We have been pretty impressed with the performance at Avingtrans plc (LON:AVG) recently and CEO Steve McQuillan deserves a mention for their role in it. Coming up to the next AGM on 18 November 2021, shareholders would be keeping this in mind. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

View our latest analysis for Avingtrans

Comparing Avingtrans plc's CEO Compensation With the industry

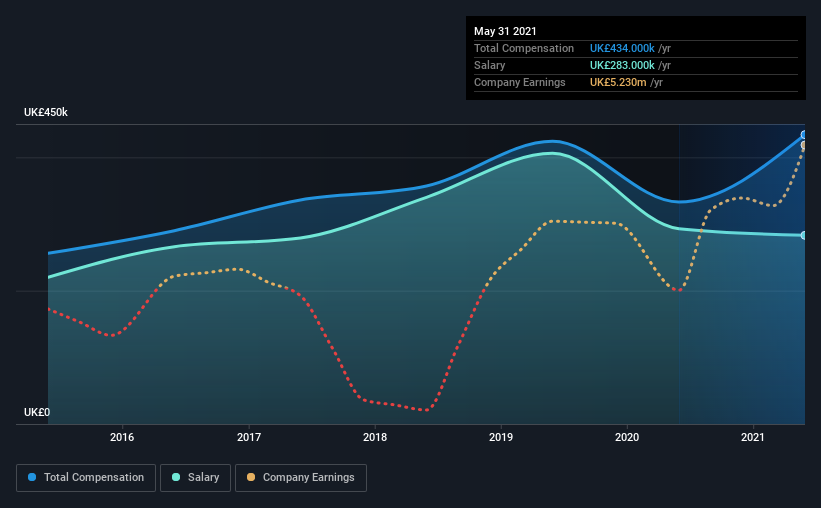

Our data indicates that Avingtrans plc has a market capitalization of UK£143m, and total annual CEO compensation was reported as UK£434k for the year to May 2021. We note that's an increase of 30% above last year. In particular, the salary of UK£283.0k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between UK£75m and UK£299m, we discovered that the median CEO total compensation of that group was UK£366k. From this we gather that Steve McQuillan is paid around the median for CEOs in the industry. What's more, Steve McQuillan holds UK£1.9m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£283k | UK£293k | 65% |

| Other | UK£151k | UK£40k | 35% |

| Total Compensation | UK£434k | UK£333k | 100% |

On an industry level, around 64% of total compensation represents salary and 36% is other remuneration. Although there is a difference in how total compensation is set, Avingtrans more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Avingtrans plc's Growth Numbers

Avingtrans plc has seen its earnings per share (EPS) increase by 85% a year over the past three years. Its revenue is up 7.1% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Avingtrans plc Been A Good Investment?

We think that the total shareholder return of 109%, over three years, would leave most Avingtrans plc shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. In saying that, some shareholders may feel that the more important issues to be addressed may be how the management plans to steer the company towards sustainable profitability in the future.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Avingtrans.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:AVG

Avingtrans

Provides engineered components, systems, and services to the energy, medical, and infrastructure industries in the United Kingdom, rest of Europe, the United States of America, Africa, the Middle East, the Americas, the Carribean, China, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives