- United Kingdom

- /

- Professional Services

- /

- LSE:ITRK

UK Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices face downward pressure due to weak trade data from China, concerns about global economic recovery continue to weigh on UK markets. In such uncertain times, dividend stocks can offer a measure of stability and potential income, making them an attractive consideration for investors seeking resilience amid market fluctuations.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 9.09% | ★★★★★★ |

| Treatt (LSE:TET) | 3.39% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 6.66% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 5.98% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.71% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.16% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.53% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.96% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.88% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.65% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

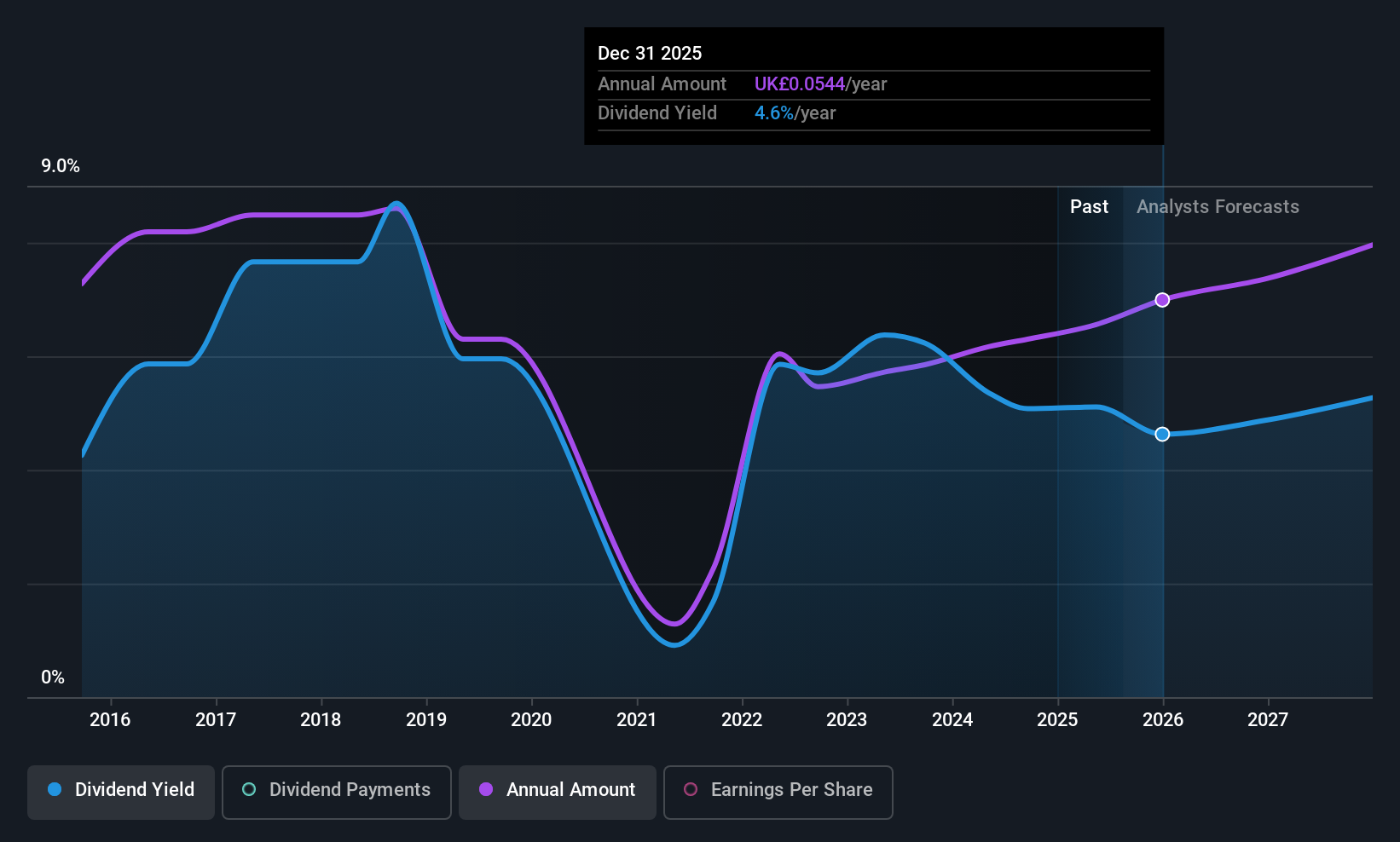

Epwin Group (AIM:EPWN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Epwin Group Plc manufactures building products for various markets including repair, maintenance, improvement, social housing, and new builds in the UK, Europe, and internationally with a market cap of £138.32 million.

Operations: Epwin Group's revenue is primarily derived from its Extrusion and Moulding segment, which accounts for £232.20 million, and its Fabrication and Distribution segment, contributing £131.30 million.

Dividend Yield: 5%

Epwin Group offers a mixed dividend profile, with recent growth in earnings of £78.5 million. However, its dividend payments have been volatile over the past decade, showing significant annual drops at times. The current 5% yield is lower than the top 25% of UK payers yet remains well-covered by earnings and cash flows with payout ratios of 43.4% and 21%, respectively. The stock trades at a favorable price-to-earnings ratio of 8.3x compared to the UK market average of 16.2x, indicating good relative value despite its unreliable dividend history.

- Click to explore a detailed breakdown of our findings in Epwin Group's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Epwin Group shares in the market.

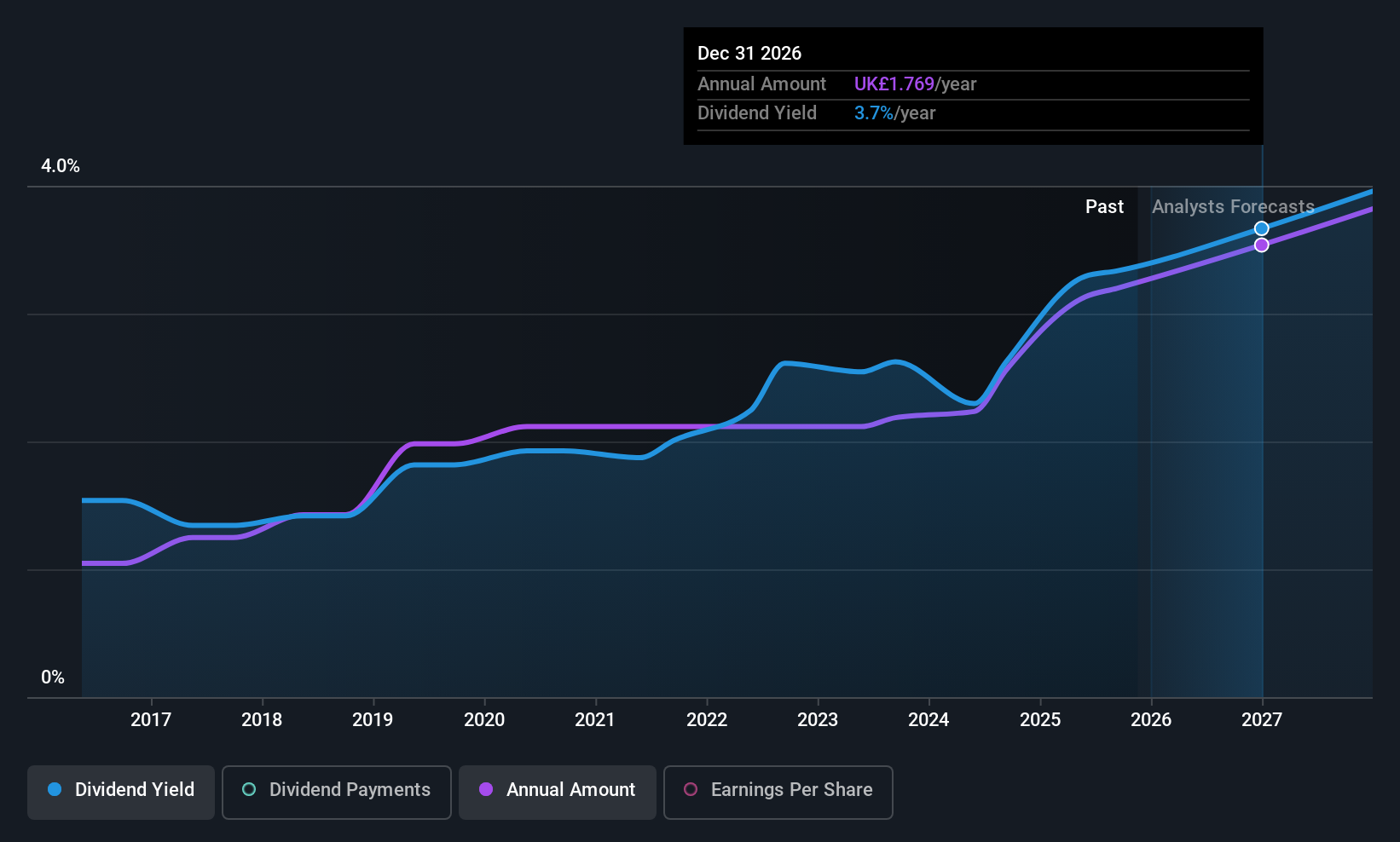

Intertek Group (LSE:ITRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Intertek Group plc offers quality assurance solutions across multiple industries globally, with a market capitalization of approximately £7.75 billion.

Operations: Intertek Group plc generates its revenue from several segments, including World of Energy (£757.30 million), Consumer Products (£958.80 million), Health and Safety (£337.20 million), Corporate Assurance (£496.30 million), and Industry and Infrastructure (£843.60 million).

Dividend Yield: 3.2%

Intertek Group's dividend yield of 3.17% is lower than the top quartile of UK payers but remains well-covered by earnings and cash flows, with payout ratios of 73% and 53.2%, respectively. The company has maintained stable and growing dividends over the past decade, supported by strong earnings growth of 16.1% in the last year. Recent initiatives like Intertek AI2 highlight its strategic expansion in AI assurance, potentially bolstering its long-term revenue streams.

- Delve into the full analysis dividend report here for a deeper understanding of Intertek Group.

- Upon reviewing our latest valuation report, Intertek Group's share price might be too pessimistic.

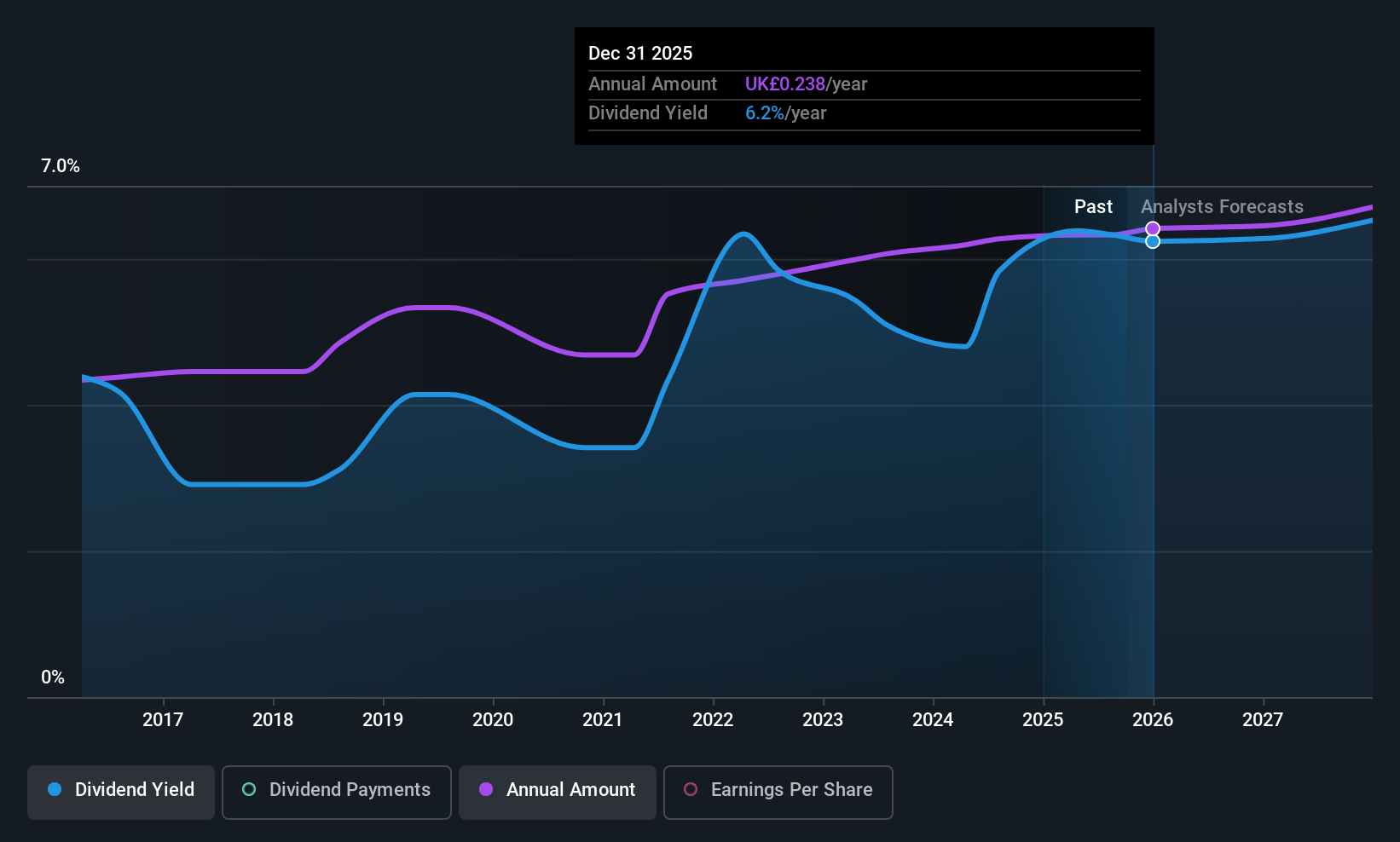

Vesuvius (LSE:VSVS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vesuvius plc offers molten metal flow engineering and technology services to the steel and foundry casting industries globally, with a market cap of approximately £972.88 million.

Operations: Vesuvius plc generates revenue through its segments: Foundry (£476.30 million), Steel - Flow Control (£769 million), Steel - Sensors & Probes (£39.20 million), and Steel - Advanced Refractories (£535.60 million).

Dividend Yield: 5.9%

Vesuvius offers a dividend yield of 5.9%, placing it in the top 25% of UK dividend payers, yet its sustainability is questionable due to cash flow coverage issues with a high cash payout ratio of 99.2%. Despite trading at an attractive valuation, the dividends have been volatile over the past decade. The company's recent shareholder call discussed its Spring trading update, which could impact future earnings and dividend stability forecasts.

- Click here to discover the nuances of Vesuvius with our detailed analytical dividend report.

- Our expertly prepared valuation report Vesuvius implies its share price may be lower than expected.

Make It Happen

- Take a closer look at our Top UK Dividend Stocks list of 56 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ITRK

Intertek Group

Provides quality assurance solutions to various industries in the United Kingdom, the United States, China, Australia, and internationally.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives