- United Kingdom

- /

- Aerospace & Defense

- /

- AIM:CHRT

What Cohort plc's (LON:CHRT) 27% Share Price Gain Is Not Telling You

Cohort plc (LON:CHRT) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The annual gain comes to 114% following the latest surge, making investors sit up and take notice.

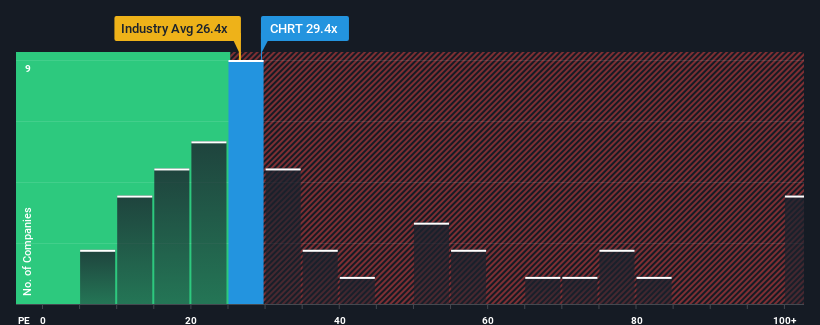

After such a large jump in price, Cohort's price-to-earnings (or "P/E") ratio of 29.4x might make it look like a strong sell right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios below 14x and even P/E's below 8x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, Cohort has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Cohort

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Cohort's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 47% gain to the company's bottom line. Pleasingly, EPS has also lifted 277% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 0.9% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 14% each year, which is noticeably more attractive.

With this information, we find it concerning that Cohort is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

The strong share price surge has got Cohort's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Cohort's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Cohort.

Of course, you might also be able to find a better stock than Cohort. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CHRT

Cohort

Provides various products and services in defense, security, and related markets in the United Kingdom, Germany, Portugal, Australia, North and South America, Asia Pacific, Africa, and other European countries.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives