- United Kingdom

- /

- Electrical

- /

- AIM:TFW

Kitwave Group And 2 Other Undiscovered Gems In The United Kingdom

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has remained flat, though it has seen a 7.0% increase over the past year with earnings forecast to grow by 14% annually. In this environment, identifying promising stocks like Kitwave Group and others requires a keen eye for companies with strong growth potential and unique market positions that stand out amidst broader trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Kitwave Group (AIM:KITW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kitwave Group plc operates as a wholesale business in the United Kingdom with a market capitalization of £267.46 million.

Operations: Kitwave Group generates revenue through three main segments: Ambient (£225.98 million), Foodservice (£191.60 million), and Frozen & Chilled (£229.17 million).

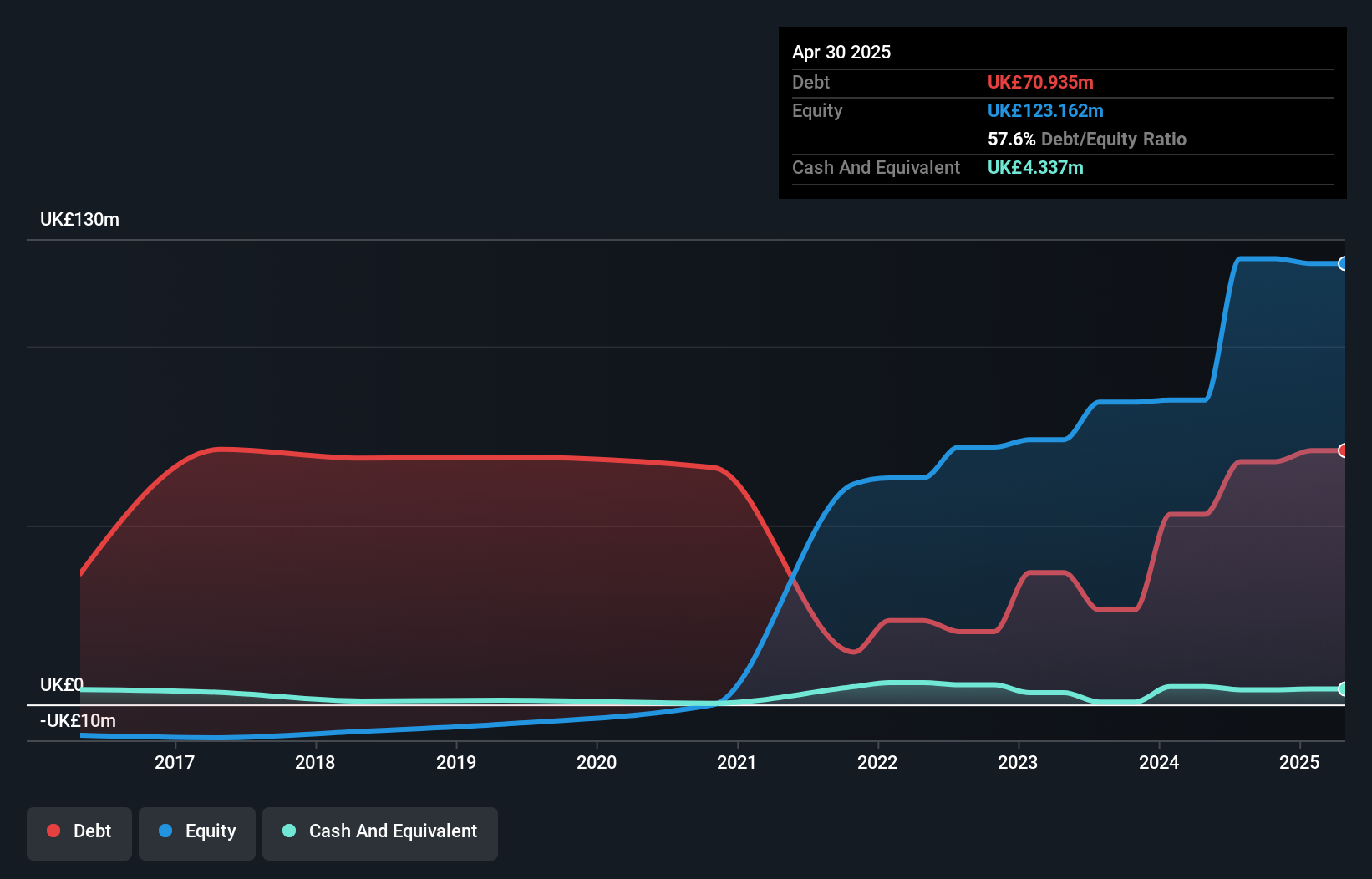

Kitwave Group, a promising player in the UK market, has seen earnings grow 40% annually over the past five years. Despite trading at 59.6% below its estimated fair value, it faces challenges with a high net debt to equity ratio of 56.6%. Recent developments include a £31 million follow-on equity offering at £3.05 per share, suggesting strategic capital raising efforts. Although its earnings growth of 8.7% lagged slightly behind industry rates, EBIT covers interest payments well at 5.7x coverage.

FW Thorpe (AIM:TFW)

Simply Wall St Value Rating: ★★★★★☆

Overview: FW Thorpe Plc designs, manufactures, and supplies professional lighting equipment in various regions including the United Kingdom and internationally, with a market cap of approximately £393.10 million.

Operations: Thorlux is the primary revenue segment, generating £103.05 million, followed by Netherlands Companies at £38.16 million and Zemper Group at £19.44 million.

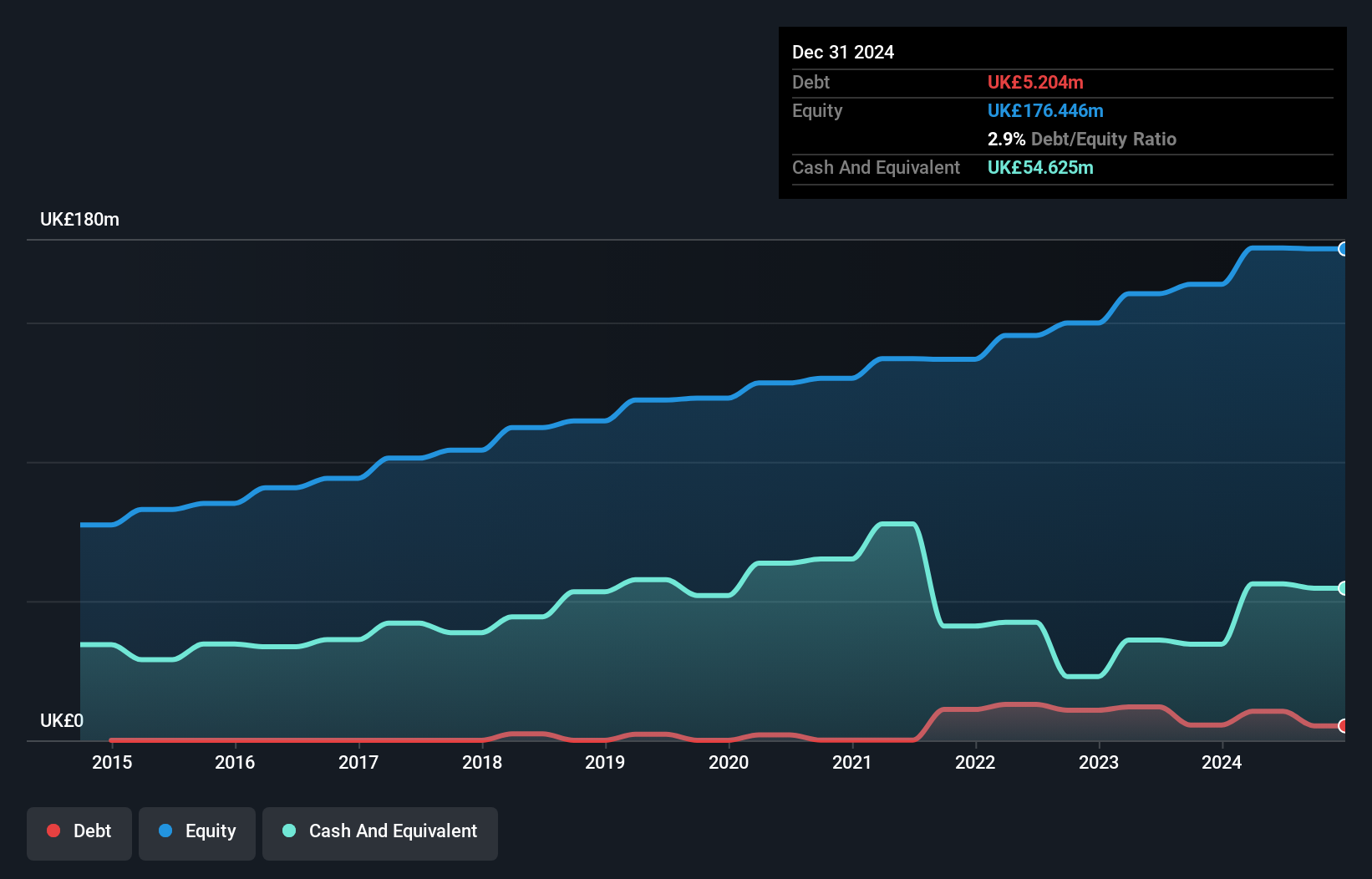

FW Thorpe, a notable player in the UK, is showcasing promising figures with its earnings growth of 10.8% over the past year outpacing the Electrical industry’s 1.6%. The company trades at a significant discount, approximately 77.5% below estimated fair value, making it an intriguing prospect for investors. Despite an increase in debt to equity from 1.8% to 5.9% over five years, FW Thorpe maintains more cash than total debt and reports high-quality earnings alongside positive free cash flow of £40.47 million as of June 2024. Recent announcements include a proposed final dividend and special dividend totaling £8.89 million pending approval at their upcoming AGM in November 2024.

- Unlock comprehensive insights into our analysis of FW Thorpe stock in this health report.

Examine FW Thorpe's past performance report to understand how it has performed in the past.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that operates as a home and community builder in Ireland, with a market capitalization of £1.09 billion.

Operations: Cairn Homes generates revenue primarily from its building and property development segment, amounting to €813.40 million.

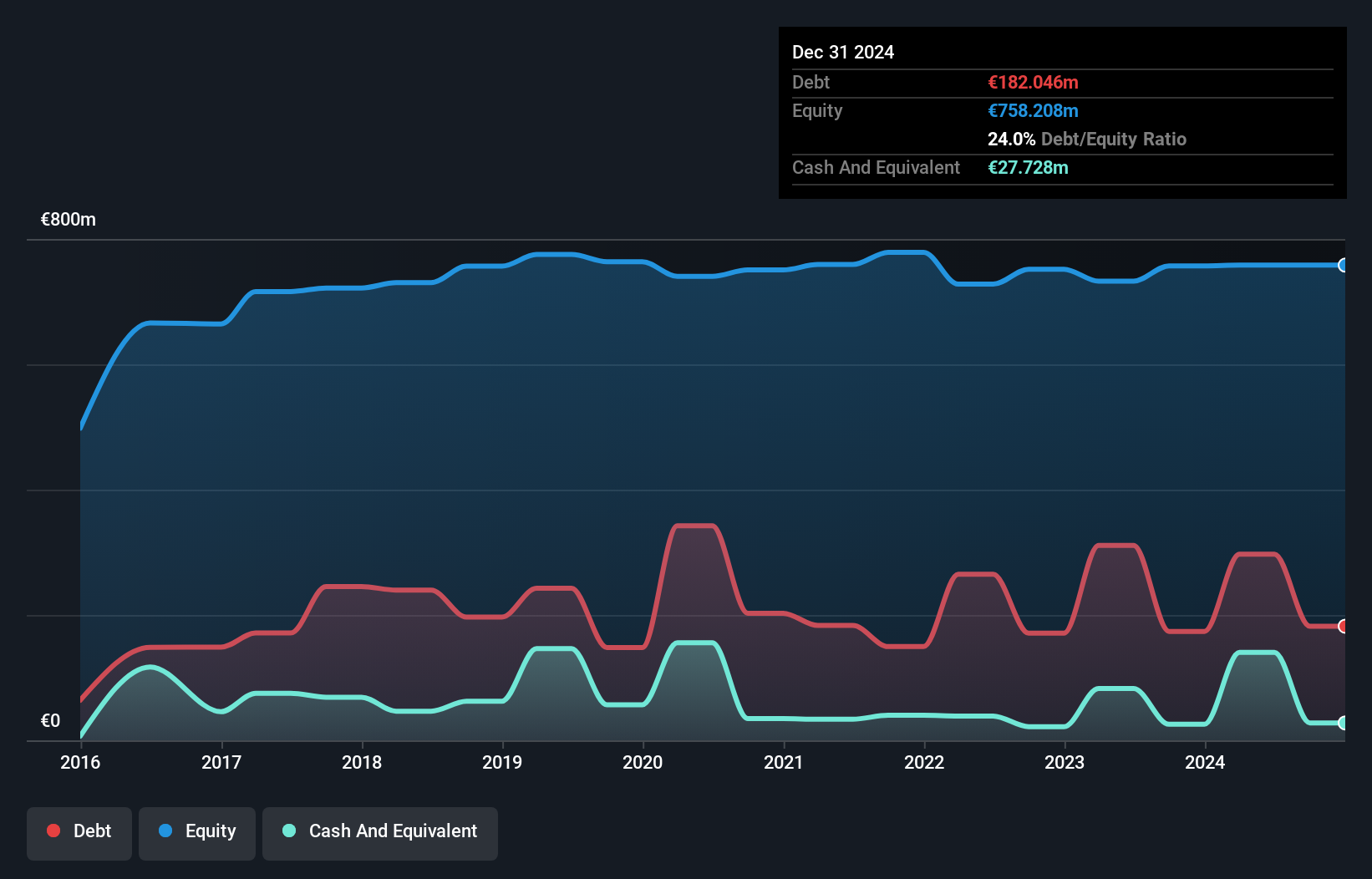

Cairn Homes, a notable player in the UK market, has shown impressive financial health with its interest payments on debt well covered by EBIT at 9.5 times. The company reported a net income of €46.89 million for H1 2024, up from €20.7 million last year, and a price-to-earnings ratio of 11.7x which is below the UK market average of 16.3x. Cairn's recent share buyback program saw the repurchase of over 56 million shares for €70 million, reflecting confidence in its growth trajectory and value proposition to investors.

- Get an in-depth perspective on Cairn Homes' performance by reading our health report here.

Gain insights into Cairn Homes' historical performance by reviewing our past performance report.

Make It Happen

- Unlock more gems! Our UK Undiscovered Gems With Strong Fundamentals screener has unearthed 78 more companies for you to explore.Click here to unveil our expertly curated list of 81 UK Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TFW

FW Thorpe

Designs, manufactures, and supplies professional lighting equipment in the United Kingdom, Ireland, the United Arab Emirates, Australia, the Netherlands, Germany, France, Spain, rest of Europe, and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives