- United Kingdom

- /

- Aerospace & Defense

- /

- AIM:VEL

Velocity Composites plc (LON:VEL) Stock's 27% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Velocity Composites plc (LON:VEL) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 116% in the last twelve months.

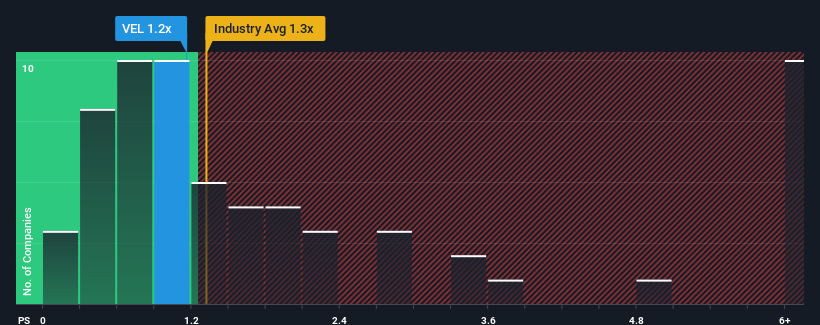

Even after such a large drop in price, it's still not a stretch to say that Velocity Composites' price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Aerospace & Defense industry in the United Kingdom, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Velocity Composites

What Does Velocity Composites' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Velocity Composites has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Velocity Composites will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Velocity Composites' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 39% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 104% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 3.5%, which is noticeably less attractive.

With this information, we find it interesting that Velocity Composites is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

With its share price dropping off a cliff, the P/S for Velocity Composites looks to be in line with the rest of the Aerospace & Defense industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at Velocity Composites' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Velocity Composites that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Velocity Composites, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:VEL

Velocity Composites

Provides engineered composite material kits and related products to the aerospace industry in the United Kingdom, Europe, the United States, and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives