- United Kingdom

- /

- Biotech

- /

- LSE:BSFA

Sosandar And 2 Other Promising Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic uncertainties. In such conditions, investors might find value in exploring smaller or newer companies that offer potential growth opportunities at lower price points. Despite their vintage name, penny stocks can still be relevant investment options when they possess strong financial foundations and clear growth trajectories.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £431.2M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.195 | £827.11M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.24 | £159.81M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.43 | £84.49M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.195 | £317.76M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.61 | £2.01B | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.435 | £182.75M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Sosandar (AIM:SOS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sosandar Plc is involved in the manufacture and distribution of clothing products through internet and mail order both in the United Kingdom and internationally, with a market cap of £16.63 million.

Operations: The company's revenue is generated from retail sales amounting to £40.30 million.

Market Cap: £16.63M

Sosandar Plc, with a market cap of £16.63 million and retail sales of £40.30 million, has demonstrated financial resilience by maintaining no debt and having short-term assets (£23.0M) that exceed both its short-term (£8.0M) and long-term liabilities (£1.7M). The company has experienced high earnings growth over the past five years but faced negative earnings growth recently (-41.3%). Despite volatile share prices, Sosandar trades significantly below estimated fair value. Recent business expansions include opening new stores in prime UK locations like Bath and Harrogate, potentially enhancing their retail footprint amidst challenging market conditions.

- Click here to discover the nuances of Sosandar with our detailed analytical financial health report.

- Explore Sosandar's analyst forecasts in our growth report.

Titon Holdings (AIM:TON)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Titon Holdings Plc designs, manufactures, and markets ventilation products and door and window fittings in the UK, South Korea, the US, and Europe with a market cap of £8.44 million.

Operations: The company generates revenue from the United Kingdom (£12.91 million), Europe and all other countries (£2.23 million), and North America (£0.78 million).

Market Cap: £8.44M

Titon Holdings Plc, with a market cap of £8.44 million, faces challenges as it reported a net loss of £3.7 million for the year ended September 30, 2024, compared to the previous year's smaller loss. Revenues declined to £15.48 million from £19.85 million, reflecting operational difficulties and market pressures. Despite having no debt and short-term assets (£9.6M) exceeding liabilities (£3M), Titon remains unprofitable with a negative return on equity (-17.95%). The board's relatively inexperienced tenure (2.8 years) may impact strategic direction amidst these financial setbacks following the decision not to pay dividends for 2024.

- Take a closer look at Titon Holdings' potential here in our financial health report.

- Evaluate Titon Holdings' historical performance by accessing our past performance report.

BSF Enterprise (LSE:BSFA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BSF Enterprise Plc develops and commercializes innovative tissue-engineered solutions, with a market cap of £3.23 million.

Operations: The company generates revenue of £0.06 million from identifying and acquiring investment projects.

Market Cap: £3.23M

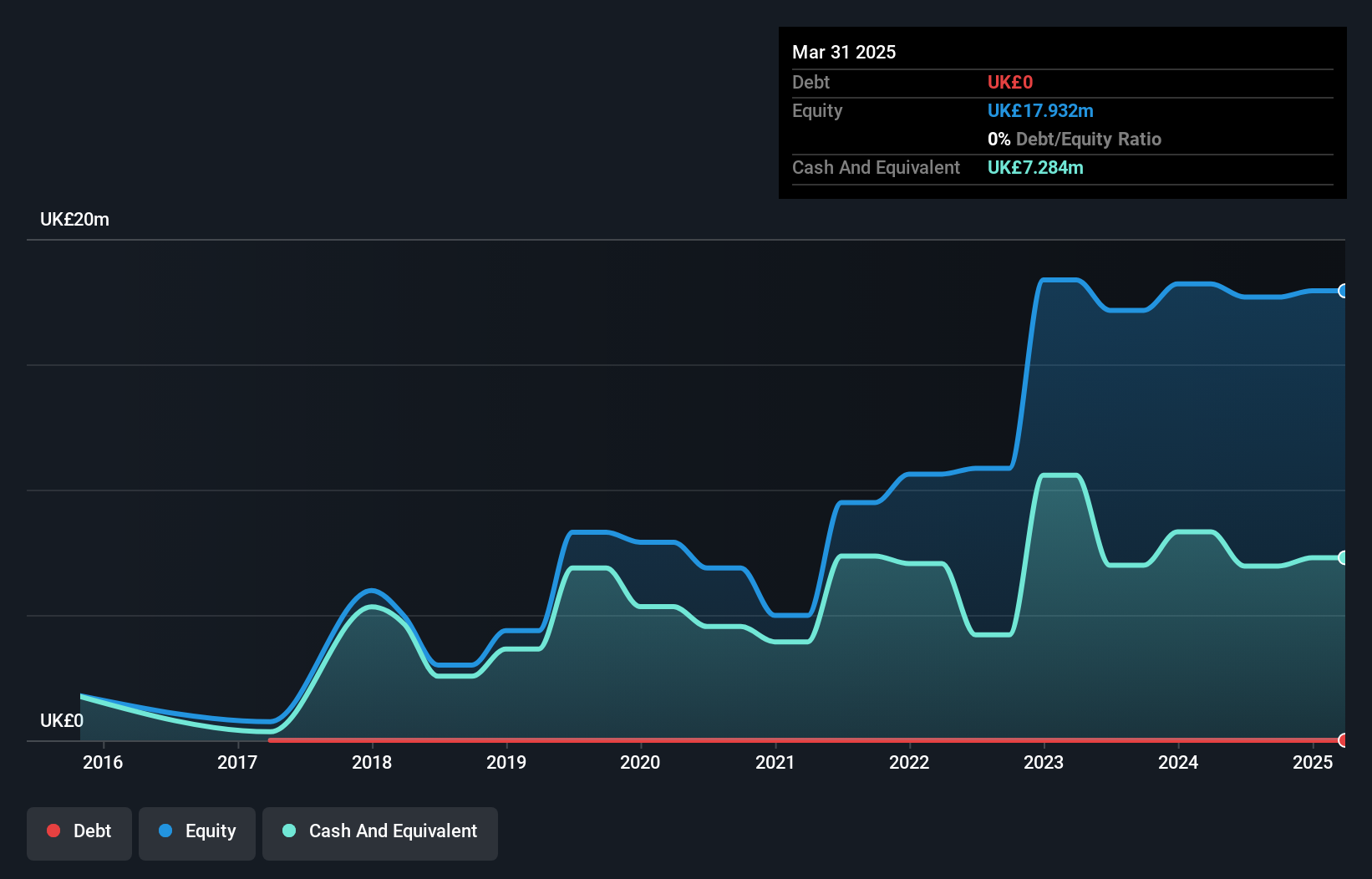

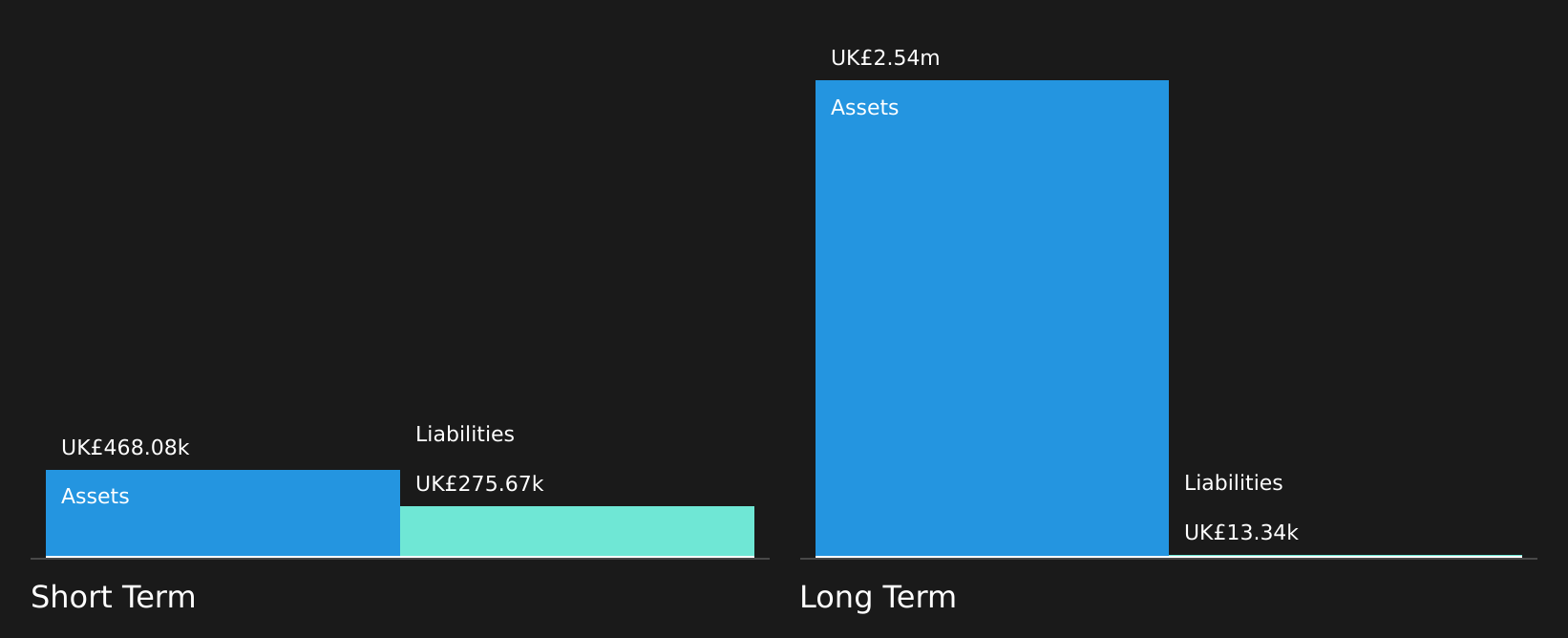

BSF Enterprise Plc, with a market cap of £3.23 million, is pre-revenue and reported a net loss of £1.67 million for the year ending September 30, 2024. The company has no debt and its short-term assets (£857.1K) surpass both short-term (£289.7K) and long-term liabilities (£15.4K). Despite raising £0.5 million through equity offerings, auditors have expressed doubts about its ability to continue as a going concern due to limited cash runway and ongoing losses increasing at an annual rate of 56.4%. The management team is experienced with an average tenure of 2.7 years.

- Get an in-depth perspective on BSF Enterprise's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into BSF Enterprise's track record.

Key Takeaways

- Investigate our full lineup of 446 UK Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BSF Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BSFA

BSF Enterprise

Develops and commercializes cutting-edge tissue-engineered solutions.

Flawless balance sheet slight.

Market Insights

Community Narratives