Stock Analysis

- United Kingdom

- /

- Oil and Gas

- /

- AIM:NWF

Unveiling Three Premier UK Dividend Stocks With Yields Up To 6.9%

Reviewed by Simply Wall St

As the UK employment data sets a cautious tone and the FTSE 100 shows signs of stability, investors are keenly observing market dynamics for potential opportunities. In such a landscape, dividend stocks emerge as attractive options for those seeking steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Record (LSE:REC) | 8.12% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.67% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 6.60% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.22% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.10% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.75% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.69% | ★★★★★☆ |

| Rio Tinto Group (LSE:RIO) | 6.18% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.08% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.59% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Mincon Group (AIM:MCON)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mincon Group plc specializes in designing, manufacturing, selling, and servicing rock drilling tools and associated products across Ireland, the Americas, Australasia, Europe, the Middle East, and Africa with a market capitalization of £84.99 million.

Operations: Mincon Group plc generates €156.93 million in revenue from the sale of drilling equipment.

Dividend Yield: 4%

Mincon Group's recent performance reflects a challenging market, with 2024 starting off flat after a subdued second half in 2023. Sales dropped to €156.93 million from €170.01 million the previous year, and net income halved to €7.47 million. Despite this downturn, Mincon maintains a conservative cash payout ratio of 36.8%, supporting its dividend sustainability; however, its dividends have been historically volatile over the last decade, indicating potential unpredictability for investors relying on consistent income streams from their investments.

- Take a closer look at Mincon Group's potential here in our dividend report.

- According our valuation report, there's an indication that Mincon Group's share price might be on the cheaper side.

NWF Group (AIM:NWF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NWF Group plc operates primarily in the sale and distribution of fuel oils across the United Kingdom, with a market capitalization of approximately £94.43 million.

Operations: NWF Group plc generates revenue through three key segments: Food (£74.30 million), Feeds (£210.40 million), and Fuels (£707.20 million).

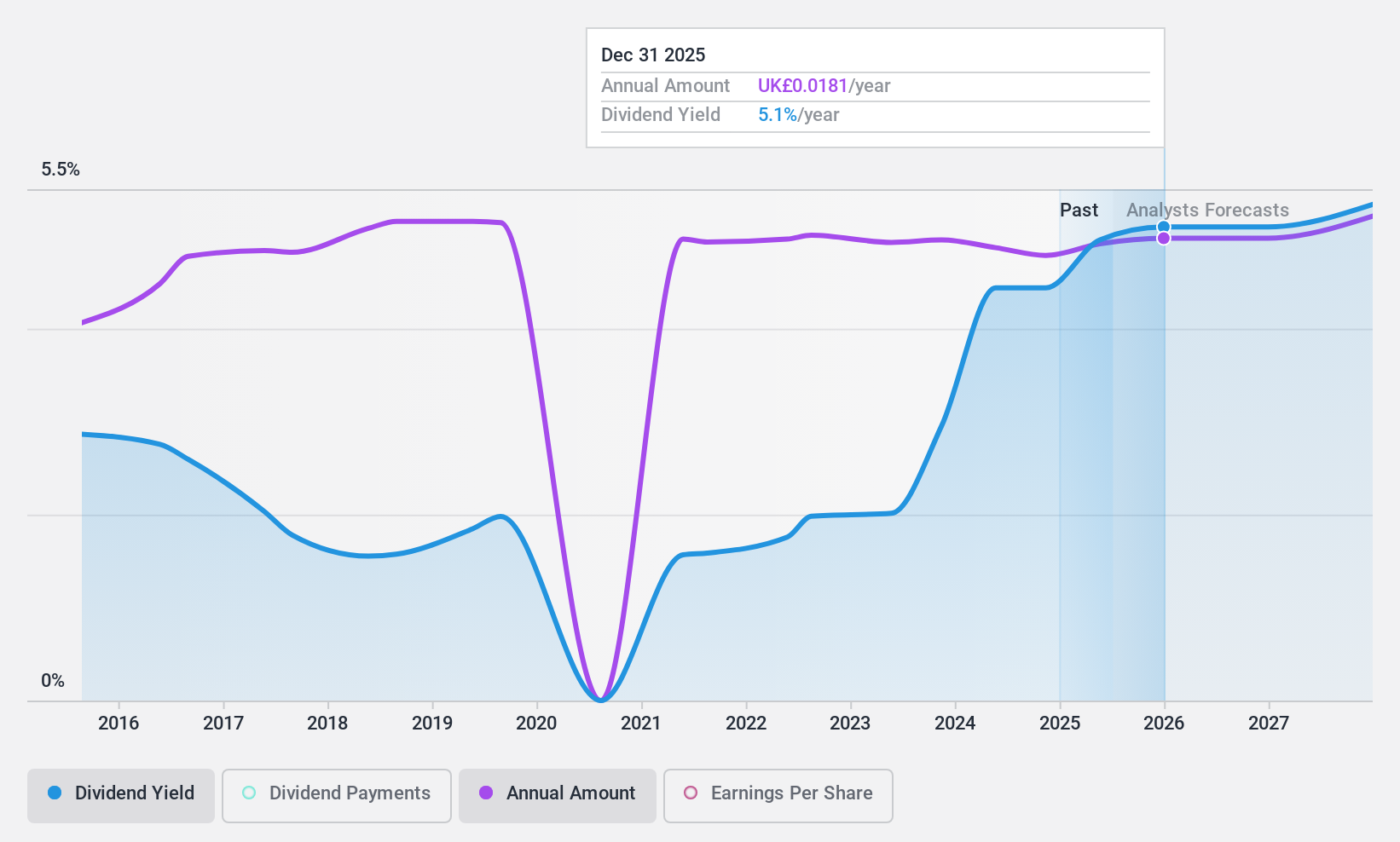

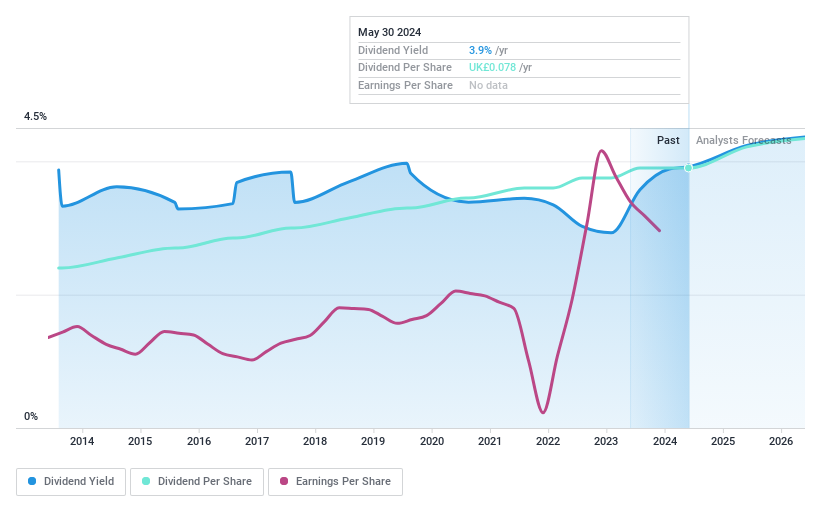

Dividend Yield: 4.1%

NWF Group offers a stable dividend yield of 4.08%, supported by a low payout ratio of 29.6% and an even lower cash payout ratio of 10.3%, indicating strong coverage from both earnings and cash flows. Despite this, the company's dividends are less attractive compared to the top UK dividend payers, with forecasts suggesting an average earnings decline of 0.2% annually over the next three years. Additionally, its price-to-earnings ratio stands at 7.3x, well below the UK market average of 16.8x.

- Unlock comprehensive insights into our analysis of NWF Group stock in this dividend report.

- Upon reviewing our latest valuation report, NWF Group's share price might be too optimistic.

HSBC Holdings (LSE:HSBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HSBC Holdings plc operates globally, offering banking and financial services with a market capitalization of approximately £127.97 billion.

Operations: HSBC Holdings plc generates revenue through four primary segments: Commercial Banking ($19.43 billion), Wealth and Personal Banking ($24.34 billion), Global Banking and Markets ($15.80 billion), and Corporate Centre ($3.33 billion).

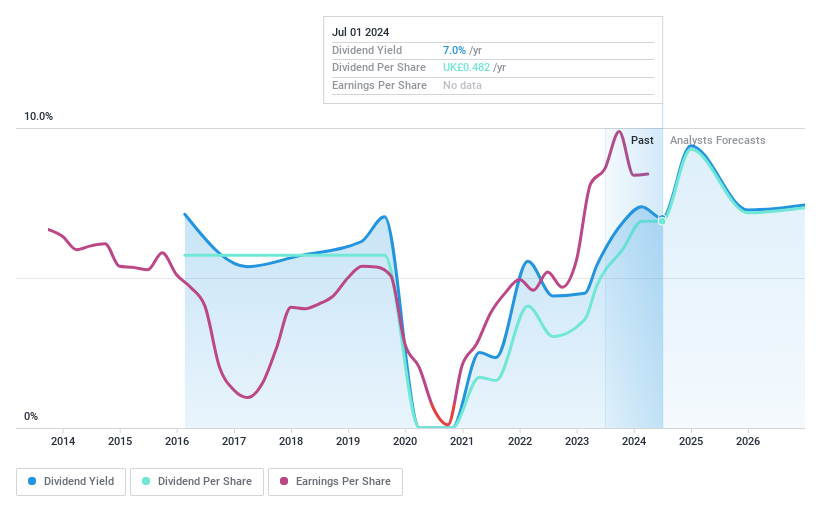

Dividend Yield: 6.9%

HSBC Holdings has shown a mixed performance as a dividend stock. While its recent expansions, such as the new workspace in Buffalo and U.S. headquarters at The Spiral, highlight growth initiatives, these are balanced against financial metrics that show challenges in maintaining consistent dividend growth. The company's dividends are covered by earnings with a payout ratio of 52.7%, but the forecast suggests a slight decline in earnings over the next three years. Additionally, HSBC's recent fixed-income offerings might bolster its capital structure but also reflect ongoing funding needs amidst its strategic shifts including significant real estate investments and global expansion efforts like the opening of new wealth centers.

- Get an in-depth perspective on HSBC Holdings' performance by reading our dividend report here.

- The valuation report we've compiled suggests that HSBC Holdings' current price could be quite moderate.

Make It Happen

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 56 more companies for you to explore.Click here to unveil our expertly curated list of 59 Top Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether NWF Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NWF

NWF Group

Primarily engages in the sale and distribution of fuel oils in the United Kingdom.

Flawless balance sheet established dividend payer.