- United Kingdom

- /

- Machinery

- /

- AIM:TAND

Companies Like Tan Delta Systems (LON:TAND) Are In A Position To Invest In Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Tan Delta Systems (LON:TAND) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Tan Delta Systems

How Long Is Tan Delta Systems' Cash Runway?

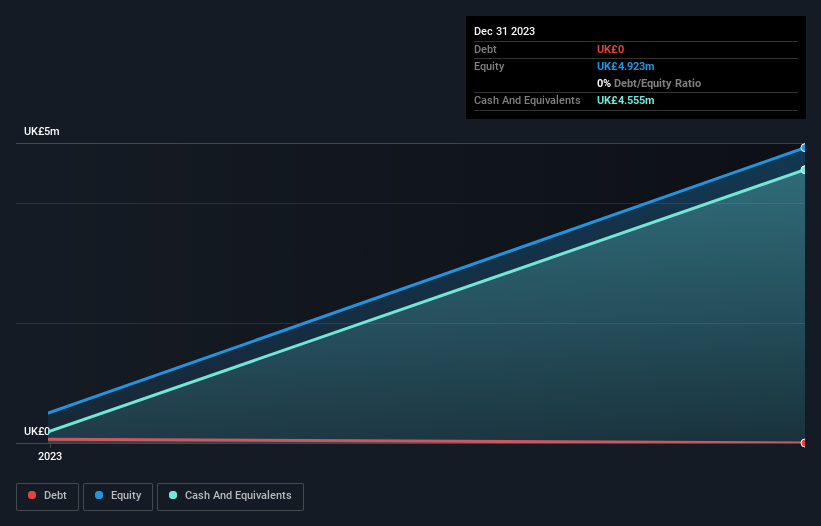

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In December 2023, Tan Delta Systems had UK£4.6m in cash, and was debt-free. Importantly, its cash burn was UK£1.0m over the trailing twelve months. That means it had a cash runway of about 4.5 years as of December 2023. There's no doubt that this is a reassuringly long runway. The image below shows how its cash balance has been changing over the last few years.

Is Tan Delta Systems' Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Tan Delta Systems actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. Regrettably, the company's operating revenue moved in the wrong direction over the last twelve months, declining by 7.5%. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Tan Delta Systems Raise More Cash Easily?

Given its problematic fall in revenue, Tan Delta Systems shareholders should consider how the company could fund its growth, if it turns out it needs more cash. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Tan Delta Systems' cash burn of UK£1.0m is about 5.4% of its UK£19m market capitalisation. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Tan Delta Systems' Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Tan Delta Systems' cash burn. For example, we think its cash runway suggests that the company is on a good path. Although its falling revenue does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for Tan Delta Systems (1 is concerning!) that you should be aware of before investing here.

Of course Tan Delta Systems may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Tan Delta Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TAND

Tan Delta Systems

Engages in the development, manufacture, and sale of oil sensors in the United Kingdom, Europe, North and South America, Asia, and the Middle East.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026