- United Kingdom

- /

- Software

- /

- AIM:ALT

3 UK Penny Stocks With Market Caps Over £10M To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. In such fluctuating markets, investors often seek opportunities in smaller companies that may offer potential growth at lower price points. Penny stocks, though an older term, continue to represent these opportunities by focusing on firms with solid fundamentals and financial resilience.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £470.9M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.09 | £776.24M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £178.85M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.932 | £148.21M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.81 | £417.98M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.44 | £82.58M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.88 | £367.99M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.05 | £87.29M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.435 | £181.48M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Altitude Group (AIM:ALT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Altitude Group plc offers comprehensive solutions for branded merchandise across the corporate promotional products industry, print vertical markets, and higher-education sector in North America, the United Kingdom, and Europe with a market cap of £18.48 million.

Operations: The company generates revenue from North America (£25.35 million) and the United Kingdom and Europe (£1.13 million).

Market Cap: £18.48M

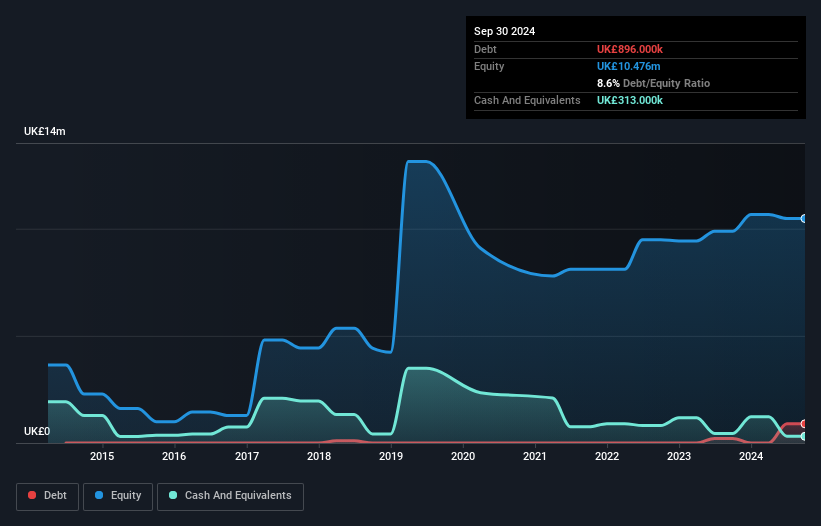

Altitude Group plc, with a market cap of £18.48 million, has shown stable weekly volatility over the past year and improved net profit margins from 2.2% to 2.7%. The company’s short-term assets (£8.6M) comfortably cover both its short and long-term liabilities, indicating solid financial health despite an increased debt-to-equity ratio over five years. Earnings growth of 38.4% last year surpassed the industry average, although it was below its five-year average growth rate of 90.7%. Recent earnings reported for the half-year ended September 2024 showed sales growth to £14.24 million with modest net income improvement.

- Dive into the specifics of Altitude Group here with our thorough balance sheet health report.

- Explore Altitude Group's analyst forecasts in our growth report.

Nexus Infrastructure (AIM:NEXS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nexus Infrastructure plc provides infrastructure and civil engineering services to the housebuilding and commercial sectors in the United Kingdom, with a market cap of £10.93 million.

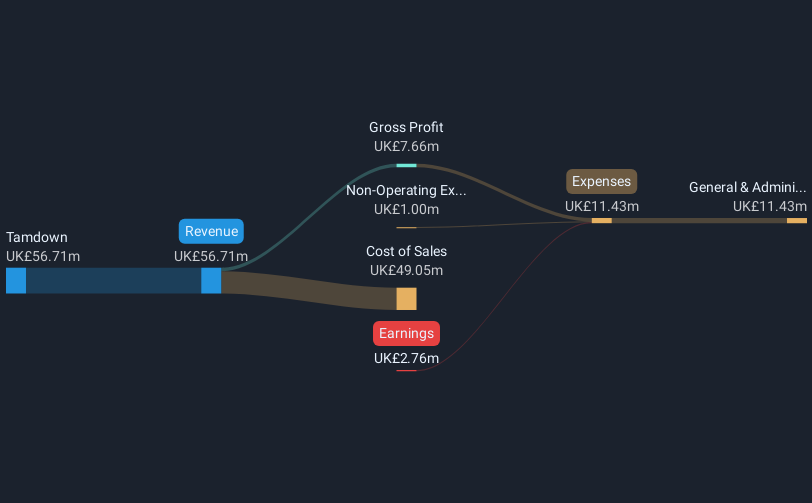

Operations: The company's revenue is primarily derived from its Tamdown segment, which generated £56.71 million.

Market Cap: £10.93M

Nexus Infrastructure plc, with a market cap of £10.93 million, faces challenges as it remains unprofitable and has seen a decline in sales to £56.71 million from the previous year's £88.69 million. Despite this, the company maintains financial stability with short-term assets (£37.3M) exceeding both short and long-term liabilities (£15.4M and £9.6M respectively). The firm is debt-free, reducing financial risk but also highlighting its struggle to generate profits as losses have increased over five years by 4.3% annually. Looking ahead, Nexus is exploring mergers and acquisitions for growth diversification while proposing a modest dividend of 3 pence per share for 2024.

- Click here and access our complete financial health analysis report to understand the dynamics of Nexus Infrastructure.

- Review our historical performance report to gain insights into Nexus Infrastructure's track record.

Parkmead Group (AIM:PMG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: The Parkmead Group plc is an independent oil and gas company focused on the exploration and production of oil and gas properties in Europe, with a market cap of £18.85 million.

Operations: The company's revenue is derived from two segments: Renewables, generating £0.68 million, and Oil and Gas Exploration and Production, which contributes £5.04 million.

Market Cap: £18.85M

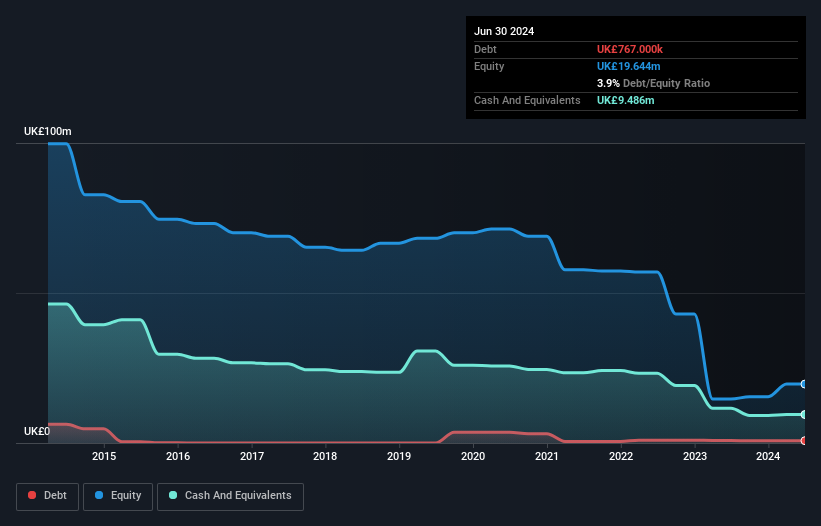

The Parkmead Group, with a market cap of £18.85 million, has transitioned to profitability, reporting a net income of £4.94 million for the year ending June 30, 2024. Despite sales dropping to £5.72 million from the previous year's £14.77 million, the company maintains financial stability with short-term assets (£14.1M) surpassing both short and long-term liabilities (£4.9M and £2.7M respectively). Its debt is well-covered by operating cash flow, and it holds more cash than total debt. The firm is actively seeking acquisitions in UK renewables and international exploration sectors to enhance shareholder value further.

- Navigate through the intricacies of Parkmead Group with our comprehensive balance sheet health report here.

- Evaluate Parkmead Group's historical performance by accessing our past performance report.

Summing It All Up

- Dive into all 445 of the UK Penny Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ALT

Altitude Group

Provides end-to-end solutions for branded merchandise in corporate promotional products industry, print vertical markets, and the higher-education sector in North America, the United Kingdom, and Europe.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives