- United Kingdom

- /

- Renewable Energy

- /

- LSE:DRX

James Halstead And 2 Other Leading UK Dividend Stocks

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced downward pressure, largely influenced by weak trade data from China that has impacted global markets and commodity prices. In such uncertain economic conditions, dividend stocks like James Halstead can offer investors a measure of stability and income through regular payouts, making them an attractive option for those seeking reliable returns amidst market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 6.68% | ★★★★★★ |

| Man Group (LSE:EMG) | 7.74% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.43% | ★★★★★☆ |

| Treatt (LSE:TET) | 3.30% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.57% | ★★★★★☆ |

| DCC (LSE:DCC) | 4.05% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.70% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.41% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.55% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.99% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

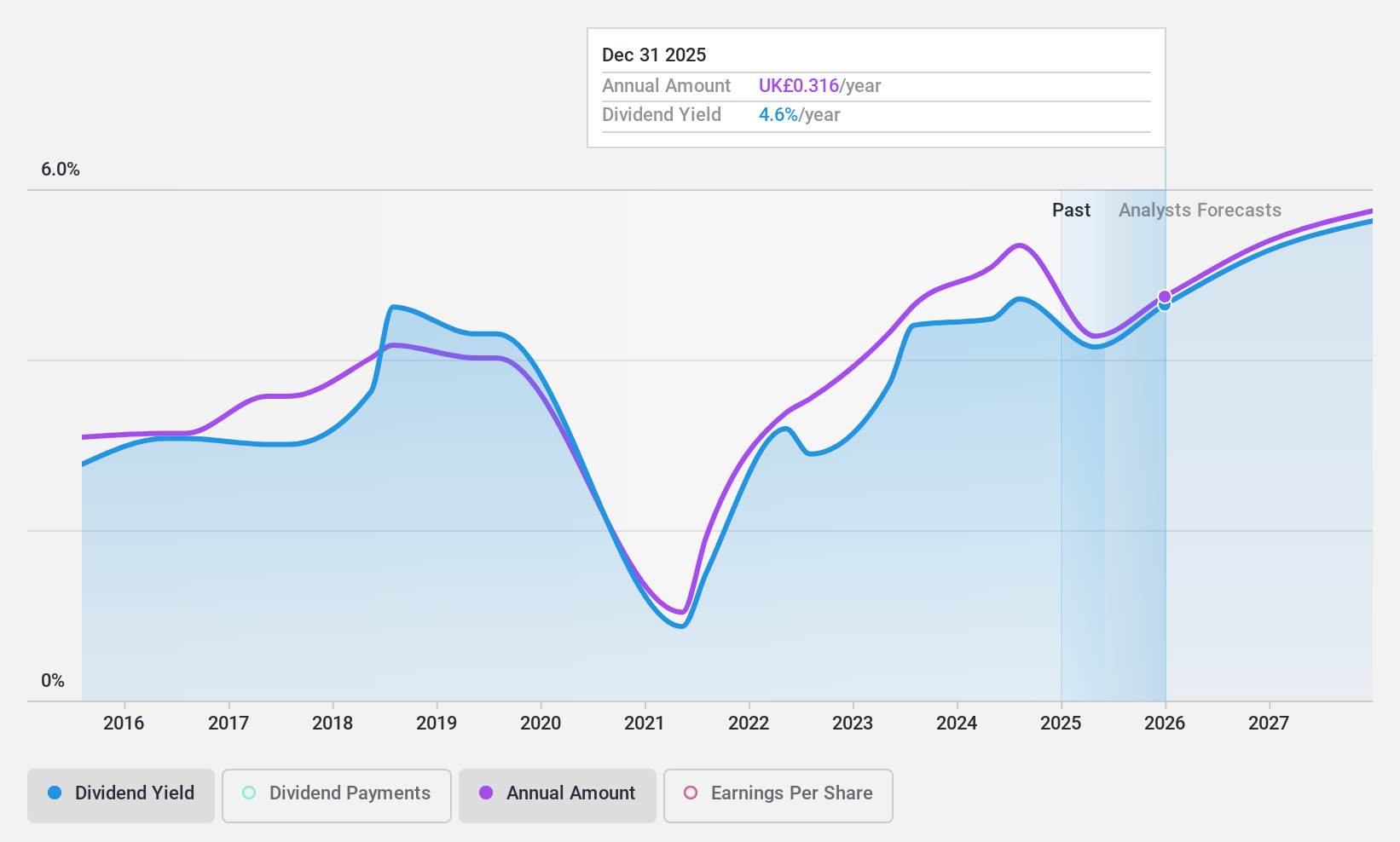

James Halstead (AIM:JHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic uses across the UK, Europe, Scandinavia, Australasia, Asia, and other international markets with a market cap of £662.69 million.

Operations: James Halstead plc generates its revenue from the manufacture and distribution of flooring products, amounting to £268.52 million.

Dividend Yield: 5.3%

James Halstead has consistently delivered reliable and stable dividends over the past decade, with recent growth evidenced by a 10% increase in its interim dividend. However, while its payout ratio of 86% suggests earnings coverage, the high cash payout ratio of 95% indicates limited coverage by free cash flow. Trading slightly below fair value, its dividend yield of 5.35% is lower than the top UK payers. Earnings have shown modest growth despite a slight decline in sales.

- Get an in-depth perspective on James Halstead's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of James Halstead shares in the market.

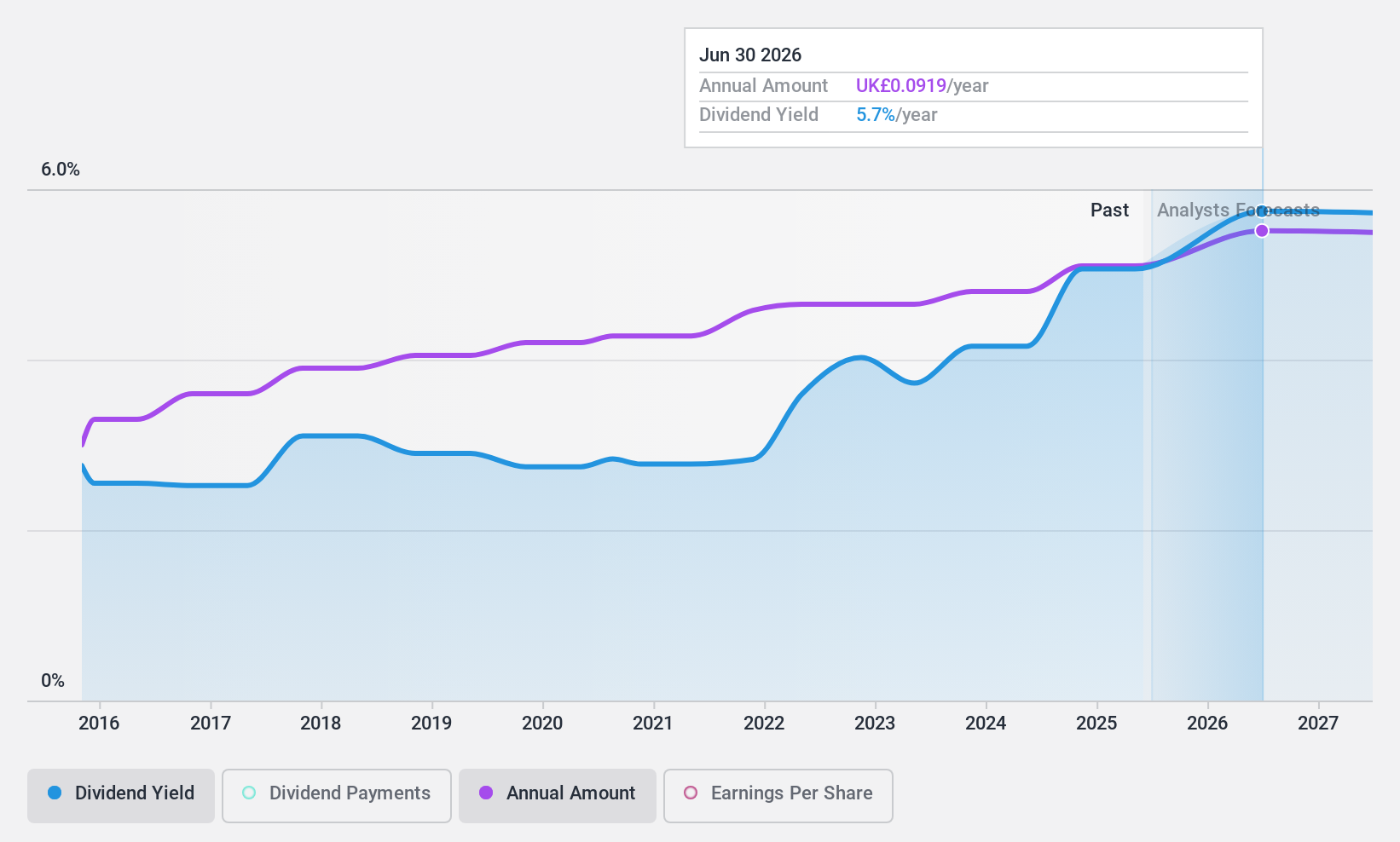

Drax Group (LSE:DRX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc, with a market cap of £2.16 billion, operates in the United Kingdom focusing on renewable power generation through its subsidiaries.

Operations: Drax Group's revenue is primarily derived from Biomass Generation (£4.92 billion), Energy Solutions (£3.79 billion), Pellet Production (£942.10 million), and Flexible Generation (£222.80 million).

Dividend Yield: 4.3%

Drax Group recently approved a final dividend of 15.6 pence per share, marking a 12.6% increase from the previous year, with dividends well-covered by both earnings and cash flows due to low payout ratios of 18.9% and 19.6%, respectively. Despite past volatility in dividend payments, recent increases suggest potential stability ahead. However, earnings are forecasted to decline significantly over the next three years, which could impact future dividend sustainability despite current coverage metrics being robust.

- Click to explore a detailed breakdown of our findings in Drax Group's dividend report.

- Our comprehensive valuation report raises the possibility that Drax Group is priced lower than what may be justified by its financials.

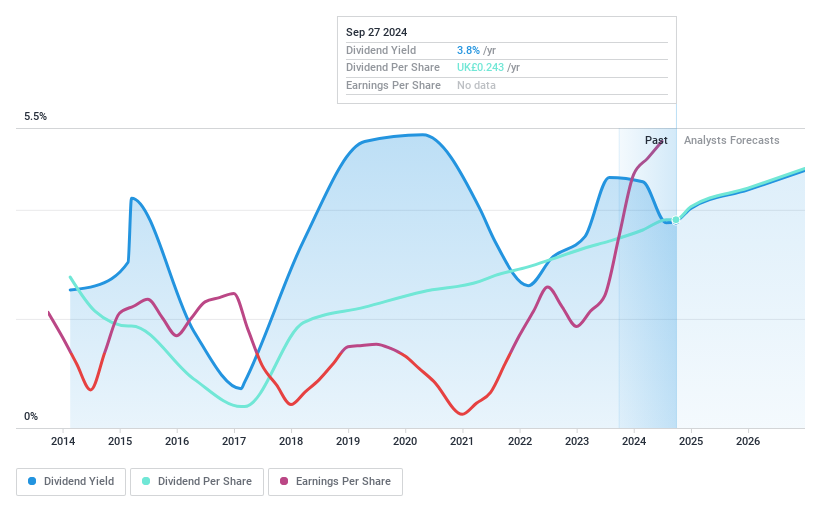

Inchcape (LSE:INCH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inchcape plc operates as an automotive distributor and retailer with a market cap of £2.54 billion.

Operations: Inchcape plc generates revenue from its operations across three main segments: APAC (£2.99 billion), Americas (£3.27 billion), and Europe & Africa (£3.00 billion).

Dividend Yield: 4.3%

Inchcape's dividends are supported by a low payout ratio of 42.9% from earnings and 21.5% from cash flows, indicating strong coverage. However, its dividend history over the past decade has been volatile despite recent growth. The current yield of 4.29% is below the top tier in the UK market, but trading at a significant discount to fair value may offer potential for capital appreciation alongside income generation. Recent leadership changes and strategic expansion into Poland with XPENG could influence future performance.

- Click here and access our complete dividend analysis report to understand the dynamics of Inchcape.

- The analysis detailed in our Inchcape valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Explore the 60 names from our Top UK Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Drax Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DRX

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives