- United Kingdom

- /

- Trade Distributors

- /

- AIM:FLO

Take Care Before Jumping Onto Flowtech Fluidpower plc (LON:FLO) Even Though It's 27% Cheaper

Flowtech Fluidpower plc (LON:FLO) shares have had a horrible month, losing 27% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 42% in that time.

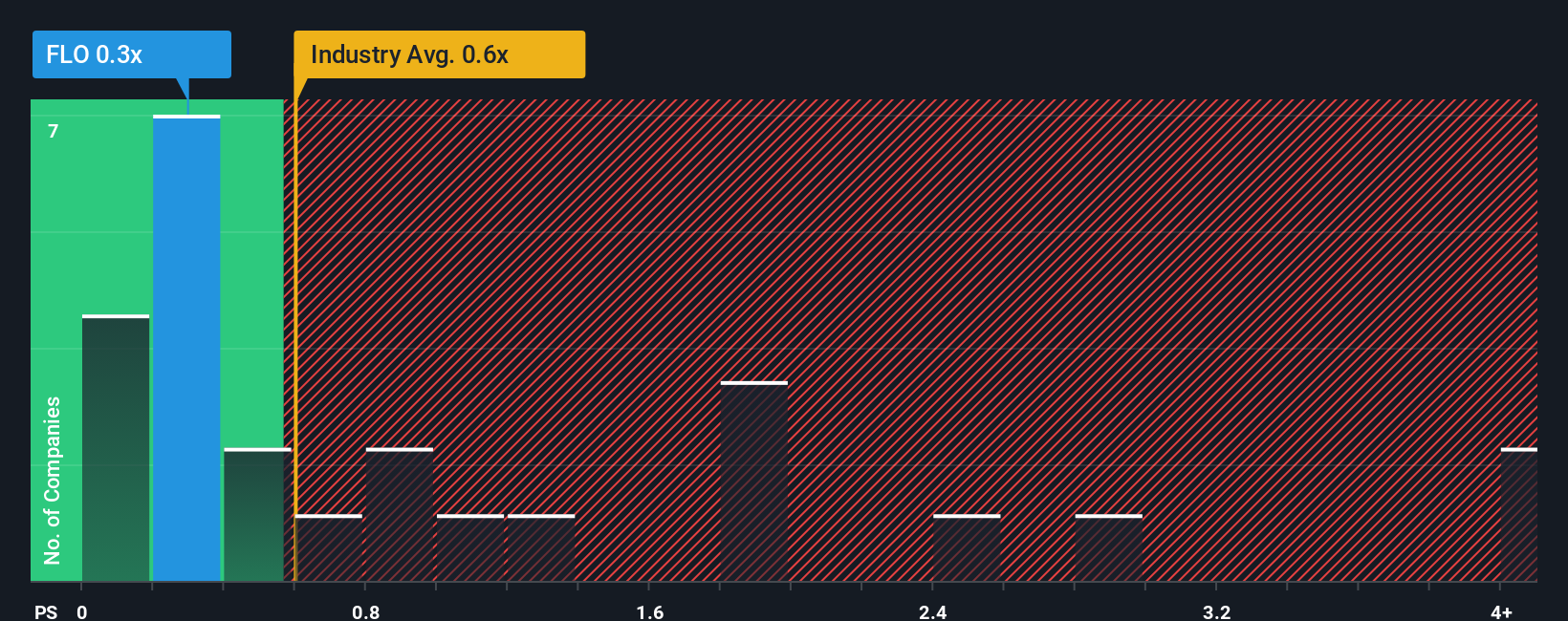

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Flowtech Fluidpower's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Trade Distributors industry in the United Kingdom is also close to 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Flowtech Fluidpower

What Does Flowtech Fluidpower's Recent Performance Look Like?

Flowtech Fluidpower could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Flowtech Fluidpower.How Is Flowtech Fluidpower's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Flowtech Fluidpower's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 2.5% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 13% over the next year. With the industry only predicted to deliver 2.9%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Flowtech Fluidpower's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Flowtech Fluidpower's P/S?

Following Flowtech Fluidpower's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Flowtech Fluidpower's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Flowtech Fluidpower is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:FLO

Flowtech Fluidpower

Distributes engineering components and assemblies in the areas of fluid power industry in the United Kingdom, The Netherlands, Belgium, and Ireland.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives