- United Kingdom

- /

- Capital Markets

- /

- LSE:N91

3 UK Dividend Stocks With Yields Up To 8.2%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced challenges, closing lower amid weak trade data from China and declines in key sectors such as mining. As the market navigates these turbulent times, investors often look to dividend stocks for their potential to provide steady income and mitigate volatility. In this article, we will explore three UK dividend stocks with yields up to 8.2%, highlighting how they can offer stability and income in an unpredictable economic landscape.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 6.01% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.41% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.56% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.95% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.90% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.83% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.46% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.55% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.52% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 4.26% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

James Latham (AIM:LTHM)

Simply Wall St Dividend Rating: ★★★★★★

Overview: James Latham plc, with a market cap of £261.49 million, imports and distributes timbers, panels, and decorative surfaces across the United Kingdom, the Republic of Ireland, Europe, and internationally.

Operations: James Latham plc generates £366.51 million in revenue from its timber importing and distribution segment.

Dividend Yield: 6%

James Latham offers a high and reliable dividend yield of 6.01%, placing it in the top 25% of UK dividend payers. The company’s dividends are well-covered by earnings (30% payout ratio) and cash flows (87.4% cash payout ratio). Despite a forecasted decline in earnings by 3.4% annually over the next three years, dividends have grown steadily over the past decade. Recent news includes an increased final dividend to 26 pence per share and a special dividend of 45 pence per share, payable on August 23, 2024.

- Click here to discover the nuances of James Latham with our detailed analytical dividend report.

- The analysis detailed in our James Latham valuation report hints at an inflated share price compared to its estimated value.

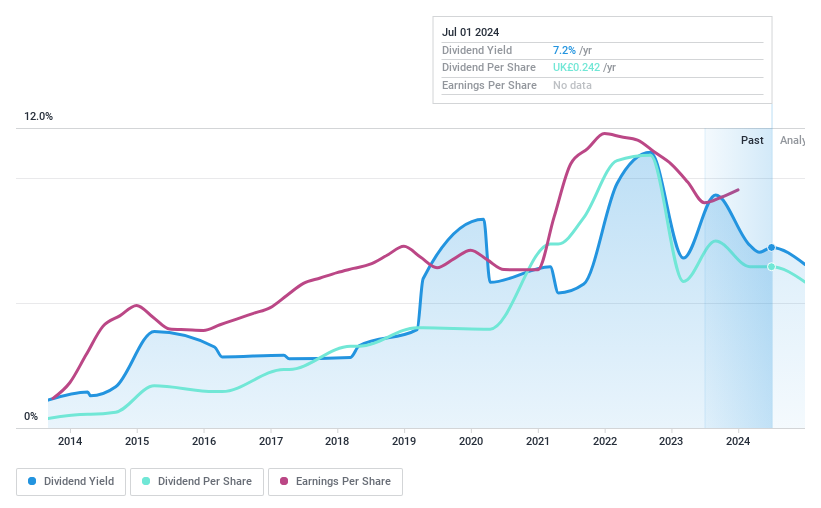

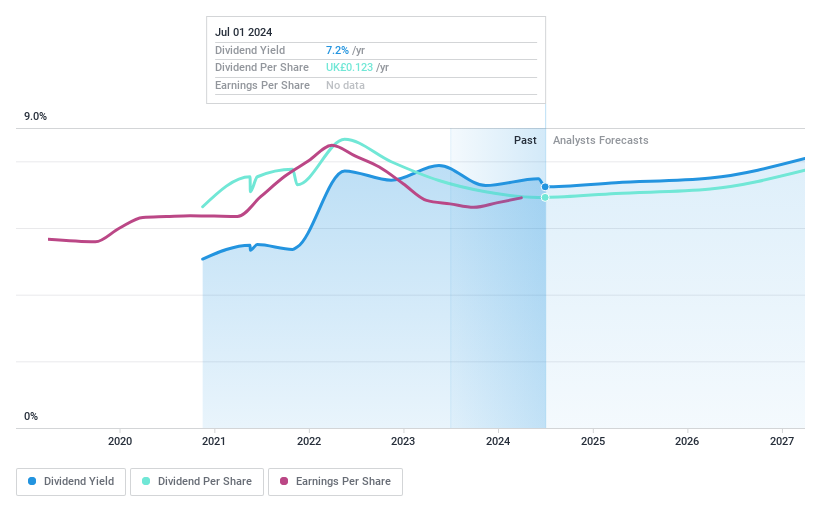

Somero Enterprises (AIM:SOM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Somero Enterprises, Inc. designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment in the United States and internationally with a market cap of £155.64 million.

Operations: Somero Enterprises generates $113.69 million in revenue from its construction machinery and equipment segment.

Dividend Yield: 8.3%

Somero Enterprises has a volatile dividend history but offers a high yield of 8.29%, placing it in the top 25% of UK dividend payers. However, its dividends are not well covered by free cash flows, with a high cash payout ratio of 104.4%. Recent earnings showed a decline, with H1 2024 sales at $51.84 million and net income at $8.14 million compared to the previous year. The company declared an interim dividend of $0.08 per share for H1 2024, payable on October 18, 2024.

- Dive into the specifics of Somero Enterprises here with our thorough dividend report.

- The valuation report we've compiled suggests that Somero Enterprises' current price could be quite moderate.

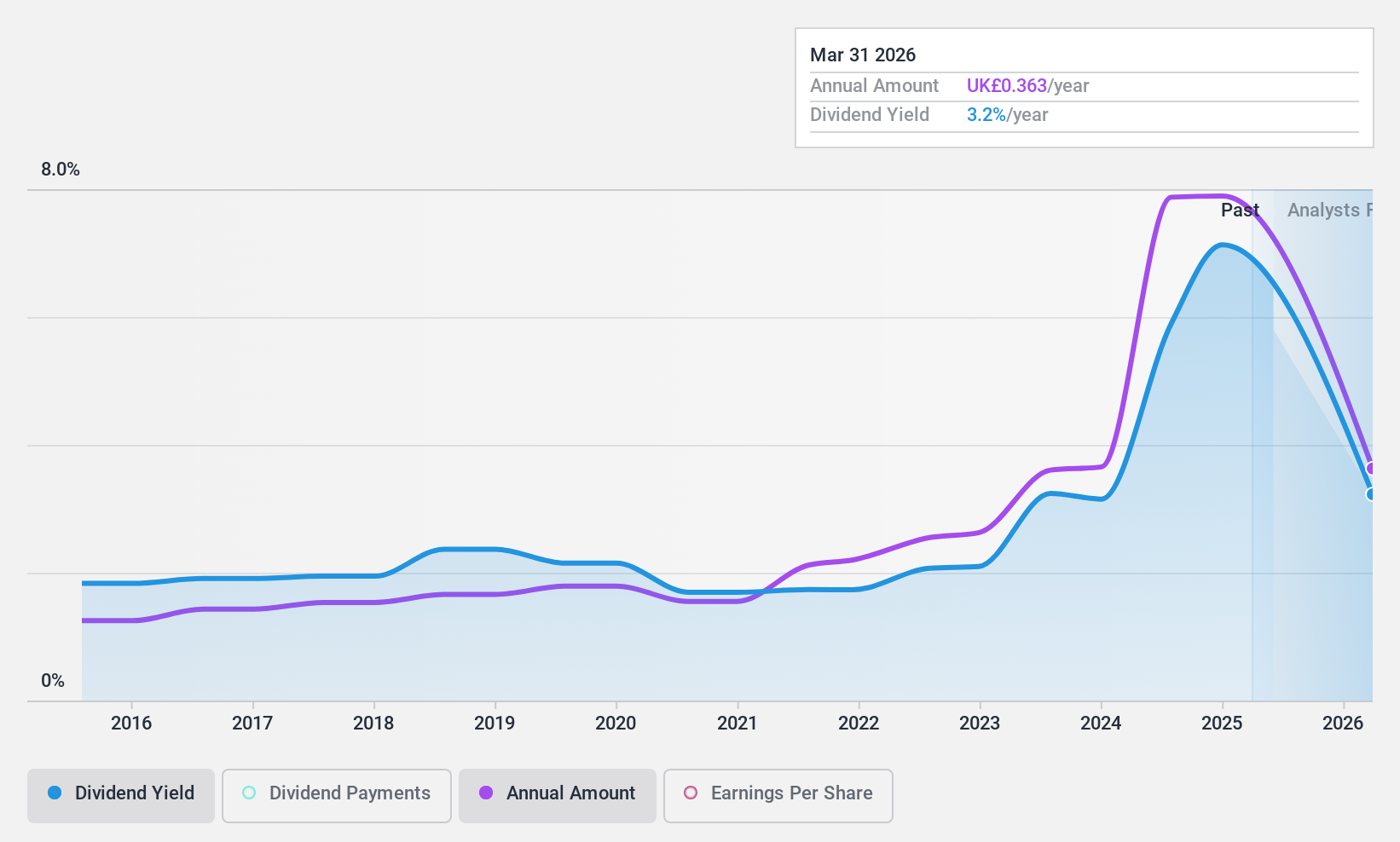

Ninety One Group (LSE:N91)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ninety One Group operates as an independent global asset manager worldwide, with a market cap of £1.44 billion.

Operations: Ninety One Group generates revenue primarily from its Investment Management Business, amounting to £588.50 million.

Dividend Yield: 7.7%

Ninety One Group has provided consistent dividend payments for four years, with a payout ratio of 66.8%, indicating dividends are well-covered by earnings and cash flows (65.3%). The stock trades at 26.2% below its estimated fair value, offering good relative value compared to peers. Recent leadership changes, including the appointment of Duane Cable as CIO South Africa and Alan Siow as co-head of emerging market corporate debt, aim to enhance investment excellence and regional coverage.

- Navigate through the intricacies of Ninety One Group with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Ninety One Group is priced lower than what may be justified by its financials.

Make It Happen

- Unlock our comprehensive list of 57 Top UK Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ninety One Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:N91

Ninety One Group

Operates as an independent global asset manager worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives