- United Kingdom

- /

- Personal Products

- /

- AIM:VLG

Top UK Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The UK market is experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting the interconnectedness of global economies. Despite such challenges, investors often seek opportunities in smaller or newer companies that may offer growth potential at lower price points. Penny stocks, though sometimes seen as a relic term, still represent a viable investment area when these companies are backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £4.08 | £329.19M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.922 | £146.94M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.225 | £838.41M | ★★★★★★ |

| RTC Group (AIM:RTC) | £0.975 | £13.27M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.23 | £159.09M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.57 | £87.16M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.295 | £327.71M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.425 | £181.48M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

PowerHouse Energy Group (AIM:PHE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PowerHouse Energy Group Plc designs facilities to convert non-recyclable waste into electricity, heat, and gases such as hydrogen and methane, with a market cap of £41.97 million.

Operations: PowerHouse Energy Group Plc has not reported any revenue segments.

Market Cap: £41.97M

PowerHouse Energy Group, with a market cap of £41.97 million, is pre-revenue and focuses on converting waste into energy. Recent collaborations, such as with Avioxx Ltd. for sustainable aviation fuel production and National Hydrogen Ltd. in Australia, highlight its expanding global footprint in sustainable energy solutions. Despite having no debt and short-term assets exceeding liabilities, the company faces challenges with a limited cash runway of less than a year and high share price volatility. The management team is experienced but the board's tenure suggests recent changes; profitability remains elusive as losses have increased over five years.

- Get an in-depth perspective on PowerHouse Energy Group's performance by reading our balance sheet health report here.

- Assess PowerHouse Energy Group's previous results with our detailed historical performance reports.

Venture Life Group (AIM:VLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Venture Life Group plc develops and commercializes healthcare products across multiple countries including the United Kingdom, the Netherlands, China, Germany, Italy, Switzerland, and other international markets with a market cap of £43.92 million.

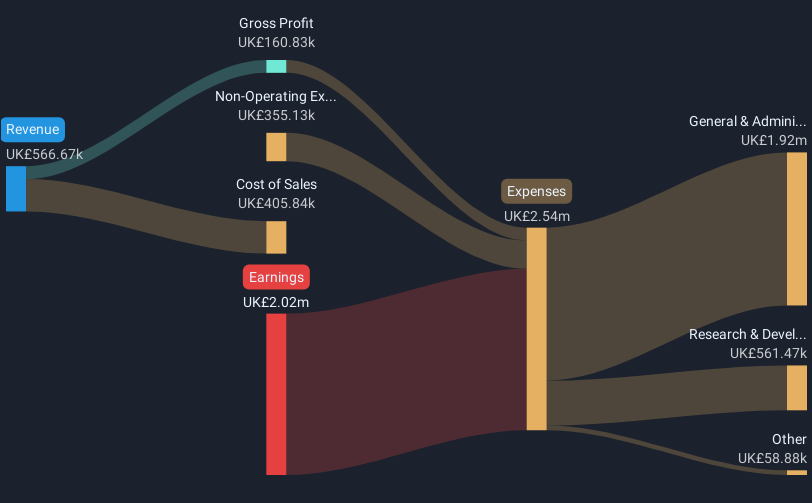

Operations: The company generates revenue through two main segments: Customer Brands, contributing £24.66 million, and Venture Life Brands, accounting for £33.50 million.

Market Cap: £43.92M

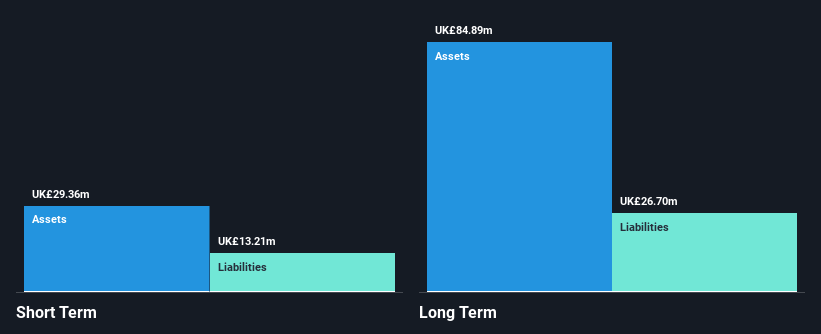

Venture Life Group, with a market cap of £43.92 million, has recently transitioned to profitability, complicating comparisons with its historical earnings growth. The company's net debt to equity ratio is satisfactory at 14.2%, and operating cash flow adequately covers its debt obligations. However, interest coverage remains weak with EBIT covering only 1.4 times the interest payments. Despite trading significantly below estimated fair value and having stable weekly volatility, the company experienced a one-off loss impacting recent financial results. Upcoming board changes include Mark Adams stepping up as Chair in April 2025 amidst ongoing efforts to appoint new directors.

- Unlock comprehensive insights into our analysis of Venture Life Group stock in this financial health report.

- Examine Venture Life Group's earnings growth report to understand how analysts expect it to perform.

Henry Boot (LSE:BOOT)

Simply Wall St Financial Health Rating: ★★★★☆☆

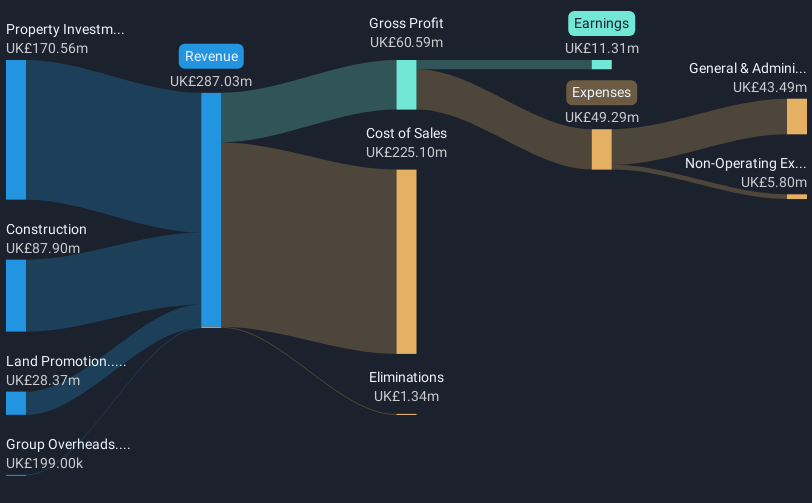

Overview: Henry Boot PLC operates in the United Kingdom, focusing on property investment and development, land promotion, and construction activities, with a market cap of £273.98 million.

Operations: The company's revenue segments consist of £170.56 million from property investment and development, £87.90 million from construction, and £28.37 million from land promotion.

Market Cap: £273.98M

Henry Boot PLC, with a market cap of £273.98 million, faces challenges despite trading significantly below estimated fair value. The company's earnings have declined by 6.7% annually over the past five years and experienced a sharp negative growth of 43.2% last year, underperforming its industry peers. Although short-term assets comfortably cover liabilities and interest payments are well covered by EBIT at 3.2 times, operating cash flow is negative, raising concerns about debt coverage and dividend sustainability at 3.65%. Despite having an experienced board and management team with an average tenure of 7.1 years, profitability remains pressured with net profit margins decreasing from last year’s figures.

- Dive into the specifics of Henry Boot here with our thorough balance sheet health report.

- Assess Henry Boot's future earnings estimates with our detailed growth reports.

Where To Now?

- Discover the full array of 446 UK Penny Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VLG

Venture Life Group

Develops and commercializes healthcare products in the United Kingdom, the Netherlands, China, Germany, Italy, Switzerland, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives