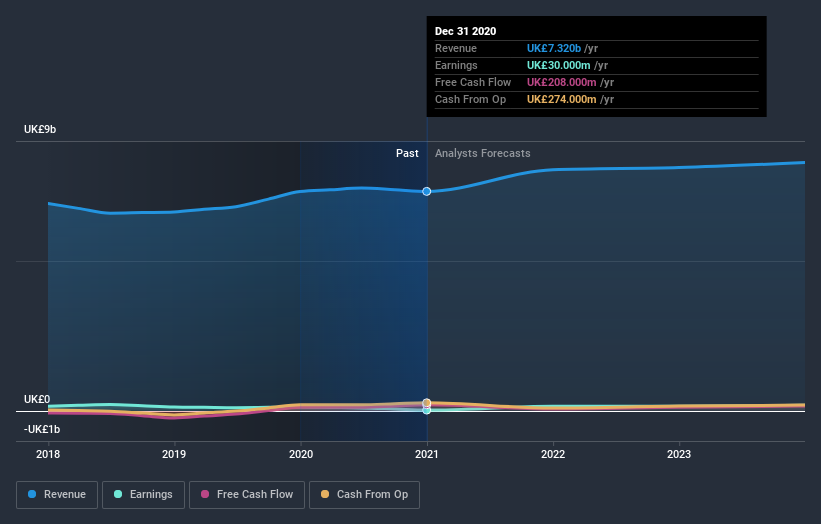

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Balfour Beatty

A Different Perspective

Balfour Beatty shareholders have received returns of 38% over twelve months (even including dividends), which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 5%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. It's always interesting to track share price performance over the longer term. But to understand Balfour Beatty better, we need to consider many other factors. For example, we've discovered 2 warning signs for Balfour Beatty (1 is significant!) that you should be aware of before investing here.

Balfour Beatty is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade Balfour Beatty, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Balfour Beatty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:BBY

Balfour Beatty

Balfour Beatty plc finances, designs, develops, builds, and maintains infrastructure in the United Kingdom, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives