- United Kingdom

- /

- Building

- /

- AIM:EPWN

Top 3 UK Dividend Stocks To Consider

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced downward pressure, influenced by weak trade data from China, which is a significant trading partner. In this challenging environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive consideration for those looking to navigate market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.17% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.88% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.63% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.20% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.90% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.09% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.88% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.12% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.37% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.11% | ★★★★★☆ |

Click here to see the full list of 53 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

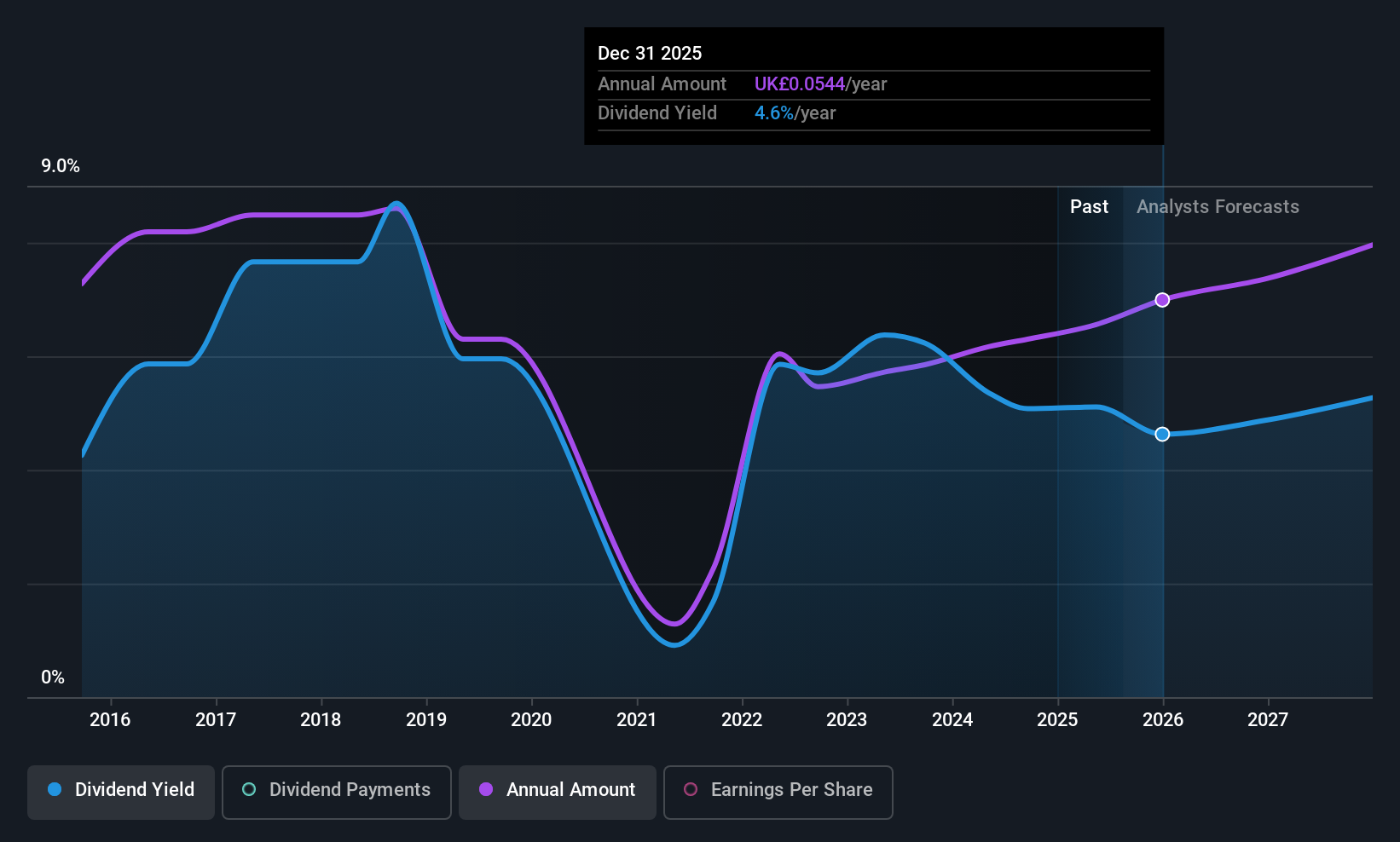

Epwin Group (AIM:EPWN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Epwin Group Plc manufactures building products for the repair, maintenance, and improvement sectors as well as social housing and new build markets in the UK, Europe, and internationally with a market cap of £160.51 million.

Operations: Epwin Group's revenue is primarily derived from its Extrusion and Moulding segment, which generated £232.20 million, and its Fabrication and Distribution segment, contributing £131.30 million.

Dividend Yield: 4.3%

Epwin Group's dividend yield of 4.32% is below the UK market's top quartile, with a history of volatility over the past decade. Despite this, dividends are well-covered by earnings and cash flow, with payout ratios of 43.4% and 21%, respectively. Trading at a favorable P/E ratio of 9.7x compared to the market average, Epwin is undergoing an acquisition by Laumann Group for £163.11 million, potentially impacting future dividend stability and strategy.

- Unlock comprehensive insights into our analysis of Epwin Group stock in this dividend report.

- Our expertly prepared valuation report Epwin Group implies its share price may be lower than expected.

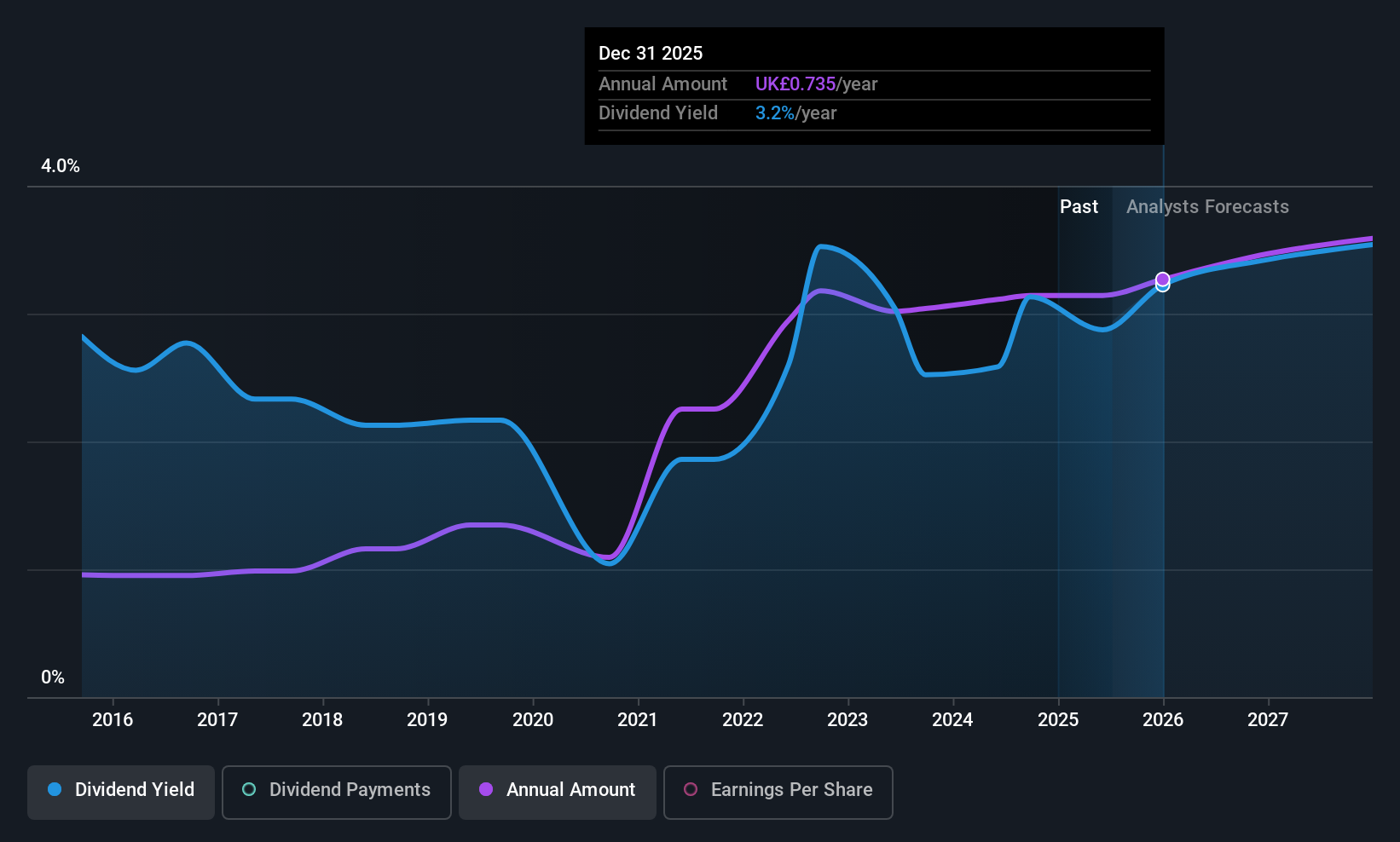

Computacenter (LSE:CCC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Computacenter plc offers technology and services to corporate and public sector organizations across the UK, Germany, Western Europe, North America, and internationally, with a market cap of approximately £2.44 billion.

Operations: Computacenter plc generates revenue primarily from its Computer Services segment, which accounts for £6.96 billion.

Dividend Yield: 3%

Computacenter's dividend yield of 3.04% is modest compared to the UK's top quartile, and its history shows volatility over the last decade. However, dividends are well-covered by earnings with a payout ratio of 45.8% and cash flows at 19.2%, indicating sustainability despite past instability. The stock trades at a favorable P/E ratio of 14.3x versus the UK market average, suggesting good value relative to peers. Recent executive changes include Keith Mortimer as CFO from September 2025, potentially influencing future financial strategy.

- Get an in-depth perspective on Computacenter's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Computacenter's current price could be quite moderate.

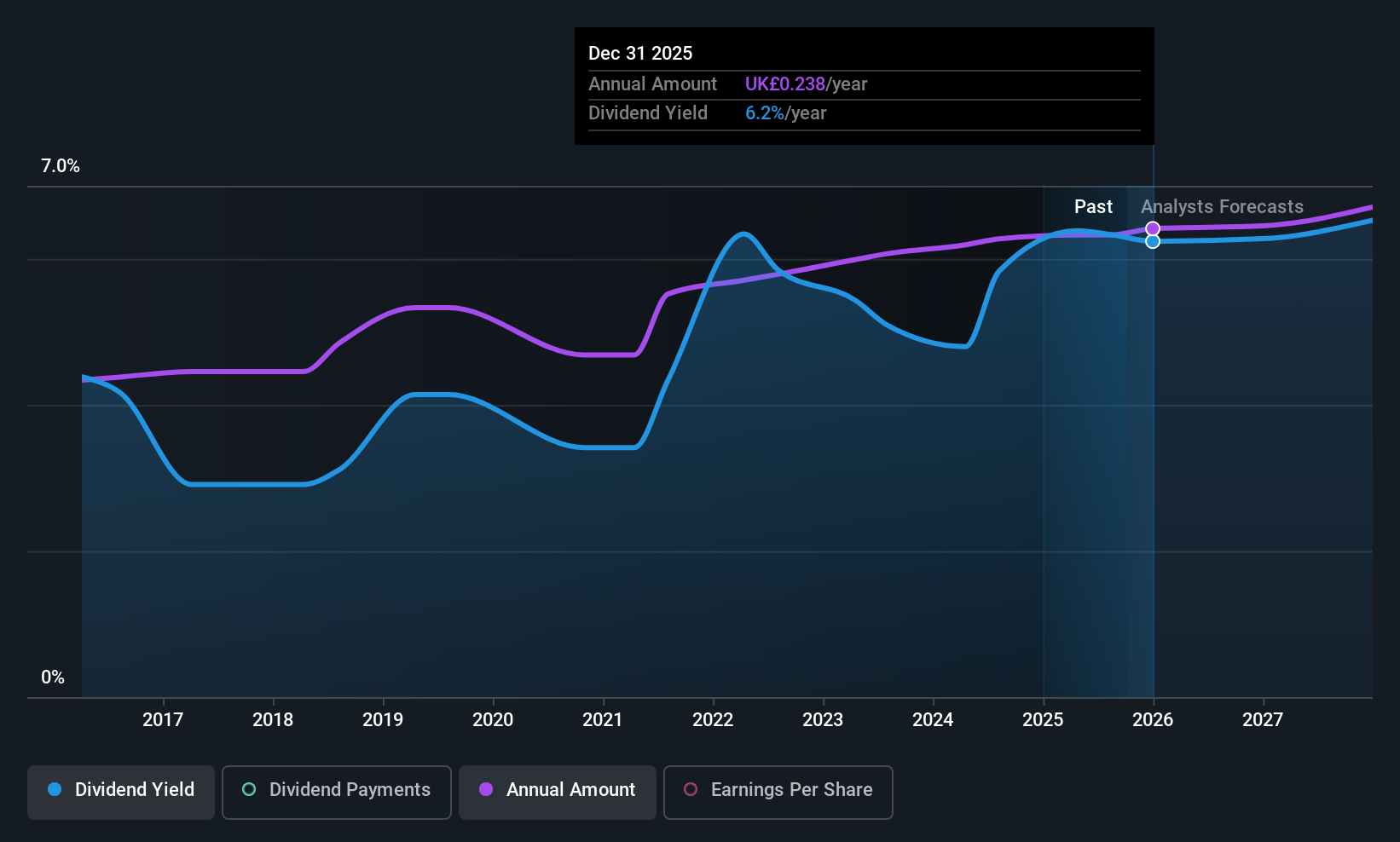

Vesuvius (LSE:VSVS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vesuvius plc offers molten metal flow engineering and technology services to the steel and foundry casting industries globally, with a market cap of approximately £942.09 million.

Operations: Vesuvius plc generates revenue through its segments: Foundry (£463 million), Steel - Flow Control (£753.40 million), Steel - Sensors & Probes (£36.30 million), and Steel - Advanced Refractories (£538.30 million).

Dividend Yield: 6.1%

Vesuvius offers a compelling dividend yield of 6.09%, placing it among the top UK payers, though its history is marked by volatility. While dividends are covered by earnings with an 84.1% payout ratio, they are not well-supported by cash flows, indicated by a high cash payout ratio of 235.3%. The interim dividend remains consistent at 7.1 pence per share for H1 2025, reflecting stable recent performance despite past inconsistencies in payments and growth prospects around €1.85 billion revenue for the year.

- Click here to discover the nuances of Vesuvius with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Vesuvius is trading behind its estimated value.

Where To Now?

- Navigate through the entire inventory of 53 Top UK Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Epwin Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EPWN

Epwin Group

Manufactures building products for the repair, maintenance and improvement, social housing, and new build markets in the United Kingdom, Europe, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives