- United Kingdom

- /

- Commercial Services

- /

- LSE:MER

Top UK Dividend Stocks For January 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index grapples with the ripple effects of weak trade data from China, investors are carefully navigating a market environment marked by global economic uncertainties. In such times, dividend stocks can offer a measure of stability and income, making them an attractive option for those looking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.58% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.14% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 8.12% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.97% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.76% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.64% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.74% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.00% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.66% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.38% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

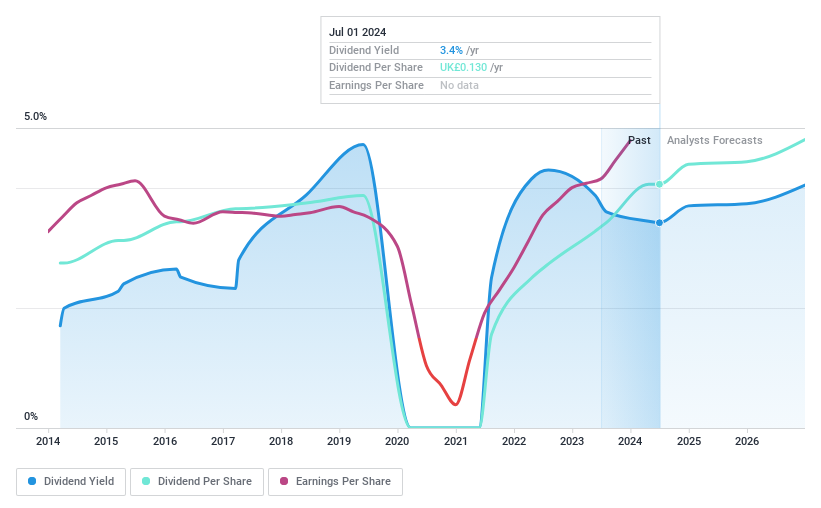

Epwin Group (AIM:EPWN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Epwin Group Plc manufactures and sells building products in the United Kingdom, Europe, and internationally, with a market cap of £126.40 million.

Operations: Epwin Group Plc generates its revenue primarily from two segments: Extrusion and Moulding, which contributes £233.30 million, and Fabrication and Distribution, accounting for £130.40 million.

Dividend Yield: 5.3%

Epwin Group's dividend payments are currently covered by earnings with a payout ratio of 77.5% and well-supported by cash flows at a 27% cash payout ratio. While the dividend has grown over the past decade, it has been volatile, experiencing significant annual drops. The current yield of 5.33% is below the top tier in the UK market. Earnings have shown recent growth, but historical instability makes its dividends less reliable for consistent income seekers.

- Click here to discover the nuances of Epwin Group with our detailed analytical dividend report.

- The analysis detailed in our Epwin Group valuation report hints at an deflated share price compared to its estimated value.

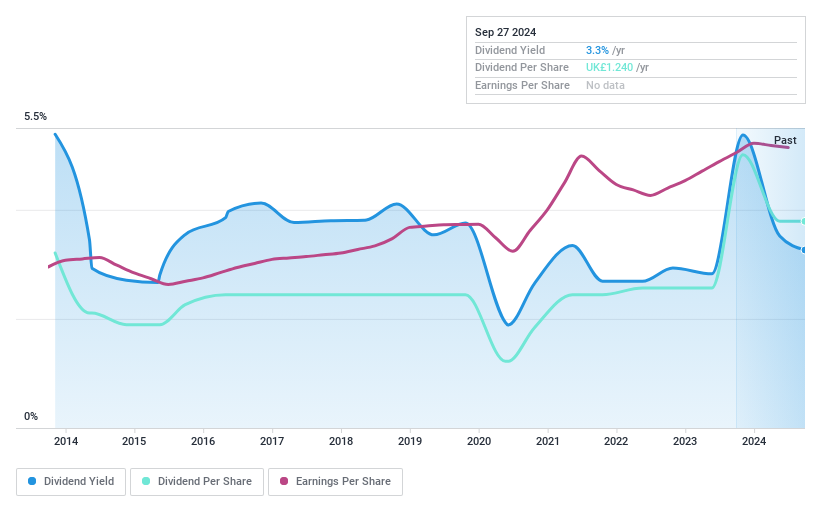

London Security (AIM:LSC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: London Security plc is an investment holding company that manufactures, sells, and rents fire protection equipment across several European countries including the United Kingdom, with a market cap of £441.36 million.

Operations: The company's revenue from the provision and maintenance of fire protection and security equipment is £221.72 million.

Dividend Yield: 3.4%

London Security's dividend payments are covered by both earnings and free cash flow, with payout ratios of 65.3% and 66.2%, respectively. Despite a decade-long increase in dividends, the payments have been volatile, experiencing annual drops over 20%. The current yield of 3.39% is lower than the top UK dividend payers at 5.9%. Earnings grew by 5.2% last year, but the unstable dividend history may concern those seeking consistent income.

- Click here and access our complete dividend analysis report to understand the dynamics of London Security.

- Our comprehensive valuation report raises the possibility that London Security is priced lower than what may be justified by its financials.

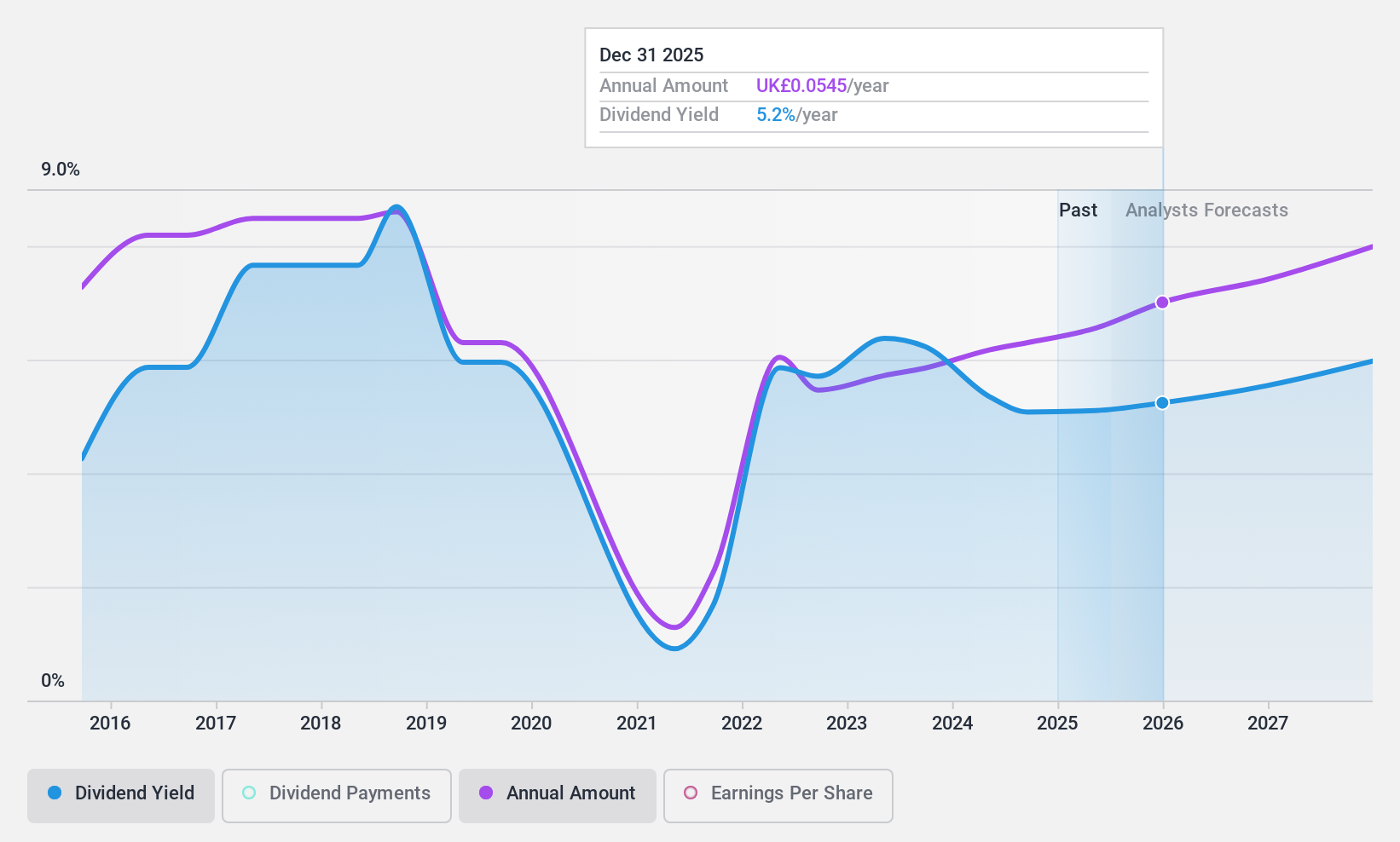

Mears Group (LSE:MER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mears Group plc, with a market cap of £326.75 million, provides outsourced services to both public and private sectors in the United Kingdom.

Operations: Mears Group plc generates revenue through its Management segment, contributing £591.63 million, and its Maintenance segment, which adds £551.73 million.

Dividend Yield: 4%

Mears Group's dividend payments are well-supported by earnings and cash flows, with payout ratios of 33.4% and 10.6%, respectively. Despite a history of volatility over the last decade, dividends have grown, though the current yield of 4.04% lags behind top UK payers at 5.9%. Recent guidance suggests revenues for 2024 will reach £1.13 billion, potentially enhancing financial stability despite forecasted earnings declines over the next three years.

- Get an in-depth perspective on Mears Group's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Mears Group is trading behind its estimated value.

Key Takeaways

- Investigate our full lineup of 61 Top UK Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MER

Mears Group

Provides various outsourced services to the public and private sectors in the United Kingdom.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives