- United Kingdom

- /

- Building

- /

- AIM:HSM

Spotlight On UK Penny Stocks In February 2025

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market fluctuations, penny stocks remain an intriguing area for investors seeking opportunities in smaller or newer companies. While the term "penny stocks" may seem outdated, they can still offer significant value when backed by strong financial health and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.99 | £321.93M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.945 | £476.68M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.27 | £855.37M | ★★★★★★ |

| RTC Group (AIM:RTC) | £0.975 | £13.27M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.23 | £159.09M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.74 | £90.4M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.31 | £329.2M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.708 | £2.06B | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Cordel Group (AIM:CRDL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cordel Group Plc is a software company with operations in Australia, the United Kingdom, New Zealand, and the Americas, and it has a market cap of £16.27 million.

Operations: The company generates £4.76 million from its data integration and analytic services segment.

Market Cap: £16.27M

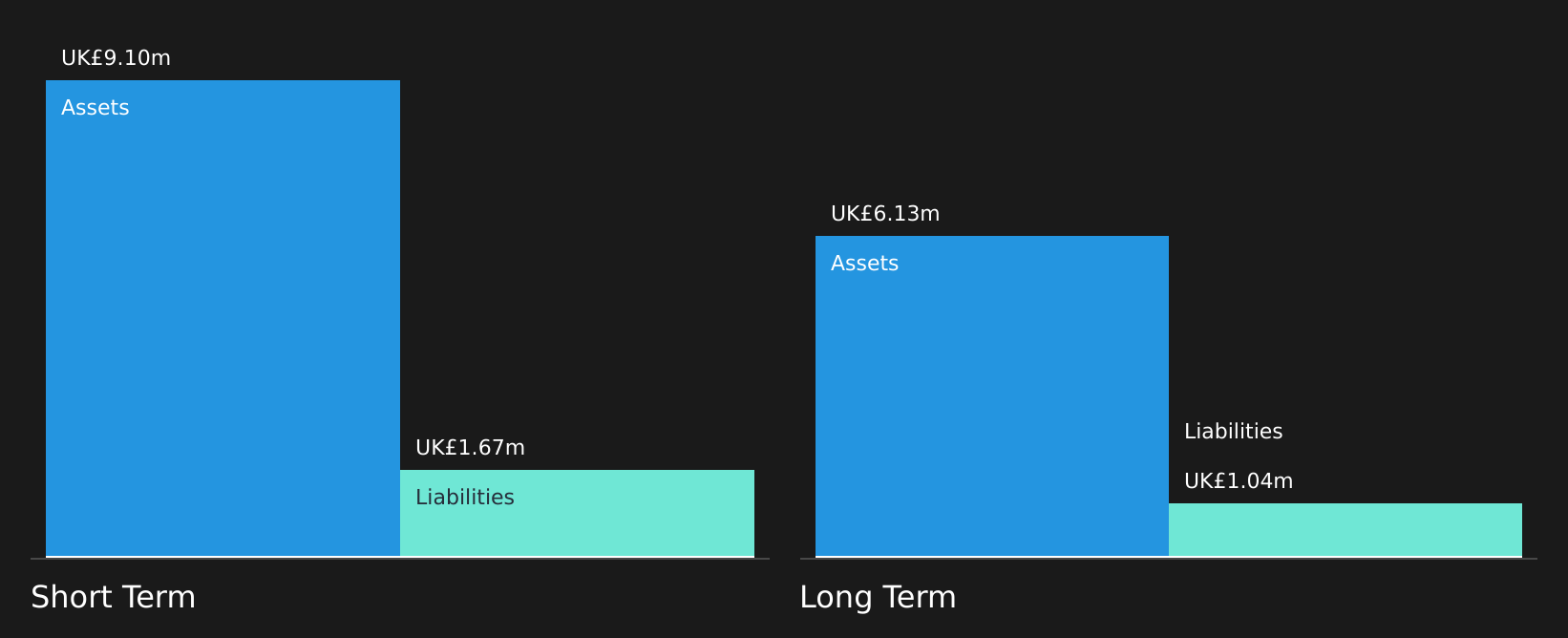

Cordel Group, with a market cap of £16.27 million, has demonstrated growth potential in the penny stock segment through strategic partnerships and contract wins. Recent collaborations include a Proof of Concept project with Vossloh AG's subsidiary VRSD to integrate Cordel's LiDAR and AI technology into railway services, as well as contracts with Network Rail and Angel Trains Ltd for enhancing railway data solutions. Despite being unprofitable, Cordel reduced its net loss from £0.715 million to £0.253 million year-on-year while maintaining sufficient cash runway over a year based on current free cash flow levels.

- Click here to discover the nuances of Cordel Group with our detailed analytical financial health report.

- Gain insights into Cordel Group's future direction by reviewing our growth report.

Samuel Heath & Sons (AIM:HSM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Samuel Heath & Sons plc manufactures and markets builders' hardware and bathroom products in the United Kingdom, with a market cap of £8.11 million.

Operations: The company's revenue is generated from the manufacture and marketing of products in the builders' hardware and bathroom field, amounting to £14.98 million.

Market Cap: £8.11M

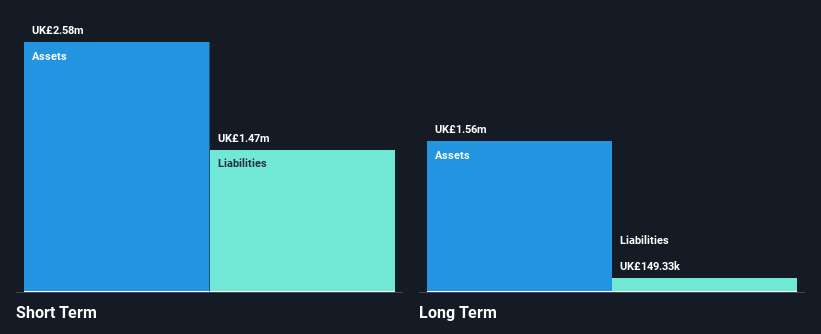

Samuel Heath & Sons, with a market cap of £8.11 million, operates without debt, highlighting financial prudence in the penny stock arena. However, recent earnings show a slight decline in net profit margins from 5.7% to 5.1%, and negative earnings growth of -10.1% over the past year contrasts with its modest five-year growth rate of 2%. The company's short-term assets substantially cover both short and long-term liabilities, reflecting solid liquidity management. Recent auditor changes to MacIntyre Hudson LLP indicate an administrative shift but no significant concerns were noted by the outgoing auditors regarding financial integrity or reporting practices.

- Click here and access our complete financial health analysis report to understand the dynamics of Samuel Heath & Sons.

- Learn about Samuel Heath & Sons' historical performance here.

Field Systems Designs Holdings (OFEX:FSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Field Systems Designs Holdings Plc is an investment holding company involved in the design, project management, supply, installation, commissioning, servicing, and maintenance of mechanical and electrical projects in the United Kingdom with a market cap of £2.29 million.

Operations: The company generates £17.81 million in revenue from mechanical and electrical projects primarily within the power, waste, and water industries.

Market Cap: £2.29M

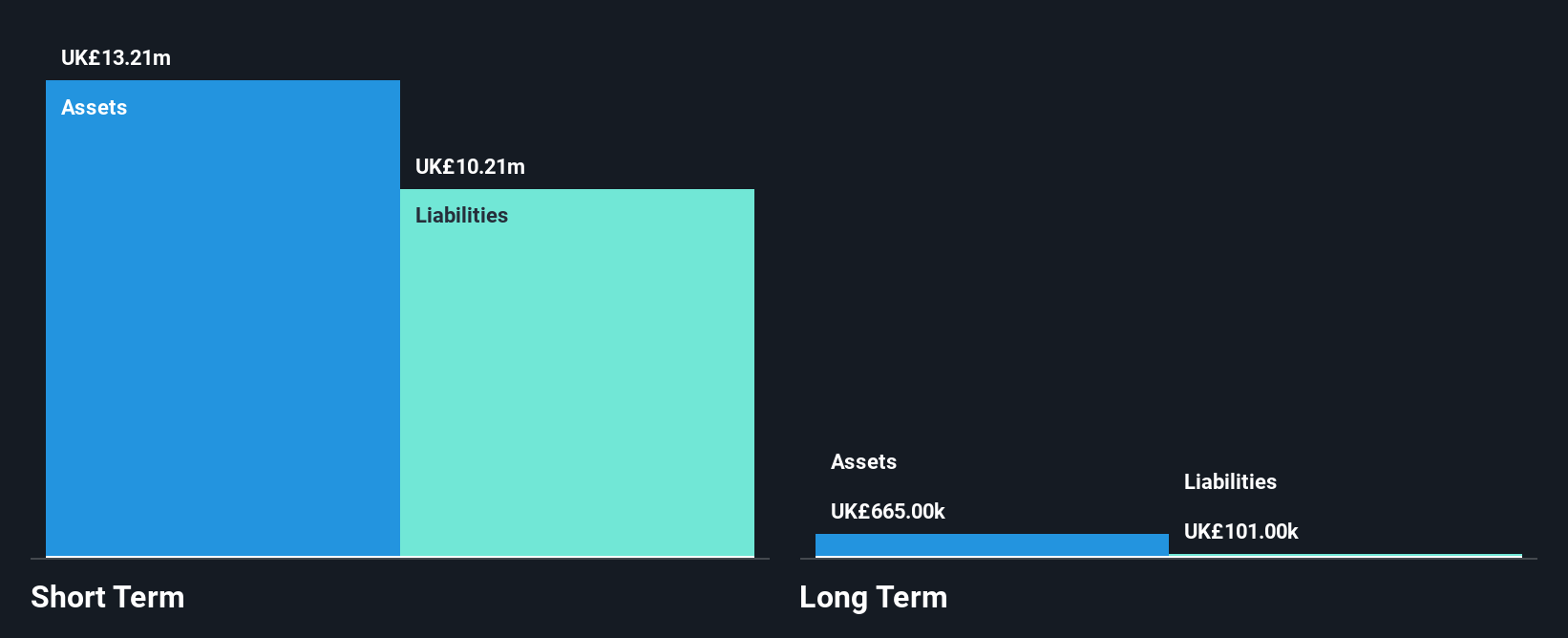

Field Systems Designs Holdings, with a market cap of £2.29 million, operates debt-free, ensuring financial stability in the penny stock sector. The company reported an increase in revenue to £17.81 million and net income of £0.47 million for the year ending May 31, 2024, reflecting improved profitability compared to the previous year. Despite a low return on equity at 17.3%, its short-term assets comfortably exceed liabilities, highlighting strong liquidity management. Earnings growth of 32.7% over the past year outpaces its declining five-year average but remains below industry performance benchmarks in construction.

- Dive into the specifics of Field Systems Designs Holdings here with our thorough balance sheet health report.

- Examine Field Systems Designs Holdings' past performance report to understand how it has performed in prior years.

Summing It All Up

- Dive into all 445 of the UK Penny Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:HSM

Samuel Heath & Sons

Engages in the manufacture and marketing of various products in the builders’ hardware and bathroom field in the United Kingdom.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives