- United Kingdom

- /

- Electrical

- /

- AIM:TFW

Most Shareholders Will Probably Agree With FW Thorpe Plc's (LON:TFW) CEO Compensation

CEO Mike Allcock has done a decent job of delivering relatively good performance at FW Thorpe Plc (LON:TFW) recently. As shareholders go into the upcoming AGM on 17 November 2022, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. We present our case of why we think CEO compensation looks fair.

View our latest analysis for FW Thorpe

Comparing FW Thorpe Plc's CEO Compensation With The Industry

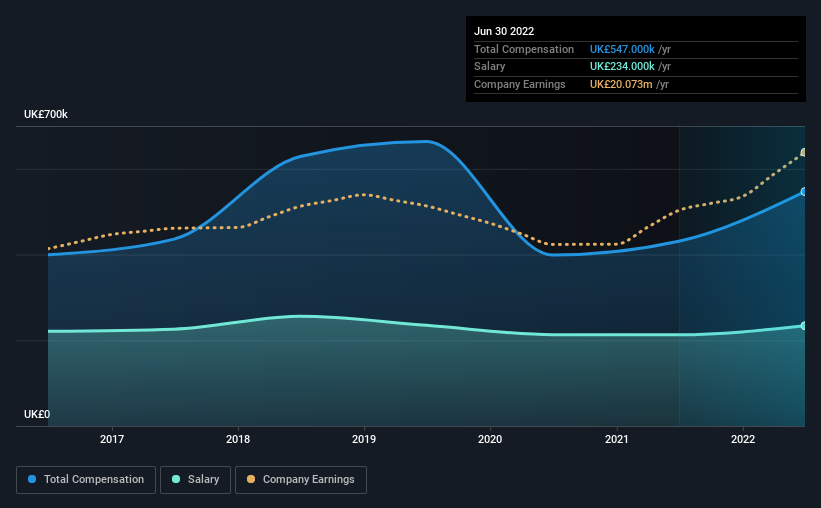

According to our data, FW Thorpe Plc has a market capitalization of UK£513m, and paid its CEO total annual compensation worth UK£547k over the year to June 2022. That's a notable increase of 27% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at UK£234k.

For comparison, other companies in the same industry with market capitalizations ranging between UK£172m and UK£686m had a median total CEO compensation of UK£703k. This suggests that FW Thorpe remunerates its CEO largely in line with the industry average. Moreover, Mike Allcock also holds UK£909k worth of FW Thorpe stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | UK£234k | UK£213k | 43% |

| Other | UK£313k | UK£218k | 57% |

| Total Compensation | UK£547k | UK£431k | 100% |

Speaking on an industry level, nearly 37% of total compensation represents salary, while the remainder of 63% is other remuneration. According to our research, FW Thorpe has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at FW Thorpe Plc's Growth Numbers

FW Thorpe Plc has seen its earnings per share (EPS) increase by 7.2% a year over the past three years. It achieved revenue growth of 22% over the last year.

We think the revenue growth is good. And, while modest, the EPS growth is noticeable. Although we'll stop short of calling the stock a top performer, we think the company has potential. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has FW Thorpe Plc Been A Good Investment?

We think that the total shareholder return of 67%, over three years, would leave most FW Thorpe Plc shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling FW Thorpe (free visualization of insider trades).

Switching gears from FW Thorpe, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TFW

FW Thorpe

Designs, manufactures, and supplies professional lighting equipment in the United Kingdom, the Netherlands, Germany, rest of Europe, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026