- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:BAB

Is Babcock International Group (LON:BAB) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Babcock International Group PLC (LON:BAB) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Babcock International Group

What Is Babcock International Group's Debt?

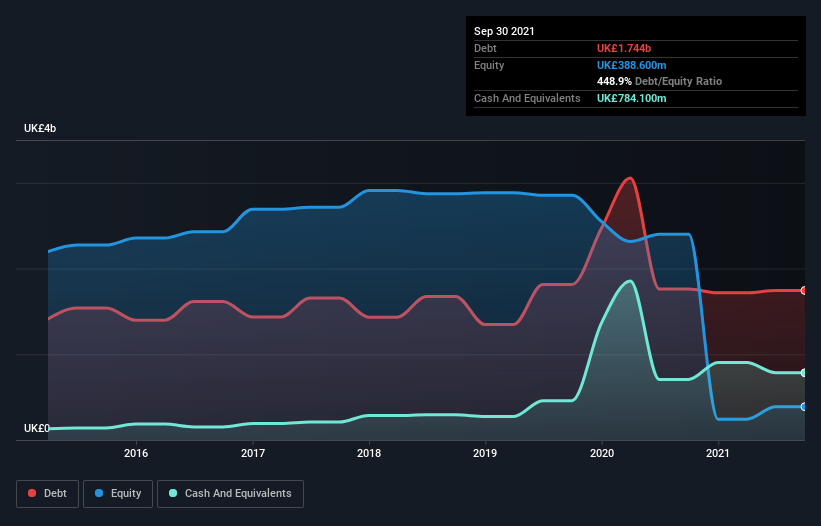

As you can see below, Babcock International Group had UK£1.74b of debt, at September 2021, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has UK£784.1m in cash leading to net debt of about UK£960.3m.

How Strong Is Babcock International Group's Balance Sheet?

We can see from the most recent balance sheet that Babcock International Group had liabilities of UK£1.99b falling due within a year, and liabilities of UK£1.97b due beyond that. On the other hand, it had cash of UK£784.1m and UK£779.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£2.40b.

When you consider that this deficiency exceeds the company's UK£1.67b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Babcock International Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Babcock International Group saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Over the last twelve months Babcock International Group produced an earnings before interest and tax (EBIT) loss. Indeed, it lost a very considerable UK£291m at the EBIT level. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. It's fair to say the loss of UK£818m didn't encourage us either; we'd like to see a profit. And until that time we think this is a risky stock. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Babcock International Group's profit, revenue, and operating cashflow have changed over the last few years.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Babcock International Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BAB

Babcock International Group

Engages in the design, development, manufacture, and integration of specialist systems for aerospace, defense, and security in the United Kingdom, rest of Europe, Africa, North America, Australasia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives