- United Kingdom

- /

- Construction

- /

- AIM:VANL

January 2025 UK Exchange Penny Stocks To Watch

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market conditions, penny stocks continue to attract attention as they represent smaller or newer companies that can offer both affordability and growth potential. By focusing on those with strong financial health and clear growth trajectories, investors may find promising opportunities within this niche investment area.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.01 | £757.4M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.966 | £152.38M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.87 | £469.45M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £425.03M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.20 | £185.07M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.63 | £361.03M | ★★★★☆☆ |

| On the Beach Group (LSE:OTB) | £2.35 | £392.43M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.25 | £202.69M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Renold (AIM:RNO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Renold plc manufactures and sells high precision engineered products and solutions across the UK, Europe, the US, Canada, Australasia, China, India, and internationally with a market cap of £94.31 million.

Operations: The company generates revenue from its Chain segment, which accounts for £191 million, and its Torque Transmission segment, contributing £53.9 million.

Market Cap: £94.31M

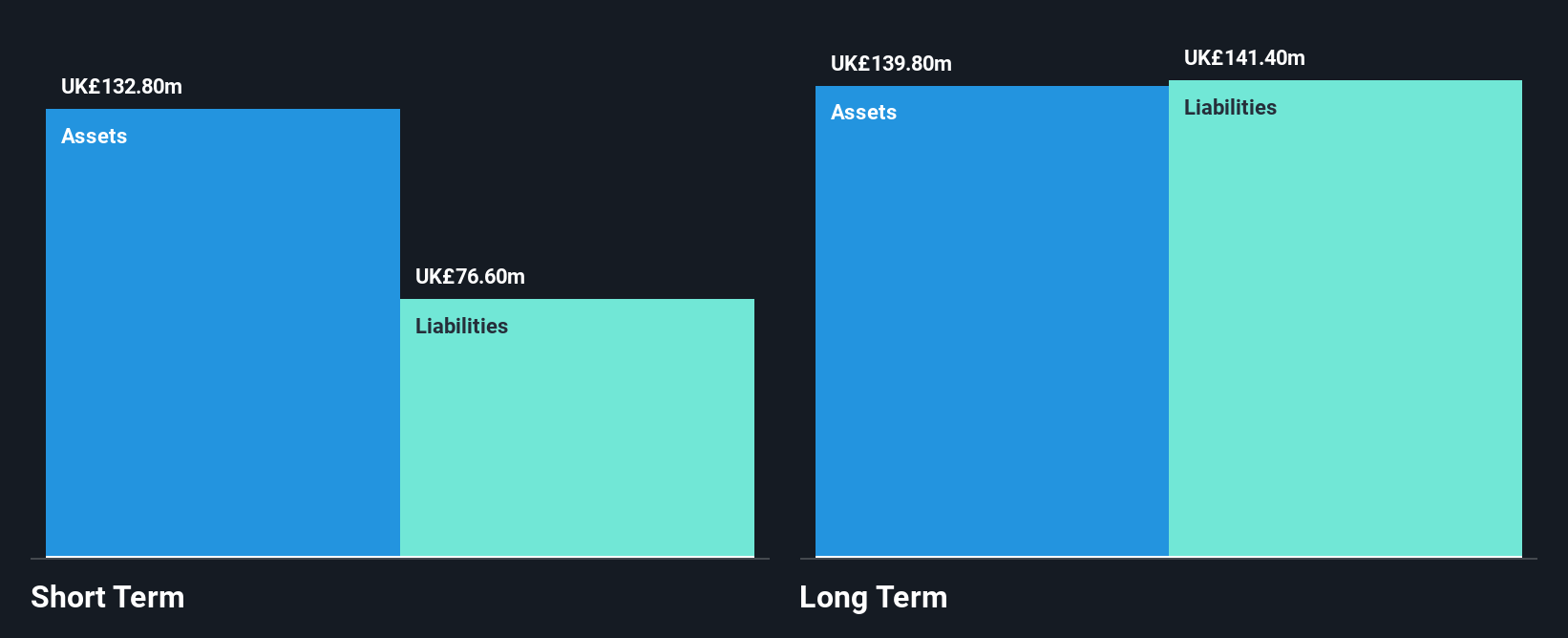

Renold plc, with a market cap of £94.31 million, is trading at 31.5% below its estimated fair value and is considered to have high-quality earnings despite recent challenges. The company's short-term assets exceed its liabilities, but long-term liabilities are not fully covered by these assets. While Renold's return on equity is high at 26.56%, this is influenced by a significant debt level, reflected in a net debt to equity ratio of 77.3%. Recent earnings reports show decreased sales and net income compared to the previous year, underscoring potential volatility in performance within the penny stock category.

- Click here to discover the nuances of Renold with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Renold's future.

Van Elle Holdings (AIM:VANL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Van Elle Holdings plc operates as a geotechnical and ground engineering contractor in the United Kingdom with a market cap of £40.58 million.

Operations: The company's revenue is primarily derived from three segments: General Piling (£56.69 million), Specialist Piling & Rail (£43.87 million), and Ground Engineering Services (£38.32 million).

Market Cap: £40.58M

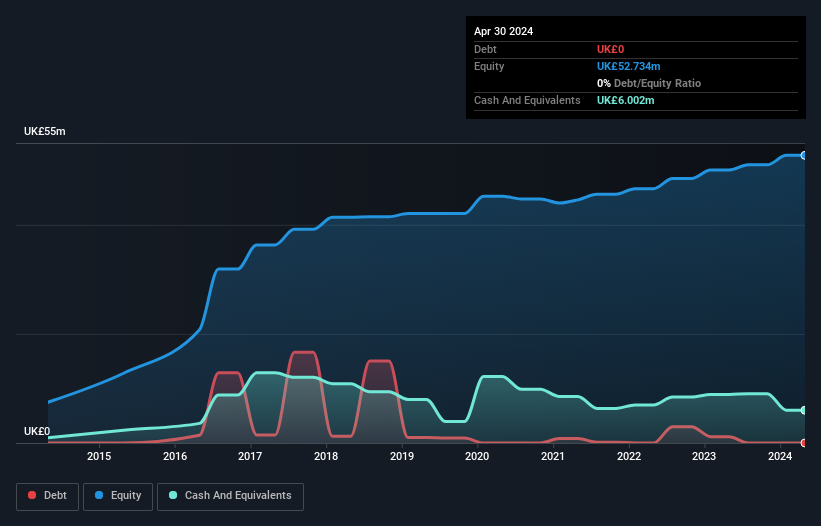

Van Elle Holdings, with a market cap of £40.58 million, is trading at 65.4% below its estimated fair value and benefits from being debt-free, which simplifies financial management and reduces risk. The company has experienced significant earnings growth over the past five years but faced negative earnings growth recently, highlighting potential volatility typical of penny stocks. Its short-term assets comfortably cover both short- and long-term liabilities. Recent developments include securing key contracts for the GO Expansion programme in Canada, potentially enhancing future revenue streams through strategic partnerships in rail infrastructure projects worth over CAD 50 million.

- Click here and access our complete financial health analysis report to understand the dynamics of Van Elle Holdings.

- Learn about Van Elle Holdings' future growth trajectory here.

Centaur Media (LSE:CAU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Centaur Media Plc provides business information, training, and specialist consultancy services to professional and commercial markets across the UK, Europe, North America, and internationally with a market cap of £35.14 million.

Operations: Centaur Media's revenue is primarily generated from its Xeim segment, contributing £27.29 million, and The Lawyer segment, which brings in £8.66 million.

Market Cap: £35.14M

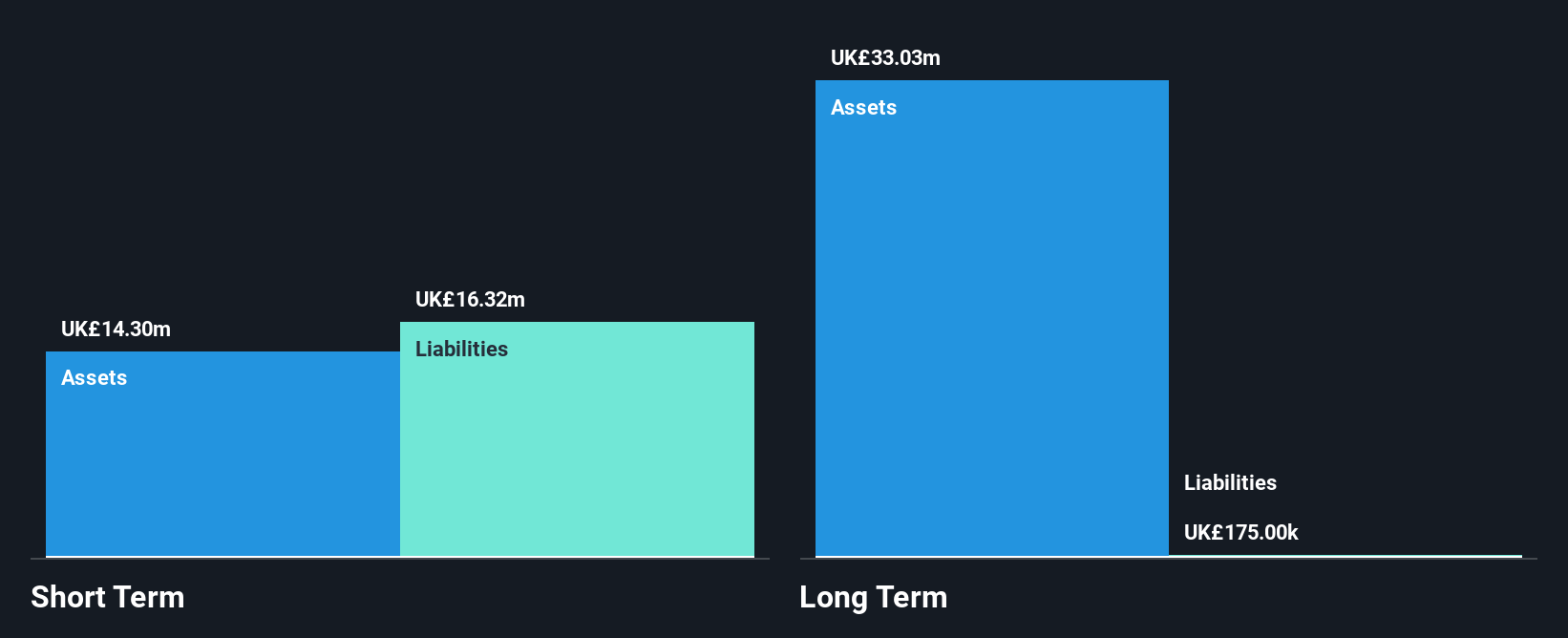

Centaur Media, with a market cap of £35.14 million, is trading at 38.7% below its estimated fair value and remains debt-free, which reduces financial risk but faces challenges with short-term liabilities exceeding assets (£17.3M vs £14.0M). Despite a stable net profit margin improvement to 12.9%, earnings growth has slowed compared to its five-year average of 81.2%. Recent leadership changes include Martin Rowland's appointment as Executive Chair following Swag Mukerji's retirement as CEO, signaling potential strategic shifts amid revised revenue expectations for 2024 that fall below analyst consensus at £34 million.

- Click to explore a detailed breakdown of our findings in Centaur Media's financial health report.

- Evaluate Centaur Media's prospects by accessing our earnings growth report.

Make It Happen

- Gain an insight into the universe of 468 UK Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VANL

Van Elle Holdings

Operates as a geotechnical and ground engineering contractor in the United Kingdom.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives