The latest analyst coverage could presage a bad day for EQTEC plc (LON:EQT), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

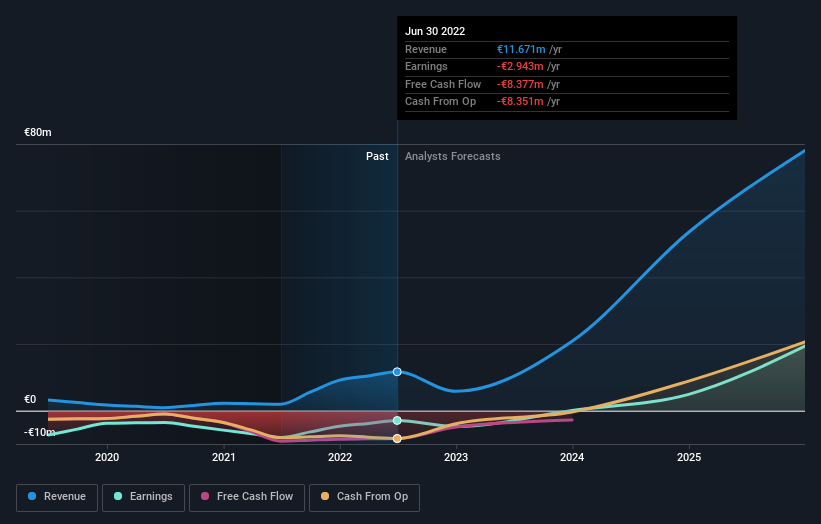

Following the downgrade, the latest consensus from EQTEC's four analysts is for revenues of €21m in 2023, which would reflect a major 79% improvement in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of €26m in 2023. It looks like forecasts have become a fair bit less optimistic on EQTEC, given the measurable cut to revenue estimates.

View our latest analysis for EQTEC

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the EQTEC's past performance and to peers in the same industry. The analysts are definitely expecting EQTEC's growth to accelerate, with the forecast 79% annualised growth to the end of 2023 ranking favourably alongside historical growth of 52% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 5.5% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect EQTEC to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They're also forecasting more rapid revenue growth than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on EQTEC after today.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with EQTEC's business, like dilutive stock issuance over the past year. For more information, you can click here to discover this and the 2 other risks we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if EQTEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:EQT

EQTEC

Provides advanced gasification technology that fuels by waste from industrial, municipal, agricultural, forestry and other sources in the Republic of Ireland, the United Kingdom, European Union, and the United States.

Medium-low risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026