- United Kingdom

- /

- Auto Components

- /

- AIM:TRT

3 UK Penny Stocks With Market Caps Under £30M

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over China's economic recovery. Despite these broader market pressures, penny stocks continue to capture the interest of investors seeking opportunities in smaller or newer companies. While the term "penny stock" might seem outdated, these stocks can still offer potential for growth when supported by strong financials and sound business fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.295 | £864.67M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.70 | £198.24M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.45 | £355.58M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.885 | £67.03M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.25 | £106.71M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.308 | £201.73M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4295 | $249.68M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £3.47 | £444.03M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.35 | £207.28M | ★★★★★★ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Brand Architekts Group (AIM:BAR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brand Architekts Group plc operates in the beauty sector across the United Kingdom, other European Union countries, and internationally, with a market cap of £7.68 million.

Operations: The company generates revenue from its Innovaderma Brands segment, which contributes £3.16 million, and its Brand Architekt Brands segment, which brings in £13.87 million.

Market Cap: £7.68M

Brand Architekts Group plc, with a market cap of £7.68 million, operates in the beauty sector and reported sales of £17.03 million for the year ending June 30, 2024. Despite a reduction in net loss to £1.46 million from the previous year's £6.59 million, the company remains unprofitable with a negative return on equity of -5.62%. The company's short-term assets (£16.5M) comfortably cover both its short and long-term liabilities (£3.3M and £2M respectively), and it is debt-free with sufficient cash runway for over three years if current cash flow trends persist.

- Jump into the full analysis health report here for a deeper understanding of Brand Architekts Group.

- Gain insights into Brand Architekts Group's historical outcomes by reviewing our past performance report.

LPA Group (AIM:LPA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LPA Group Plc, with a market cap of £7.99 million, designs, manufactures, and markets industrial electrical and electronic products for sectors such as rail, aerospace and defense, aircraft, infrastructure, and industrial markets in the UK and internationally.

Operations: The company generates revenue of £24.14 million from its operations in designing, manufacturing, and marketing industrial electrical and electronic products.

Market Cap: £7.99M

LPA Group Plc, with a market cap of £7.99 million and revenues of £24.14 million, is navigating challenges typical for penny stocks. Despite negative earnings growth over the past year and reduced profit margins (4.2% from 5.6%), the company maintains a satisfactory net debt to equity ratio of 6.5%. Short-term assets (£12M) exceed both short-term (£6.1M) and long-term liabilities (£2.8M), indicating solid liquidity management. Recent executive changes with Philo Daniel-Tran's appointment as CEO may bring strategic shifts, leveraging her vast experience in transport and security sectors to potentially drive future growth initiatives amidst current volatility stability (2%).

- Unlock comprehensive insights into our analysis of LPA Group stock in this financial health report.

- Learn about LPA Group's historical performance here.

Transense Technologies (AIM:TRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Transense Technologies plc develops and supplies specialist sensor systems globally, with a market cap of £25.87 million.

Operations: The company generates revenue from three segments: SAW (£0.45 million), Translogik (£1.12 million), and Itrack Royalties (£2.61 million).

Market Cap: £25.87M

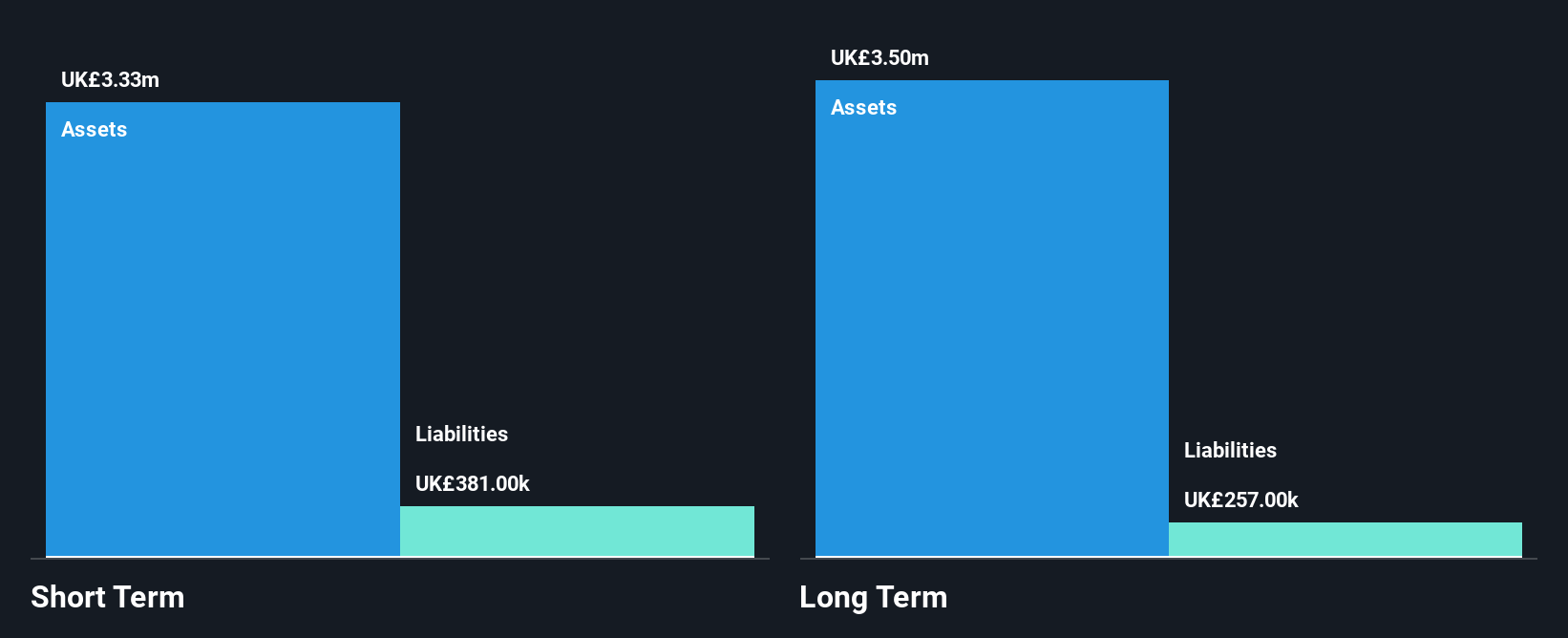

Transense Technologies plc, with a market cap of £25.87 million, is showcasing growth characteristics that are noteworthy for penny stocks. The company reported sales of £4.18 million for the year ended June 2024, up from £3.53 million the previous year, and net income increased to £1.57 million from £1.4 million. Despite its high share price volatility over recent months, Transense remains debt-free with strong liquidity as short-term assets (£3.1M) cover both short-term (£593K) and long-term liabilities (£304K). The recent appointment of Craig Beresford Wilson as Director may influence strategic directions positively amidst stable earnings growth trends.

- Navigate through the intricacies of Transense Technologies with our comprehensive balance sheet health report here.

- Evaluate Transense Technologies' historical performance by accessing our past performance report.

Make It Happen

- Investigate our full lineup of 467 UK Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transense Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TRT

Transense Technologies

Develops and supplies specialist sensor systems in the United Kingdom, North America, South America, Australia, Europe, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives