- United Kingdom

- /

- Aerospace & Defense

- /

- AIM:PEN

Some Pennant International Group (LON:PEN) Shareholders Are Down 40%

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the Pennant International Group plc (LON:PEN) share price slid 40% over twelve months. That contrasts poorly with the market return of -1.7%. The silver lining (for longer term investors) is that the stock is still 30% higher than it was three years ago. Shareholders have had an even rougher run lately, with the share price down 35% in the last 90 days.

Check out our latest analysis for Pennant International Group

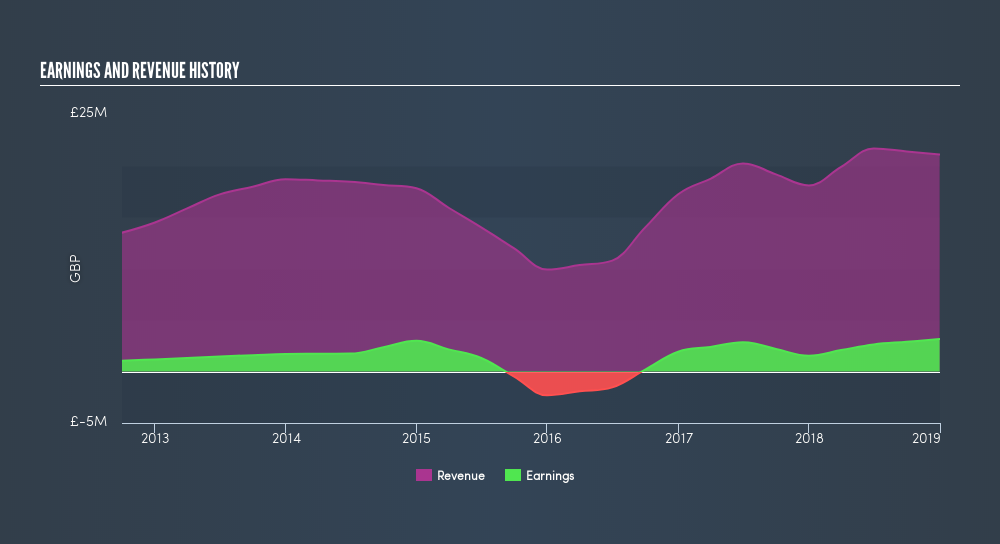

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the Pennant International Group share price fell, it actually saw its earnings per share (EPS) improve by 104%. Of course, the situation might betray previous over-optimism about growth. It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

Pennant International Group managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

We know that Pennant International Group has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Pennant International Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Pennant International Group's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Pennant International Group's TSR of was a loss of 40% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Pennant International Group shareholders are down 40% for the year. Unfortunately, that's worse than the broader market decline of 1.7%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2.7% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before spending more time on Pennant International Group it might be wise to click here to see if insiders have been buying or selling shares.

We will like Pennant International Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:PEN

Pennant International Group

Provides integrated training and support software solutions, products, and services in the United Kingdom, rest of Europe, North America, and Indo-Pacific region.

Good value with moderate growth potential.