- United Kingdom

- /

- Building

- /

- AIM:JHD

Undiscovered Gems In United Kingdom To Explore December 2024

Reviewed by Simply Wall St

The United Kingdom market has remained flat in the last week but has shown a positive trajectory with a 7.8% increase over the past year, and earnings are expected to grow by 15% annually. In this environment, identifying stocks with strong growth potential and solid fundamentals can be key to uncovering hidden opportunities that may offer promising returns.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Law Debenture | 17.95% | 8.43% | 4.01% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Griffin Mining (AIM:GFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration and development of mineral properties, with a market cap of £274.90 million.

Operations: Griffin Mining generates revenue primarily from the Caijiaying Zinc Gold Mine, contributing $162.25 million.

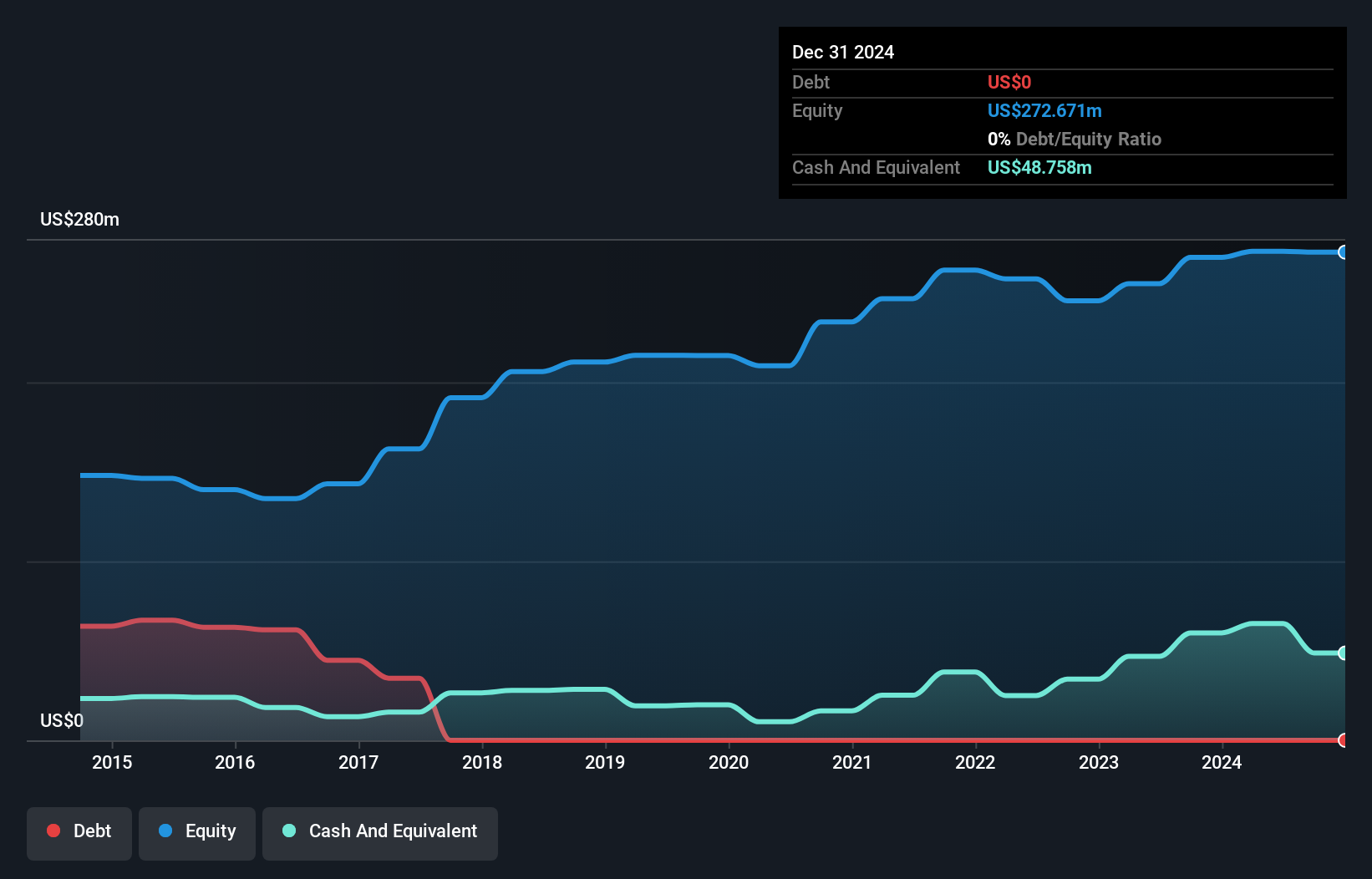

Griffin Mining, a noteworthy player in the UK's mining sector, has been making waves with its impressive earnings growth of 116.5% over the past year, outpacing the industry average. The company remains debt-free and boasts high-quality earnings, reflecting robust financial health. Recent production results show mixed outcomes; while zinc production decreased to 11,843 tonnes from 12,839 tonnes last year, gold and silver outputs rose to 4,105 Ozs and 95,276 Ozs respectively. With sales climbing to US$85.75 million for H1 2024 from US$69.52 million in the previous year and trading at a significant discount to its estimated fair value by 68%, Griffin presents an intriguing investment narrative despite forecasts of declining earnings over the next three years.

- Get an in-depth perspective on Griffin Mining's performance by reading our health report here.

Gain insights into Griffin Mining's historical performance by reviewing our past performance report.

James Halstead (AIM:JHD)

Simply Wall St Value Rating: ★★★★★★

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic uses across the United Kingdom, Europe, Scandinavia, Australasia, Asia, and other international markets with a market cap of £810.65 million.

Operations: The company generates revenue primarily through the manufacture and distribution of flooring products, amounting to £274.88 million.

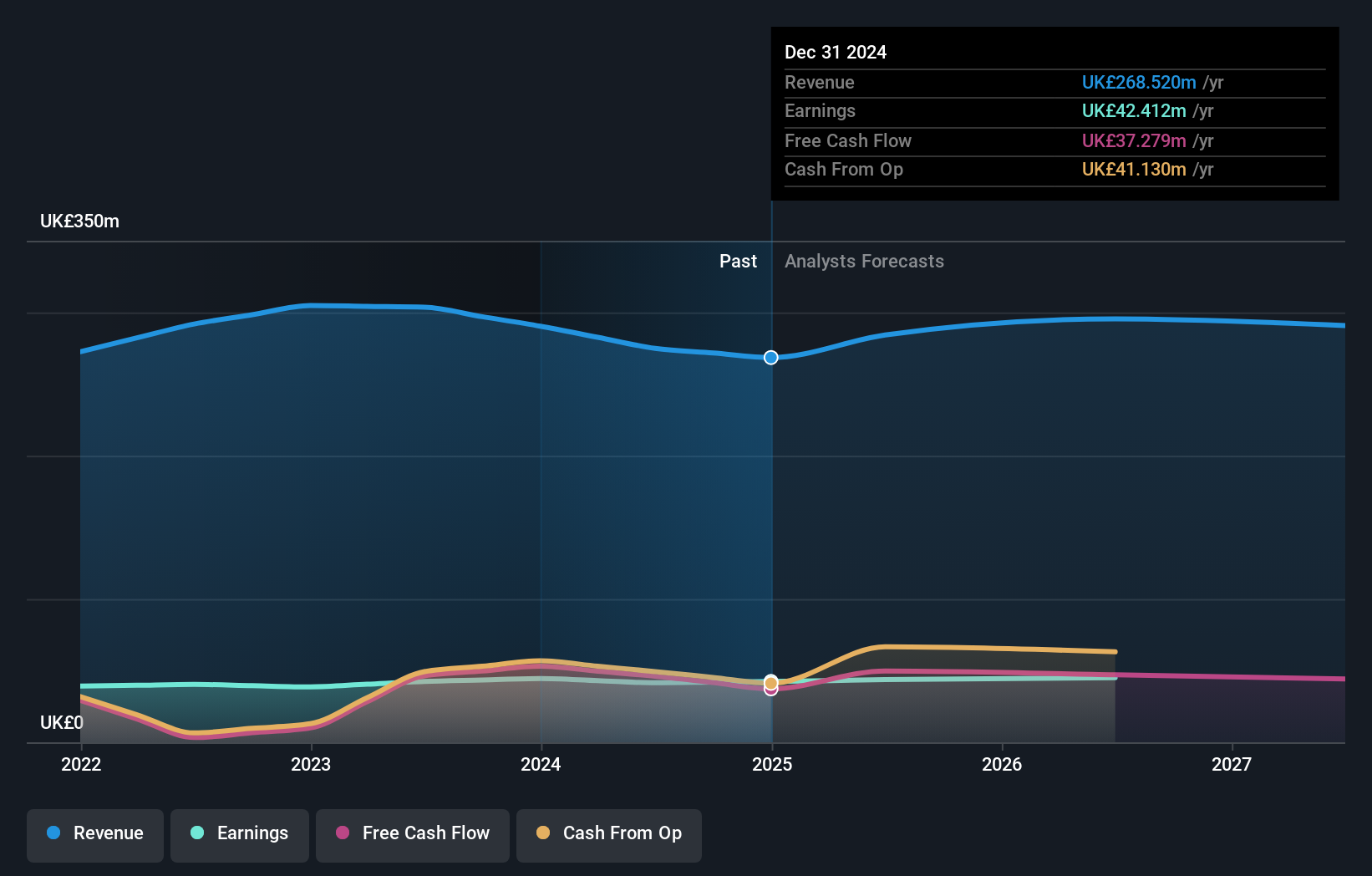

James Halstead, a UK-based flooring specialist, reflects a robust financial standing despite some challenges. The company's debt to equity ratio has improved from 0.2 to 0.1 over the past five years, indicating effective debt management. Although earnings growth was -2.1% last year, they maintain high-quality earnings and are forecasted to grow by 4.12% annually. Recent board changes saw Anthony Wild stepping down as Chairman post-AGM on December 6, 2024. Despite sales dropping to £274.88 million from £303.56 million in the previous year, net income remained relatively stable at £41.52 million compared to £42.4 million last year.

- Navigate through the intricacies of James Halstead with our comprehensive health report here.

Evaluate James Halstead's historical performance by accessing our past performance report.

FW Thorpe (AIM:TFW)

Simply Wall St Value Rating: ★★★★★☆

Overview: FW Thorpe Plc designs, manufactures, and supplies professional lighting equipment across various international markets, with a market capitalization of £382.53 million.

Operations: The company generates revenue primarily from its Thorlux segment (£103.05 million) and Netherlands Companies (£38.16 million), with additional contributions from the Zemper Group (£19.44 million) and Other Companies (£22.84 million).

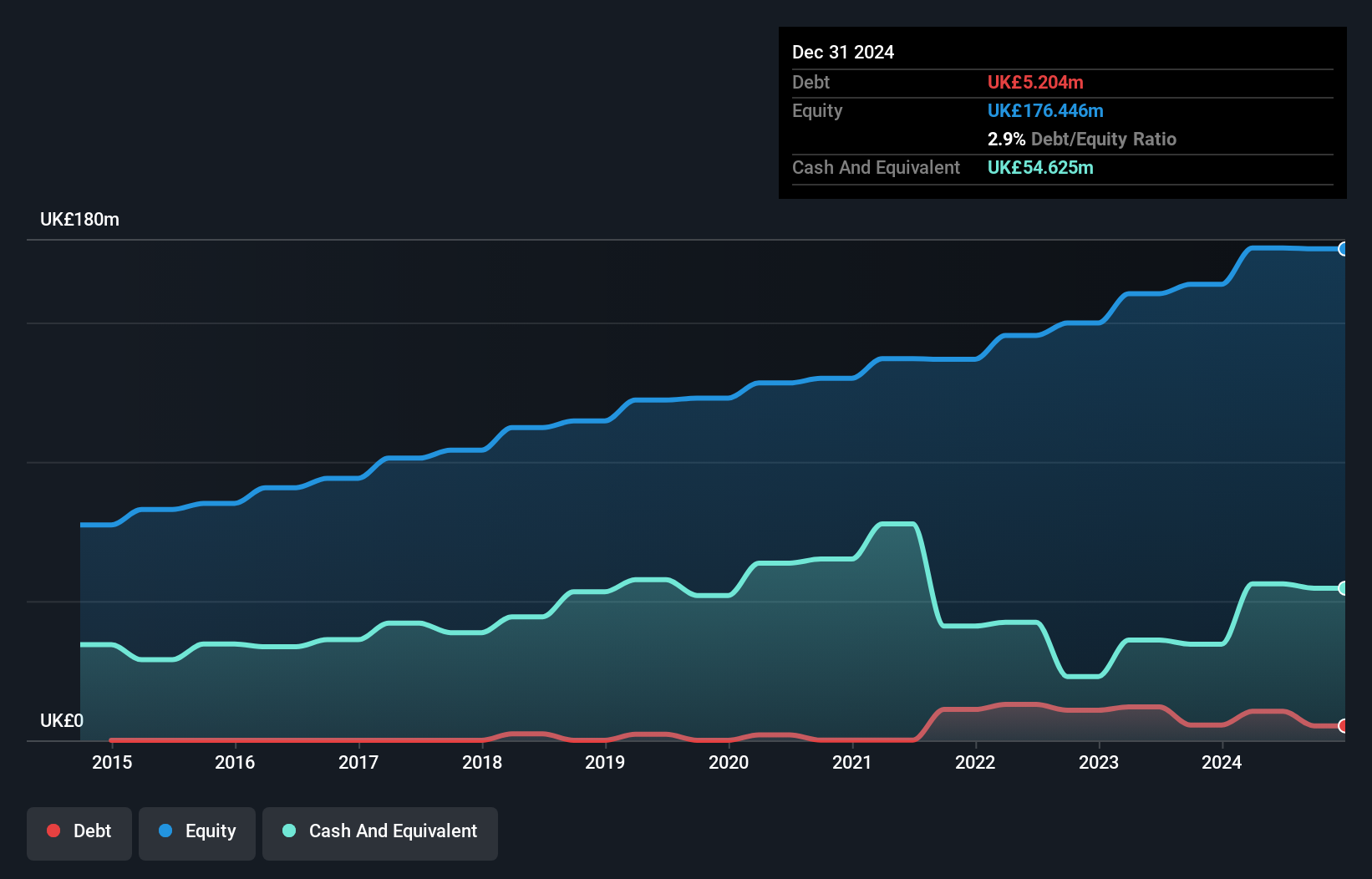

FW Thorpe, a notable player in the UK lighting industry, has shown promising financial performance. Over the past year, earnings grew by 10.8%, outpacing the electrical industry average of 3.5%. This growth is supported by high-quality earnings and free cash flow positivity, with levered free cash flow reaching £34.08 million as of June 2024. Despite an increased debt-to-equity ratio from 1.8% to 5.9% over five years, the company holds more cash than total debt, indicating sound financial health. Recent announcements include a proposed final dividend of £5.96 million and a special dividend of £2.93 million for shareholders' consideration at their upcoming AGM.

- Click to explore a detailed breakdown of our findings in FW Thorpe's health report.

Explore historical data to track FW Thorpe's performance over time in our Past section.

Summing It All Up

- Investigate our full lineup of 70 UK Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade James Halstead, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JHD

James Halstead

Manufactures and supplies flooring products for commercial and domestic uses in the United Kingdom, rest of Europe, Scandinavia, Australasia, Asia, and internationally.

Flawless balance sheet established dividend payer.