- United Kingdom

- /

- Food

- /

- AIM:MPE

Exploring Top Dividend Stocks In June 2024

Reviewed by Simply Wall St

As the United Kingdom's market navigates through a period of flat GDP and anticipatory sentiments around Federal Reserve rate decisions, investors are keenly watching the FTSE 100's movements. Amid these conditions, dividend stocks continue to attract attention for their potential to offer steady returns in a fluctuating economic landscape.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Record (LSE:REC) | 8.15% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.74% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 6.78% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.51% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.12% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.79% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.73% | ★★★★★☆ |

| Rio Tinto Group (LSE:RIO) | 6.30% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.05% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.67% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Epwin Group (AIM:EPWN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Epwin Group Plc is a manufacturer and distributor of building products primarily in the United Kingdom, with operations extending to the rest of Europe and internationally, boasting a market capitalization of approximately £133.77 million.

Operations: Epwin Group Plc generates £250.50 million from its Extrusion and Moulding segment and £135.20 million from Fabrication and Distribution.

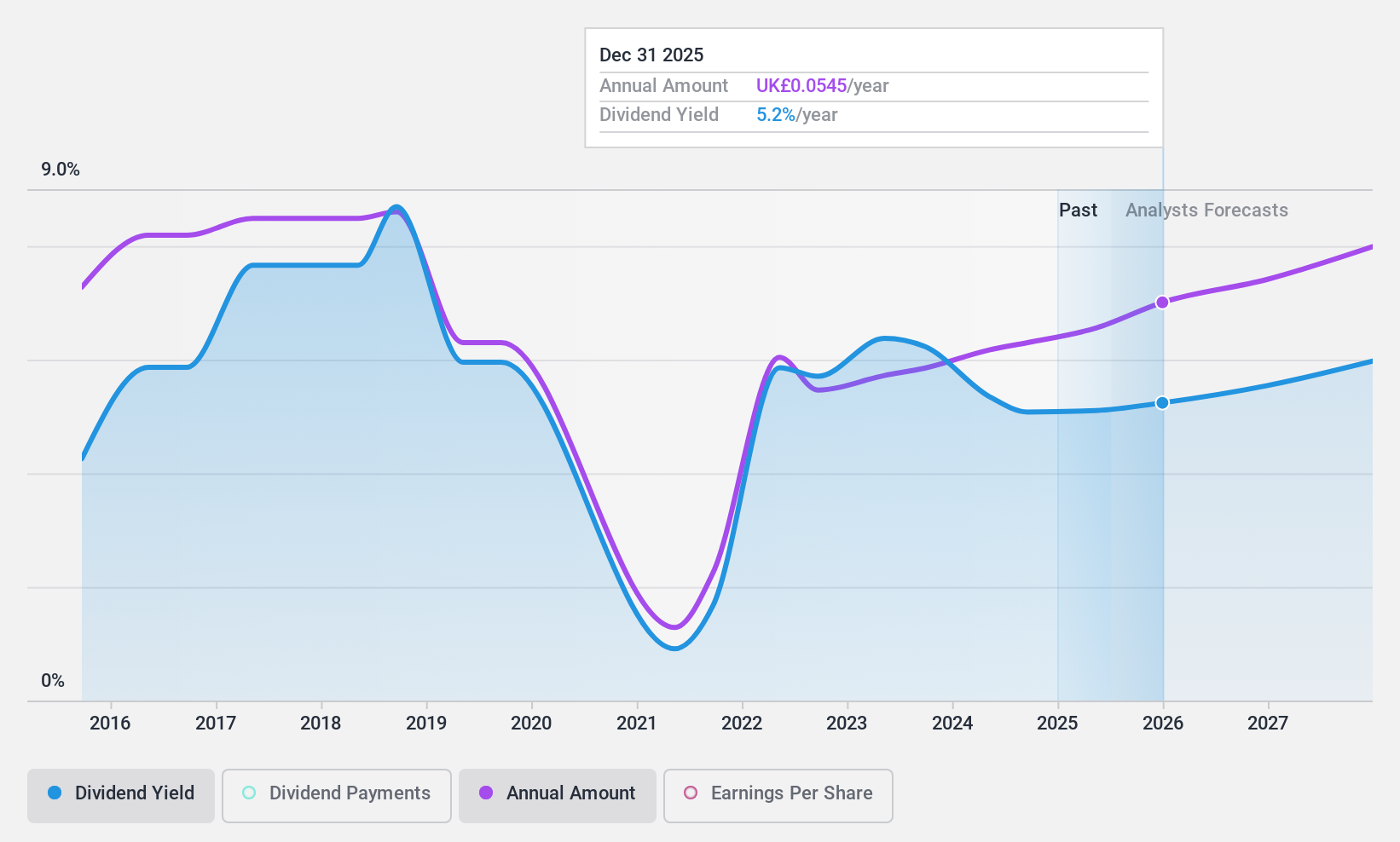

Dividend Yield: 5.1%

Epwin Group Plc has demonstrated a commitment to returning value to shareholders, evidenced by its recent share buyback and consistent dividend increases. In 2023, the company reported a modest increase in net income and declared a full-year dividend of £0.048 per share, up 8% from the previous year. Despite this growth, Epwin's dividend yield remains below the top quartile of UK dividend payers. The board changes and expanded buyback plan suggest proactive governance, yet the company's historical dividend volatility indicates potential uncertainty in future payouts.

- Get an in-depth perspective on Epwin Group's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Epwin Group's share price might be too pessimistic.

M.P. Evans Group (AIM:MPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M.P. Evans Group PLC operates oil palm plantations in Indonesia and Malaysia, with a market capitalization of approximately £447.69 million.

Operations: M.P. Evans Group PLC generates revenue primarily from its plantation operations in Indonesia, totaling $307.32 million.

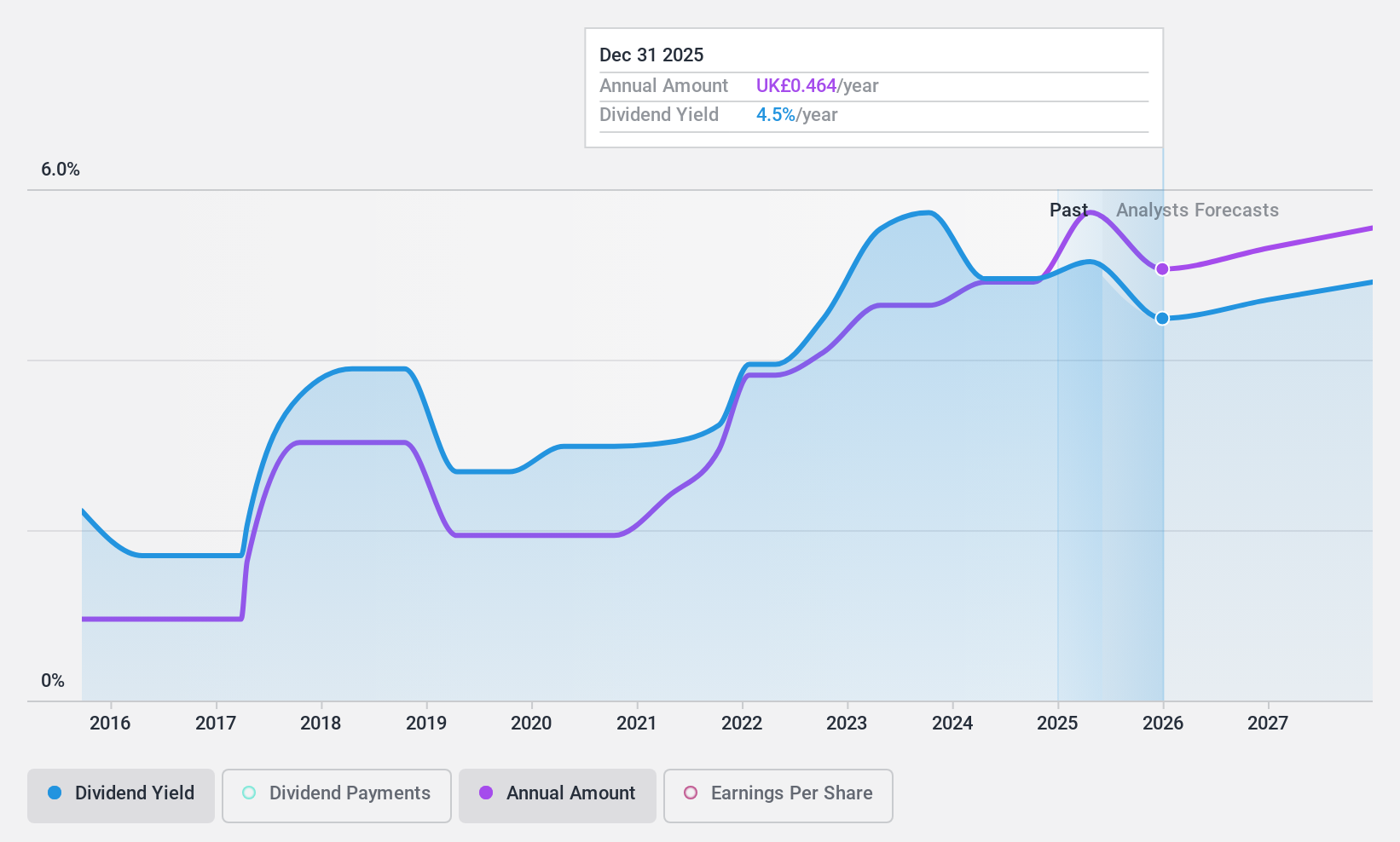

Dividend Yield: 5.1%

M.P. Evans Group PLC has shown a mixed performance in terms of dividend reliability, with significant fluctuations over the past decade. Despite this, recent increases in dividend payments, including a final proposed dividend of 32.5 pence per share for 2023, reflect a positive trend. The company's dividends are well-supported by both earnings and cash flow, with payout ratios of 58.7% and 64.6% respectively. However, its dividend yield of 5.13% remains slightly below the top quartile for UK markets, and recent financial results show a decline in net income from US$73.06 million to US$52.49 million year-over-year.

- Navigate through the intricacies of M.P. Evans Group with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that M.P. Evans Group is trading behind its estimated value.

RS Group (LSE:RS1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: RS Group plc operates as a distributor of maintenance, repair, and operations products and service solutions across several countries including the UK, US, France, Germany, Italy, and Mexico, with a market capitalization of approximately £3.36 billion.

Operations: RS Group plc generates revenue primarily through two segments: Own-Brand Products (£404.80 million) and Other Product and Service Solutions (£2.54 billion).

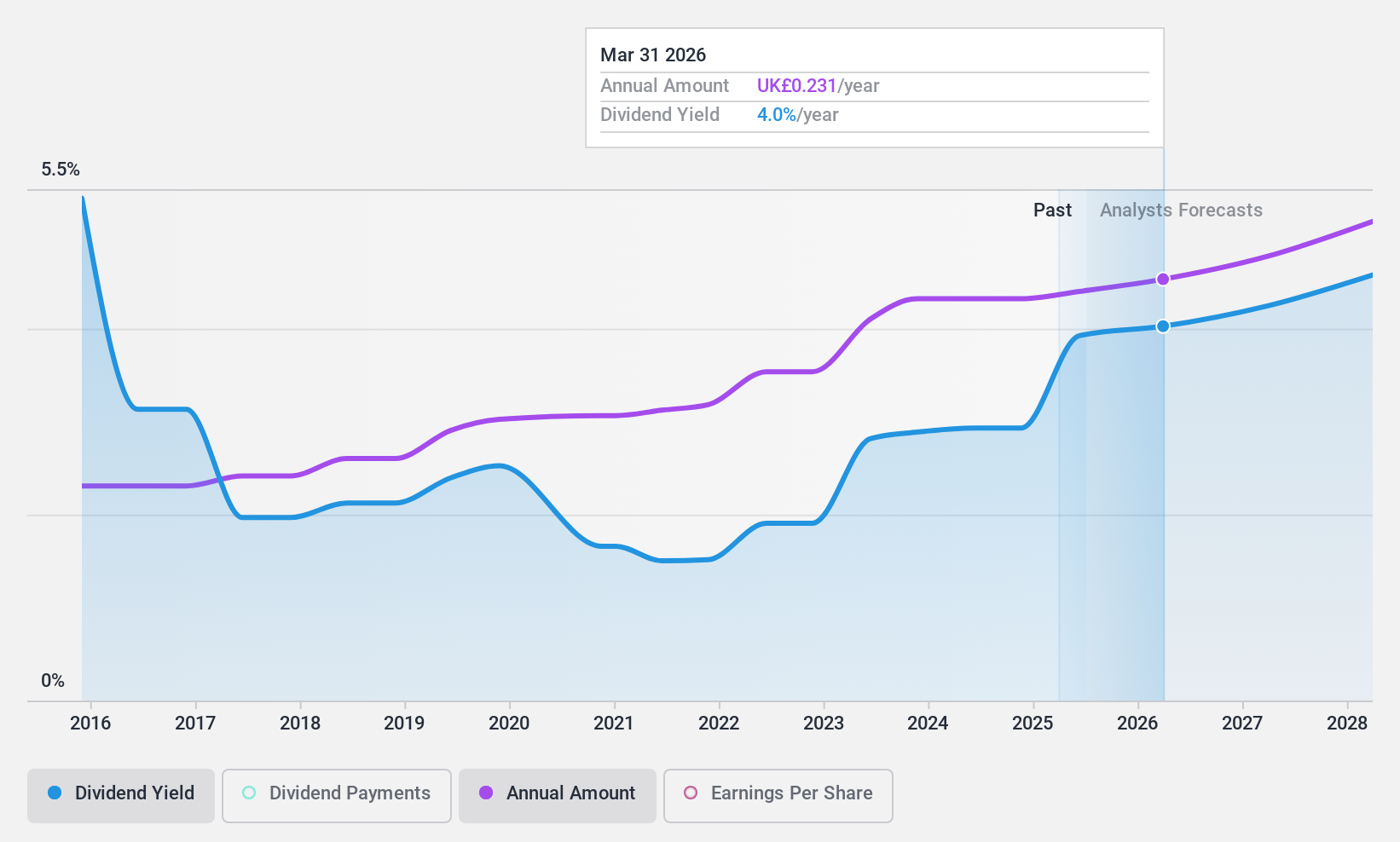

Dividend Yield: 3.1%

RS Group's dividend sustainability is moderately strong, with a 56.7% earnings payout ratio and a 71.9% cash flow payout ratio. Dividend growth is evident over the past decade, though its current yield of 3.11% trails the top UK payers. Recent strategic moves include targeted acquisitions to bolster growth, such as the GBP 8 million purchase of Trident in Australia, enhancing their MRO capabilities and supporting long-term value creation through selective mergers and acquisitions.

- Dive into the specifics of RS Group here with our thorough dividend report.

- Our expertly prepared valuation report RS Group implies its share price may be lower than expected.

Summing It All Up

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 56 more companies for you to explore.Click here to unveil our expertly curated list of 59 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MPE

M.P. Evans Group

Through its subsidiaries, owns and develops oil palm plantations in Indonesia and Malaysia.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)