- United Kingdom

- /

- Electrical

- /

- AIM:TFW

Undiscovered Gems In The UK Stocks To Explore November 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has been experiencing turbulence, with the FTSE 100 and FTSE 250 indices both closing lower amid concerns over weak trade data from China, which continues to impact global markets. As investors navigate these challenging conditions, identifying stocks that demonstrate resilience and potential for growth becomes crucial; this article explores three lesser-known UK stocks that may offer unique opportunities in the current economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Globaltrans Investment | 8.54% | 5.28% | 22.11% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Central Asia Metals (AIM:CAML)

Simply Wall St Value Rating: ★★★★★★

Overview: Central Asia Metals plc is a base metals producer with a market capitalization of £295.06 million.

Operations: Central Asia Metals generates revenue primarily from its Sasa and Kounrad operations, contributing $81.49 million and $117.70 million respectively.

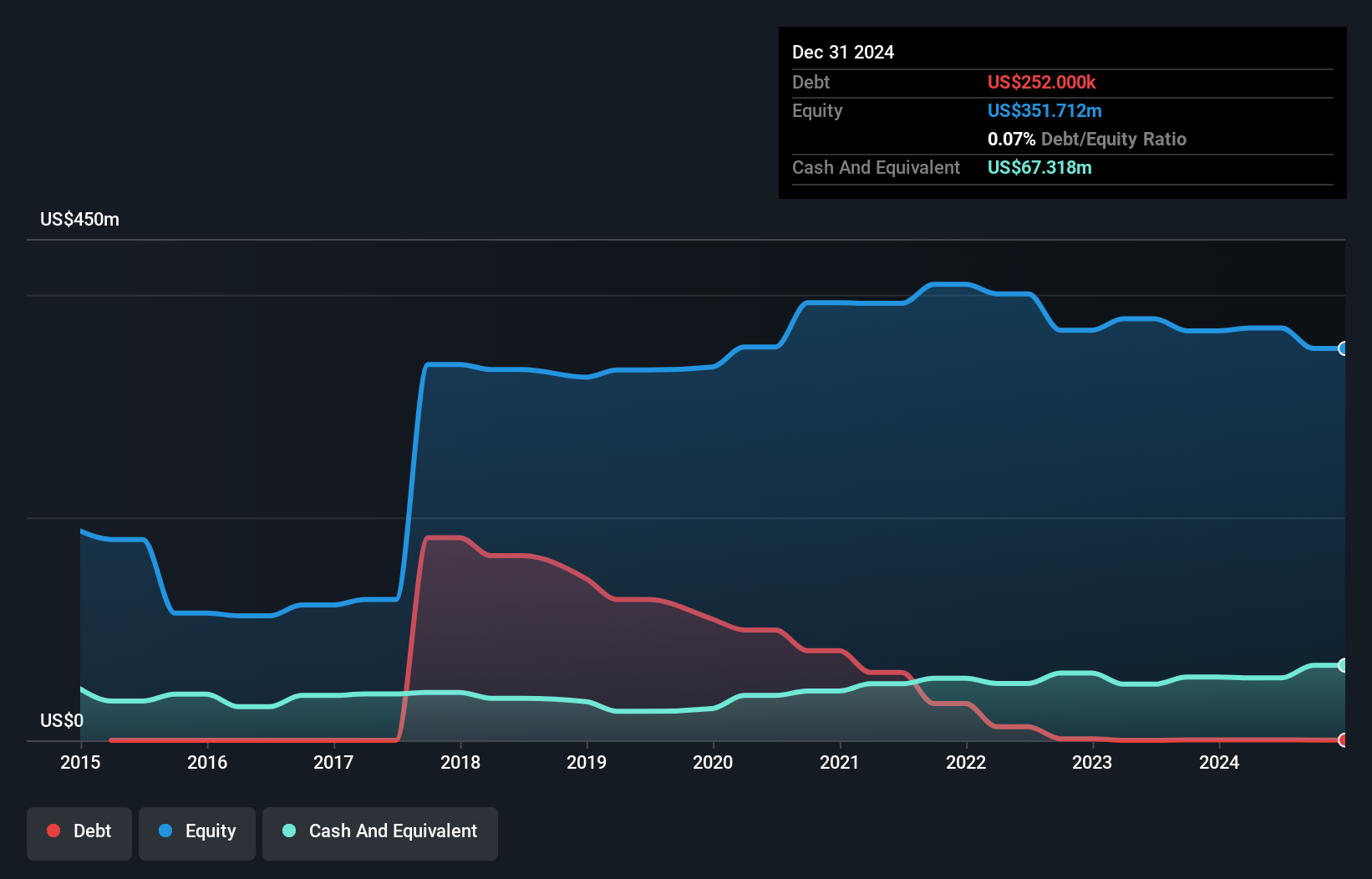

Central Asia Metals, a notable player in the metals and mining sector, has demonstrated impressive financial resilience. Over the past year, earnings skyrocketed by 2874.7%, significantly outpacing industry growth of 13%. The company trades at approximately 70.9% below its estimated fair value, indicating potential undervaluation. With a debt-to-equity ratio reduced from 38% to just 0.1% over five years, CAML's financial health appears robust. Recent executive changes saw Gavin Ferrar transition from CFO to CEO as of October 2024, continuing strategic leadership amidst strong earnings and net income growth reported for H1 2024 at US$23.79 million compared to US$21.01 million previously.

- Navigate through the intricacies of Central Asia Metals with our comprehensive health report here.

Assess Central Asia Metals' past performance with our detailed historical performance reports.

Kitwave Group (AIM:KITW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kitwave Group plc operates as a wholesale business in the United Kingdom with a market capitalization of £269.07 million.

Operations: Kitwave Group generates revenue primarily from three segments: Ambient (£225.98 million), Foodservice (£191.60 million), and Frozen & Chilled (£229.17 million).

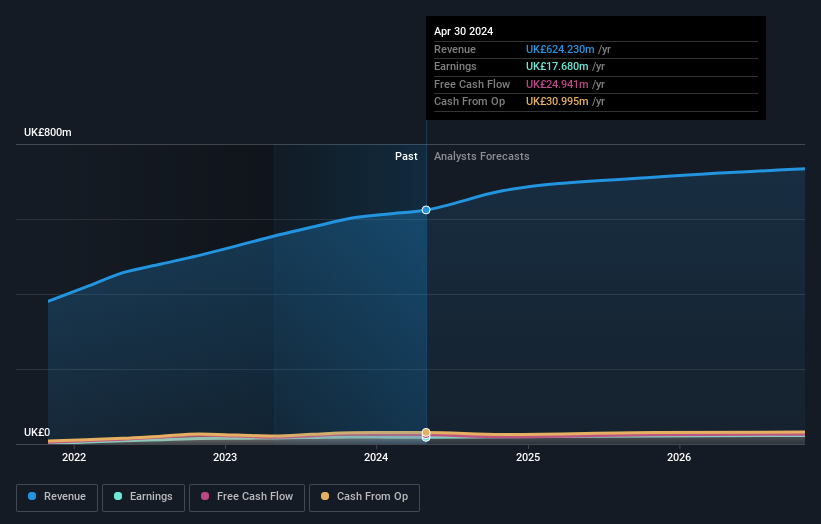

Kitwave Group, a promising player in the UK market, has shown significant improvement with positive shareholder equity after being negative five years ago. Despite a high net debt to equity ratio of 56.6%, its interest payments are well covered by EBIT at 5.7 times coverage, indicating manageable debt levels. The recent follow-on equity offering of £31.5 million suggests strategic capital raising efforts, though it resulted in shareholder dilution this year. Trading at 59% below estimated fair value and with earnings forecasted to grow annually by 18%, Kitwave seems poised for potential growth despite industry challenges.

- Delve into the full analysis health report here for a deeper understanding of Kitwave Group.

Gain insights into Kitwave Group's past trends and performance with our Past report.

FW Thorpe (AIM:TFW)

Simply Wall St Value Rating: ★★★★★☆

Overview: FW Thorpe Plc designs, manufactures, and supplies professional lighting equipment across various international markets and has a market cap of £415.39 million.

Operations: The company's revenue primarily comes from its Thorlux segment, generating £103.05 million, followed by the Netherlands Companies at £38.16 million and Other Companies contributing £22.84 million. The Zemper Group adds another £19.44 million to the revenue stream.

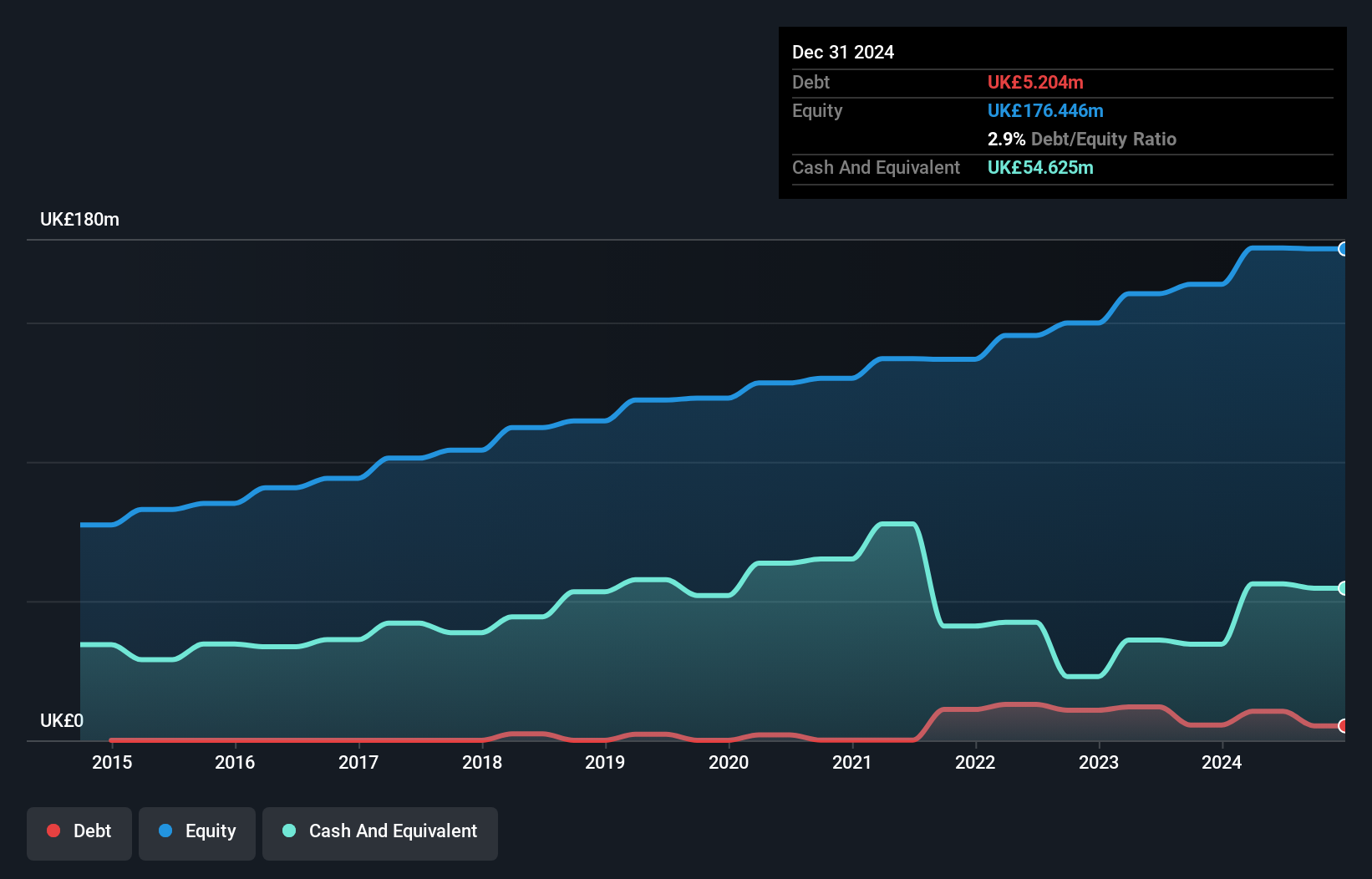

FW Thorpe, a nimble player in the electrical sector, showcases robust financial health with earnings growth of 10.8% over the past year, outpacing its industry peers. Trading at 61.9% below estimated fair value, it offers potential upside for investors seeking undervalued opportunities. The company has more cash than total debt and high-quality earnings reinforce its strong position. Recent results highlight net income of £24.31 million compared to £21.93 million last year and an increased dividend proposal of 5.08p per share alongside a special dividend of 2.50p per share, reflecting confidence in future performance despite slightly lower sales at £175.8 million from £176.75 million previously.

Where To Now?

- Get an in-depth perspective on all 79 UK Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TFW

FW Thorpe

Designs, manufactures, and supplies professional lighting equipment in the United Kingdom, Ireland, the United Arab Emirates, Australia, the Netherlands, Germany, France, Spain, rest of Europe, and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives