- United Kingdom

- /

- Real Estate

- /

- AIM:TPFG

Undiscovered Gems in the United Kingdom for August 2024

Reviewed by Simply Wall St

The United Kingdom market has recently faced challenges, with the FTSE 100 closing lower amid weak trade data from China and global economic uncertainties. Despite these headwinds, there remain opportunities for discerning investors to uncover promising small-cap stocks that may offer growth potential in a turbulent market environment. When evaluating potential investments, it's crucial to consider companies with strong fundamentals and resilience in their business models. In this article, we will explore three undiscovered gems in the UK market that could stand out amid current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 49.06% | 17.05% | 17.70% | ★★★★★☆ |

| Goodwin | 59.96% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

FW Thorpe (AIM:TFW)

Simply Wall St Value Rating: ★★★★★☆

Overview: FW Thorpe Plc, with a market cap of £422.43 million, designs, manufactures, and supplies professional lighting equipment in the United Kingdom, the Netherlands, Germany, rest of Europe, and internationally.

Operations: Thorlux generates £104.65 million in revenue, followed by Netherlands Companies with £37.80 million and Other Companies contributing £23.10 million. Zemper Group adds another £19.62 million to the total revenue stream.

FW Thorpe, a small cap in the UK, has demonstrated high-quality earnings and positive free cash flow. Over the past year, earnings grew by 2.6%, outpacing the Electrical industry’s -3.9%. The company’s debt to equity ratio increased from 0% to 3.3% over five years but remains manageable with more cash than total debt and interest payments covered by EBIT at an impressive 2805x. Trading at a significant discount of 51% below estimated fair value, FW Thorpe appears undervalued.

- Click here to discover the nuances of FW Thorpe with our detailed analytical health report.

Examine FW Thorpe's past performance report to understand how it has performed in the past.

Property Franchise Group (AIM:TPFG)

Simply Wall St Value Rating: ★★★★★★

Overview: The Property Franchise Group PLC, with a market cap of £288.58 million, manages and leases residential real estate properties in the United Kingdom.

Operations: The company generates revenue primarily from property franchising (£25.78 million) and financial services (£1.50 million).

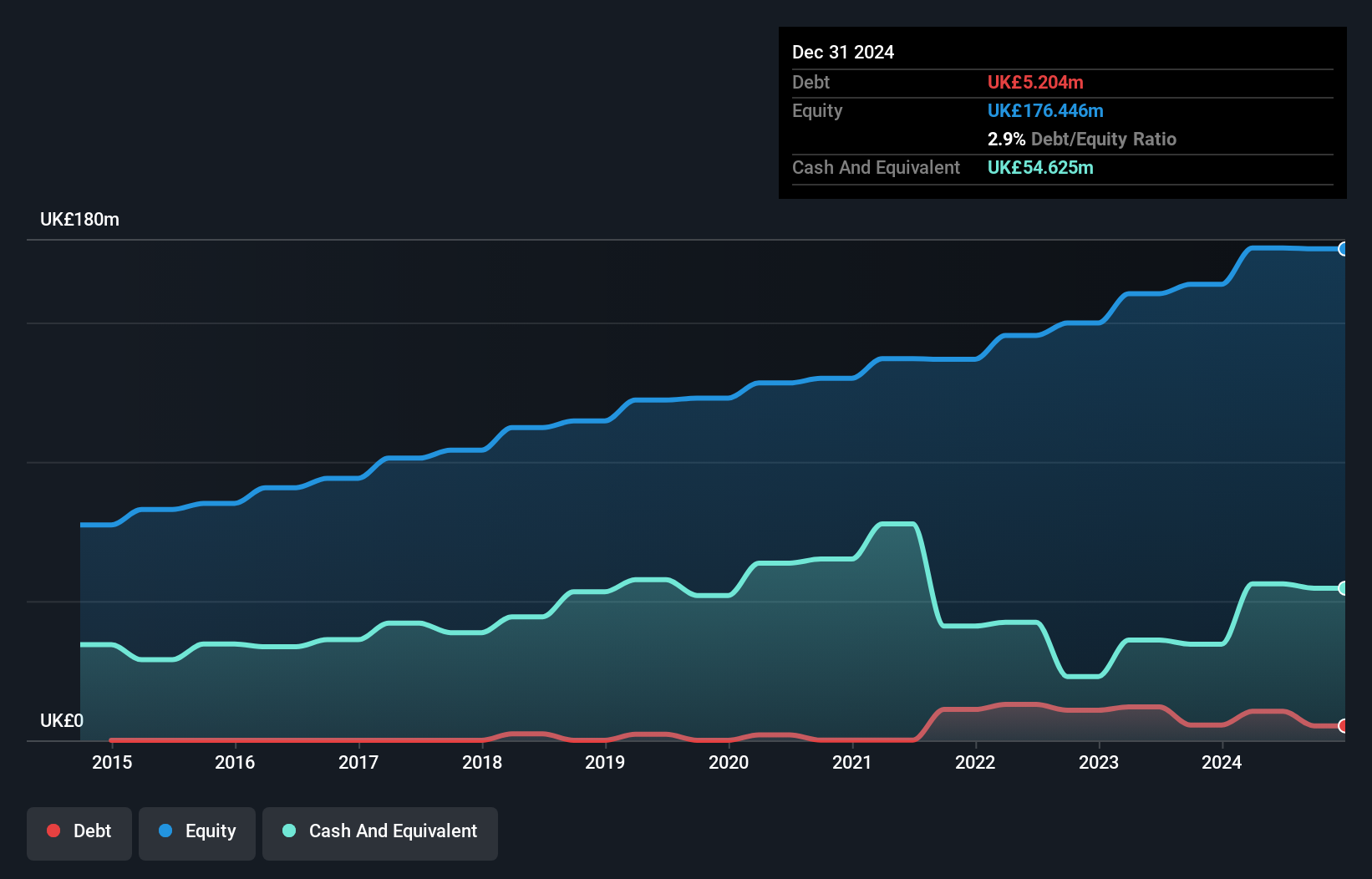

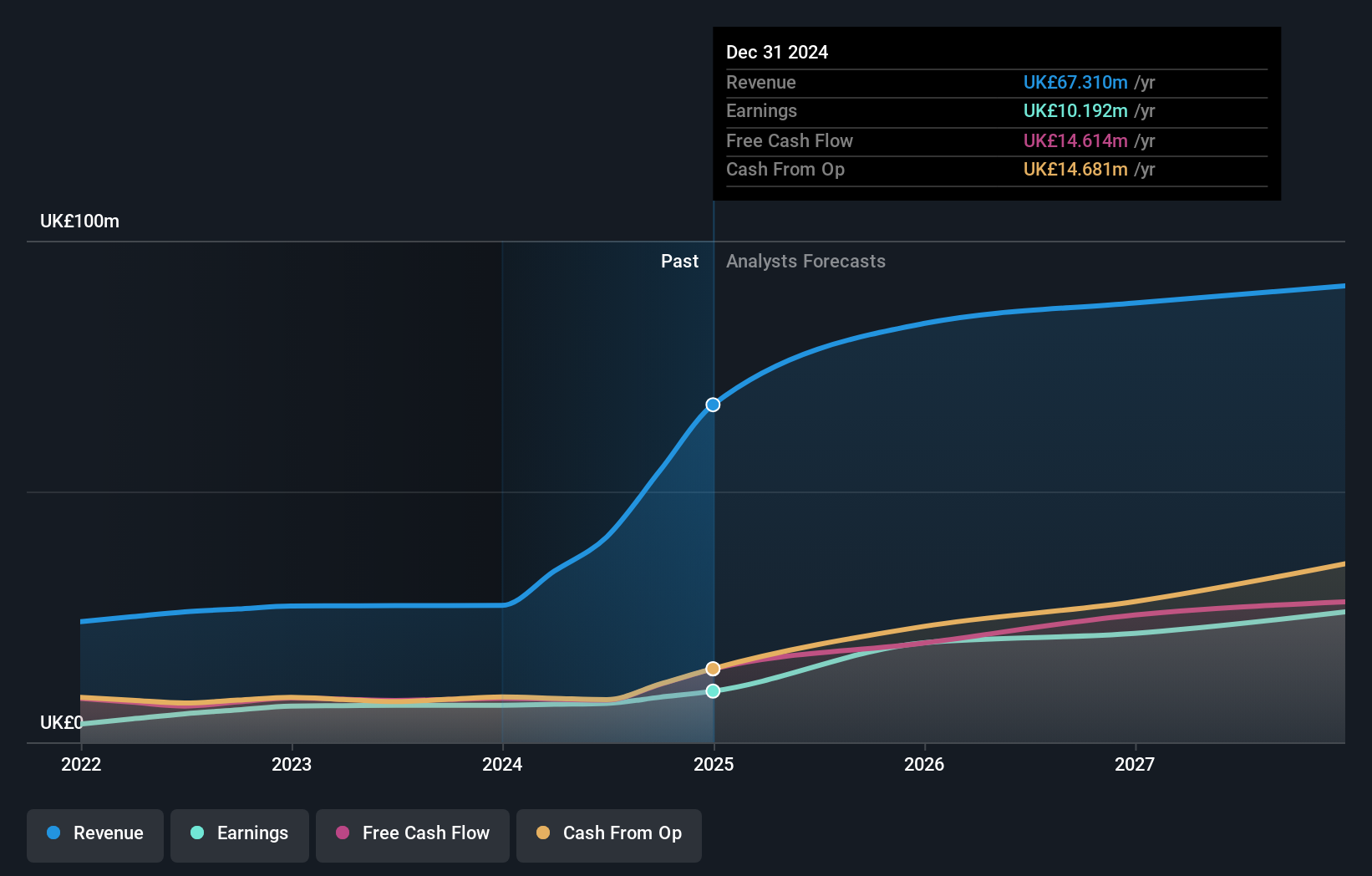

Trading at 60.4% below its estimated fair value, Property Franchise Group (TPFG) has reduced its debt to equity ratio from 10.2 to 6.1 over five years, indicating prudent financial management. Despite high-quality earnings and a robust EBIT coverage of interest payments at 26.6x, shareholders faced substantial dilution in the past year. Earnings have grown by an impressive annual rate of 20.6% over five years with forecasts suggesting a further growth of 36.71%.

- Get an in-depth perspective on Property Franchise Group's performance by reading our health report here.

Evaluate Property Franchise Group's historical performance by accessing our past performance report.

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Goodwin PLC, with a market cap of £570.73 million, offers mechanical and refractory engineering solutions across the United Kingdom, Europe, the United States, the Pacific Basin, and internationally.

Operations: Goodwin PLC generates revenue primarily from its Mechanical Engineering segment (£156.94 million) and Refractory Engineering segment (£75.86 million).

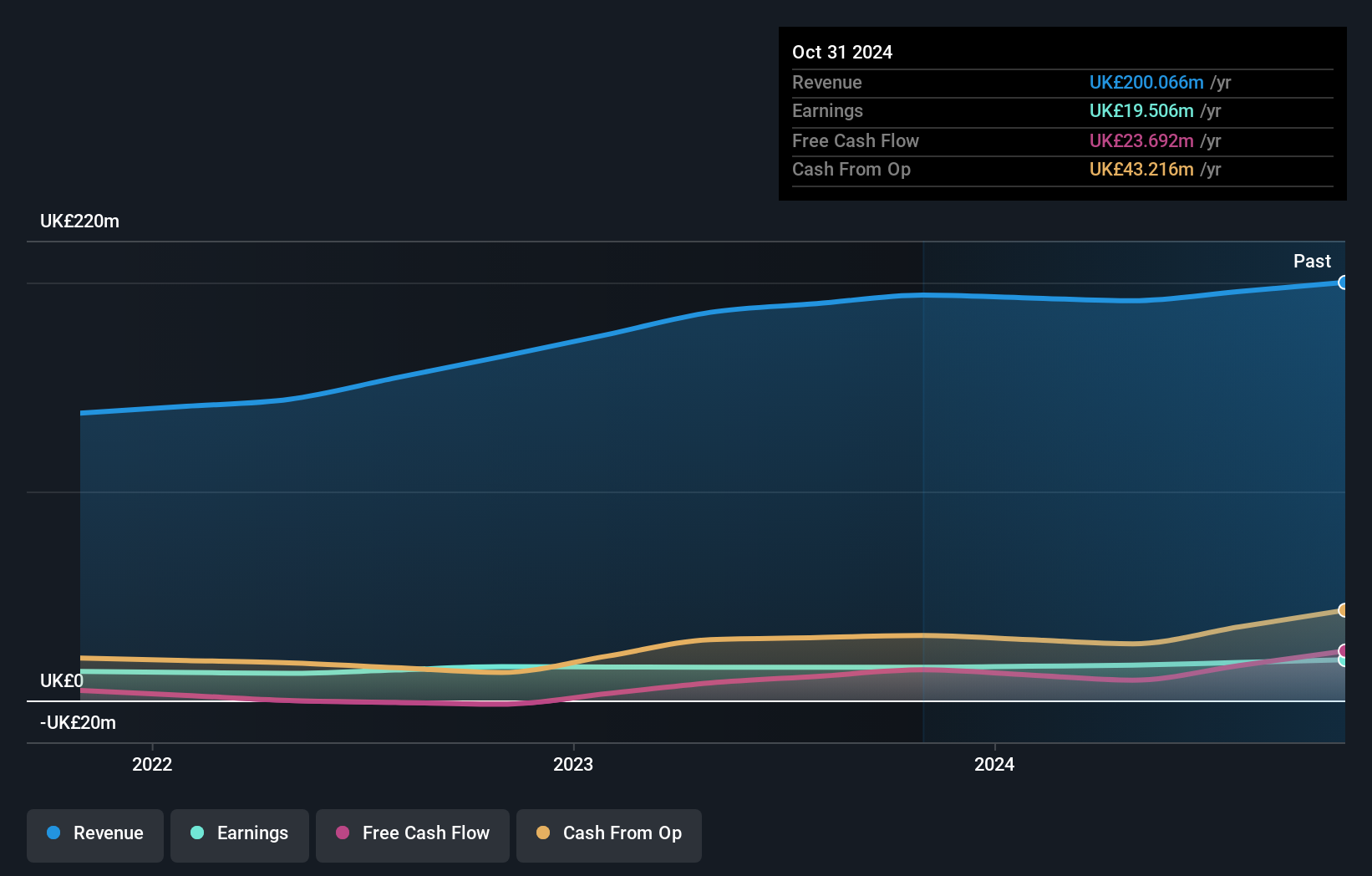

Goodwin, a UK-based firm, has shown impressive earnings growth of 6.3% over the past year, outpacing the Machinery industry’s -4.7%. The company reported sales of £191.26 million and net income of £16.9 million for the full year ending April 2024. Goodwin's debt to equity ratio increased to 60% over five years, but its interest payments are comfortably covered by EBIT at 9.8x coverage. Additionally, it was recently added to multiple FTSE indices, reflecting growing market recognition.

- Unlock comprehensive insights into our analysis of Goodwin stock in this health report.

Review our historical performance report to gain insights into Goodwin's's past performance.

Where To Now?

- Unlock more gems! Our UK Undiscovered Gems With Strong Fundamentals screener has unearthed 77 more companies for you to explore.Click here to unveil our expertly curated list of 80 UK Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TPFG

Property Franchise Group

Engages in residential property franchise, and licensing and financial services businesses in the United Kingdom.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives