- United Kingdom

- /

- Electrical

- /

- AIM:TFW

Undiscovered Gems in the United Kingdom for May 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index grapples with the ripple effects of sluggish trade data from China, particularly impacting commodity-linked companies, investors are increasingly turning their attention to smaller-cap stocks that might offer untapped potential in a challenging global environment. In this context, identifying promising small-cap stocks involves looking for companies with strong fundamentals and resilience to external economic pressures, making them potential undiscovered gems in today’s market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| MS INTERNATIONAL | NA | 13.42% | 56.55% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Integrated Diagnostics Holdings | 7.57% | 13.26% | 2.67% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

| Law Debenture | 17.80% | 11.81% | 7.59% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

M.P. Evans Group (AIM:MPE)

Simply Wall St Value Rating: ★★★★★★

Overview: M.P. Evans Group PLC, through its subsidiaries, owns and develops oil palm plantations in Indonesia and Malaysia, with a market capitalization of £546.84 million.

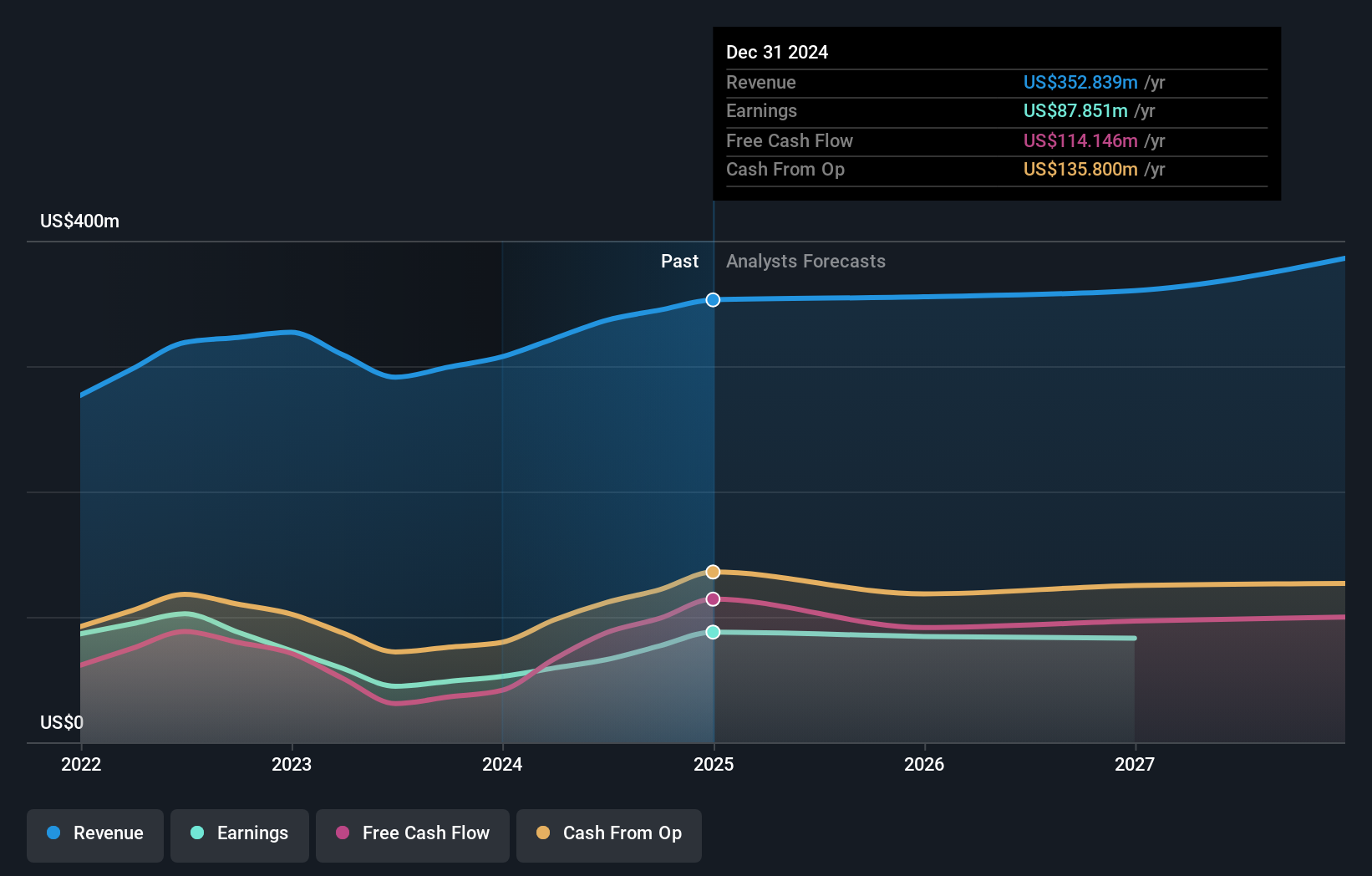

Operations: The primary revenue stream for M.P. Evans Group is its Indonesian plantation operations, generating $352.84 million.

M.P. Evans Group, a UK-based player in the palm oil industry, has demonstrated robust financial growth with earnings surging 67.4% over the past year, surpassing its industry's average of 11.1%. The company reduced its debt to equity ratio from 25.7% to 6.2% over five years and trades at a significant discount of 66.2% below estimated fair value, reflecting potential undervaluation in the market. Despite these strengths, challenges such as environmental risks and dependency on Indonesian operations present hurdles; however, strategic land acquisitions aim to bolster future production capabilities and revenue streams amidst these concerns.

FW Thorpe (AIM:TFW)

Simply Wall St Value Rating: ★★★★★☆

Overview: FW Thorpe Plc designs, manufactures, and supplies professional lighting equipment across various international markets and has a market cap of £353.11 million.

Operations: The company generates revenue primarily from its Thorlux segment (£105.34 million) and Netherlands Companies (£36.63 million), with additional contributions from the Zemper Group (£20.63 million) and other companies (£23.05 million).

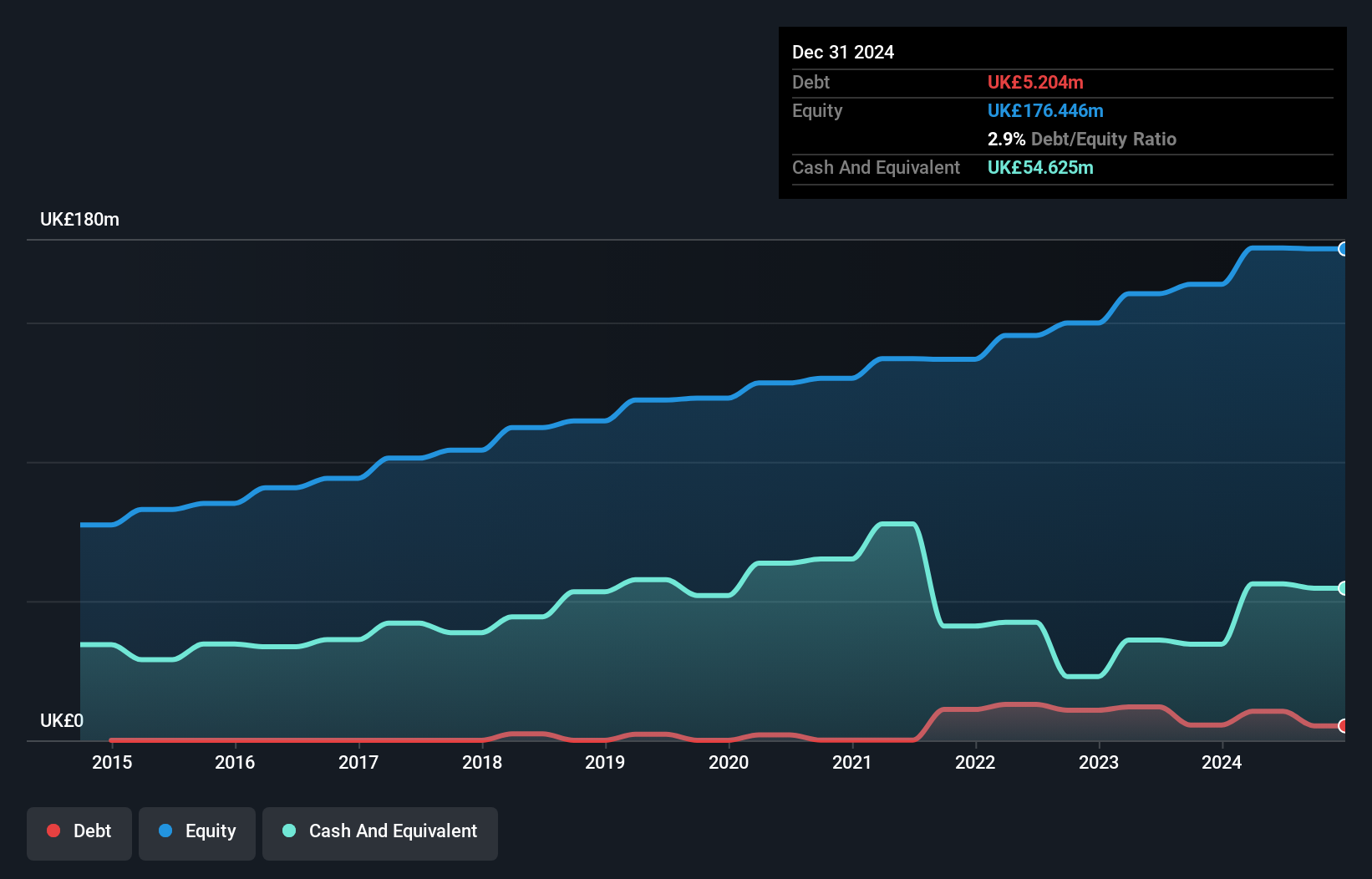

FW Thorpe, a small player in the electrical industry, is making waves with its robust financial health and strategic moves. The company boasts high-quality earnings and has seen an 11.7% growth in profits over the past year, outpacing the industry's 7.8%. Trading at a significant discount of 57% below its estimated fair value, it offers potential upside for investors. Despite a slight increase in debt to equity from 0% to 2.9% over five years, FW Thorpe remains financially sound with more cash than total debt and positive free cash flow of £34 million as of September 2024. Recent share repurchase plans further indicate confidence in future prospects.

- Take a closer look at FW Thorpe's potential here in our health report.

Gain insights into FW Thorpe's historical performance by reviewing our past performance report.

LSL Property Services (LSE:LSL)

Simply Wall St Value Rating: ★★★★★☆

Overview: LSL Property Services plc operates in the United Kingdom, offering business-to-business services to mortgage intermediaries and estate agent franchisees, as well as valuation services to lenders, with a market cap of £293.89 million.

Operations: LSL Property Services generates revenue primarily from three segments: Financial Services (£48.40 million), Surveying and Valuation (£97.82 million), and Estate Agency (£26.96 million). The Surveying and Valuation segment contributes the largest portion of revenue, highlighting its significance in the company's overall financial structure.

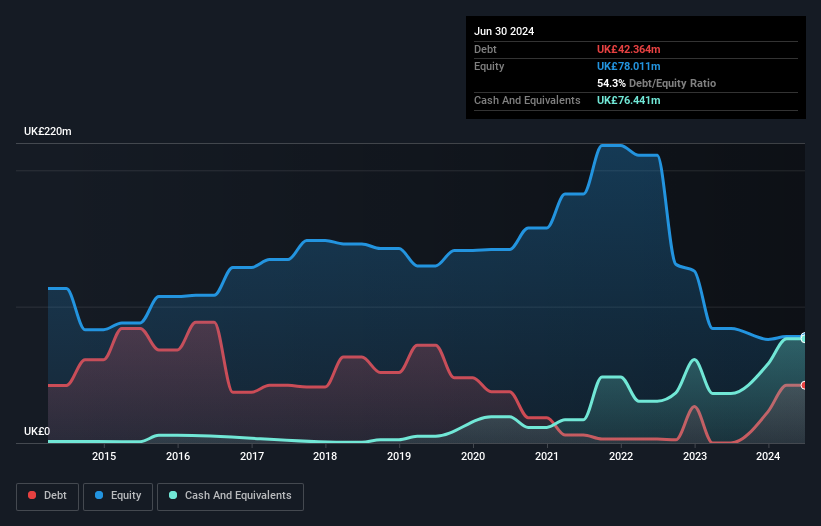

LSL Property Services, a notable player in the UK real estate sector, has shown impressive financial strides lately. With earnings growth of 119% over the past year, it outpaced its industry peers' 31% increase. The company reported sales of £173.18 million for 2024, up from £144.42 million previously, and turned a net income of £17.36 million from a prior loss of £38 million. Despite an increased debt-to-equity ratio from 33.9% to 38.6% over five years, LSL remains financially robust with more cash than total debt and trades at approximately 58% below its estimated fair value.

- Click here and access our complete health analysis report to understand the dynamics of LSL Property Services.

Assess LSL Property Services' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 53 UK Undiscovered Gems With Strong Fundamentals now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TFW

FW Thorpe

Designs, manufactures, and supplies professional lighting equipment in the United Kingdom, Ireland, the United Arab Emirates, Australia, the Netherlands, Germany, France, Spain, rest of Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives