- United Kingdom

- /

- Trade Distributors

- /

- AIM:BRCK

3 UK Stocks Estimated To Be Trading Below Intrinsic Value By At Least 13.5%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, highlighting the interconnectedness of global markets and the impact of international economic challenges on UK equities. In such volatile conditions, identifying stocks trading below their intrinsic value becomes essential for investors seeking potential opportunities amidst broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topps Tiles (LSE:TPT) | £0.378 | £0.69 | 45.6% |

| TBC Bank Group (LSE:TBCG) | £47.90 | £92.77 | 48.4% |

| Moonpig Group (LSE:MOON) | £2.21 | £4.02 | 45% |

| Marlowe (AIM:MRL) | £4.39 | £8.35 | 47.4% |

| LSL Property Services (LSE:LSL) | £3.20 | £5.95 | 46.2% |

| Informa (LSE:INF) | £8.078 | £15.08 | 46.4% |

| Hostelworld Group (LSE:HSW) | £1.37 | £2.55 | 46.3% |

| Gooch & Housego (AIM:GHH) | £6.10 | £11.21 | 45.6% |

| Burberry Group (LSE:BRBY) | £12.63 | £23.92 | 47.2% |

| AstraZeneca (LSE:AZN) | £103.36 | £188.16 | 45.1% |

Let's review some notable picks from our screened stocks.

Brickability Group (AIM:BRCK)

Overview: Brickability Group Plc, with a market cap of £204.23 million, supplies, distributes, and imports building products in the United Kingdom through its subsidiaries.

Operations: The company's revenue is primarily derived from its Bricks and Building Materials segment (£380.56 million), followed by Importing (£90.55 million), Contracting (£88.22 million), and Distribution (£63.21 million).

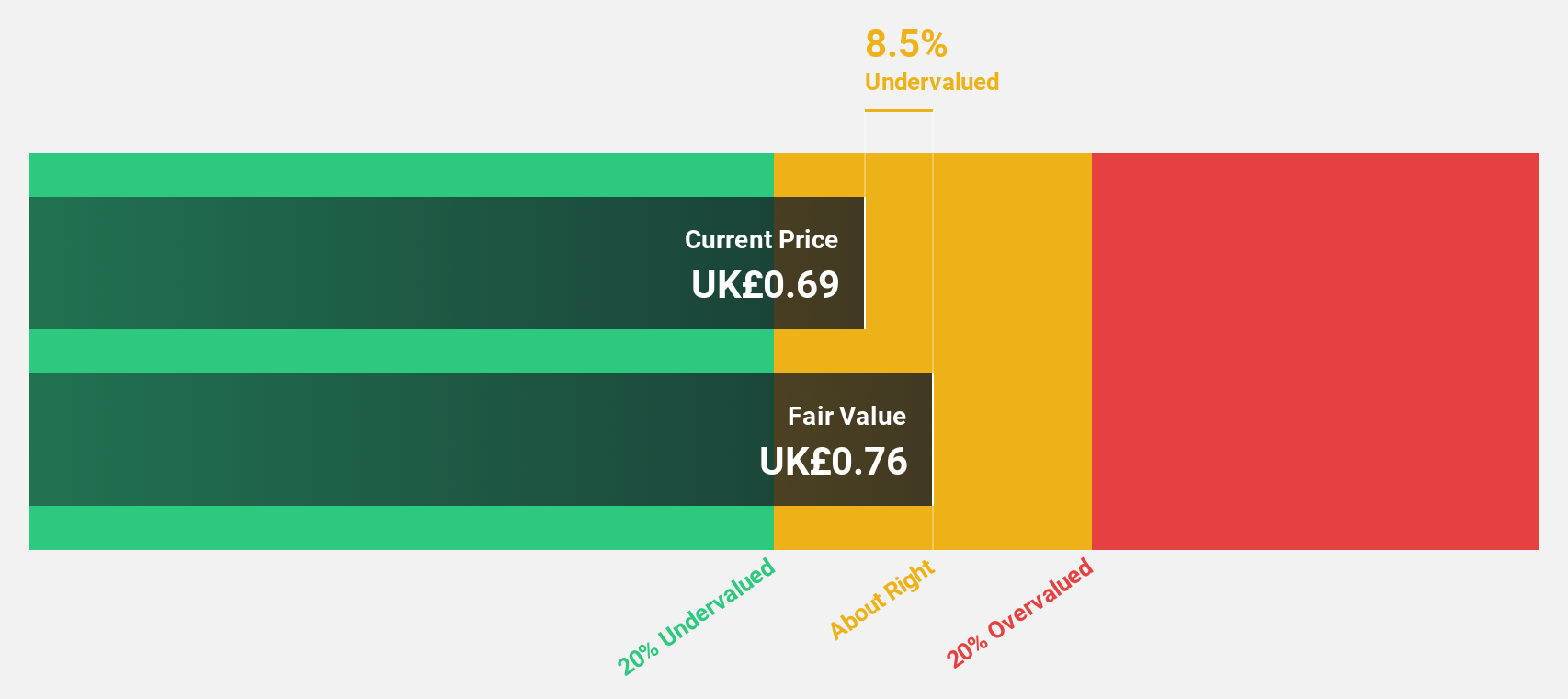

Estimated Discount To Fair Value: 13.5%

Brickability Group is trading at £0.63, below its estimated fair value of £0.73, indicating it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 62.3% per year, outpacing the UK market's 14.5%. However, profit margins have decreased from 4.3% to 1.4%, and significant insider selling has occurred recently. Revenue growth is expected to be modest at 5.9% annually but still above the UK market average of 3.6%.

- Our comprehensive growth report raises the possibility that Brickability Group is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Brickability Group.

Property Franchise Group (AIM:TPFG)

Overview: The Property Franchise Group PLC operates in the United Kingdom, focusing on residential property franchising, licensing, and financial services, with a market cap of £351.91 million.

Operations: The company's revenue is derived from property franchising (£40.90 million), financial services (£19.20 million), and licensing (£7.21 million).

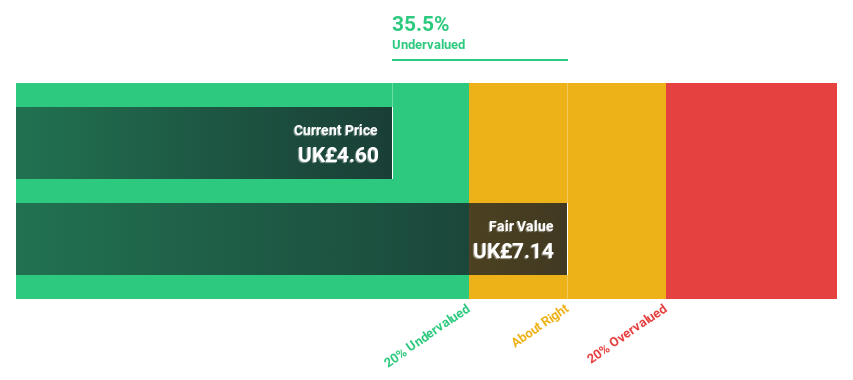

Estimated Discount To Fair Value: 28.0%

Property Franchise Group, with a trading price of £5.52, is notably undervalued based on cash flows, being 28% below its fair value estimate of £7.66. Despite a drop in profit margins from 27.1% to 15.1%, earnings grew by 37.8% last year and are forecast to rise at an annual rate of 23.55%, surpassing the UK market's growth expectations. However, the dividend yield of 3.26% is not well covered by earnings, raising sustainability concerns.

- According our earnings growth report, there's an indication that Property Franchise Group might be ready to expand.

- Get an in-depth perspective on Property Franchise Group's balance sheet by reading our health report here.

Applied Nutrition (LSE:APN)

Overview: Applied Nutrition Plc manufactures, wholesales, and retails sports nutritional products in the United Kingdom and internationally, with a market cap of £313.50 million.

Operations: The company's revenue is primarily derived from its Vitamins & Nutrition Products segment, totaling £88.35 million.

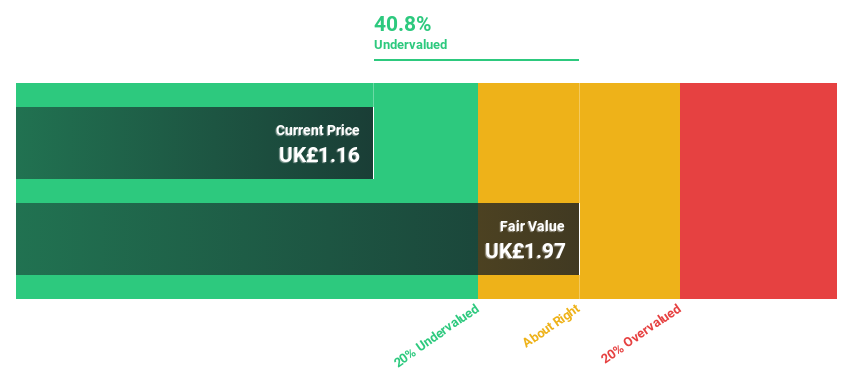

Estimated Discount To Fair Value: 40.9%

Applied Nutrition is trading at £1.25, significantly below its estimated fair value of £2.12, highlighting its undervaluation based on cash flows. The company forecasts earnings growth of 15.7% annually, outpacing the UK market's average. Despite a decline in net income to £8.9 million for the half-year ending January 2025, strategic alliances like the TANG® partnership could bolster future revenue streams and operational efficiency under new board leadership from seasoned executives Peter Cowgill and Deepti Velury Bakhshi.

- Our growth report here indicates Applied Nutrition may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Applied Nutrition's balance sheet health report.

Next Steps

- Investigate our full lineup of 59 Undervalued UK Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brickability Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BRCK

Brickability Group

Supplies, distributes, and imports building products in the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives