- United Kingdom

- /

- Trade Distributors

- /

- LSE:AT.

We Ran A Stock Scan For Earnings Growth And Ashtead Technology Holdings (LON:AT.) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Ashtead Technology Holdings (LON:AT.), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Ashtead Technology Holdings

Ashtead Technology Holdings' Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Commendations have to be given in seeing that Ashtead Technology Holdings grew its EPS from UK£0.01 to UK£0.089, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

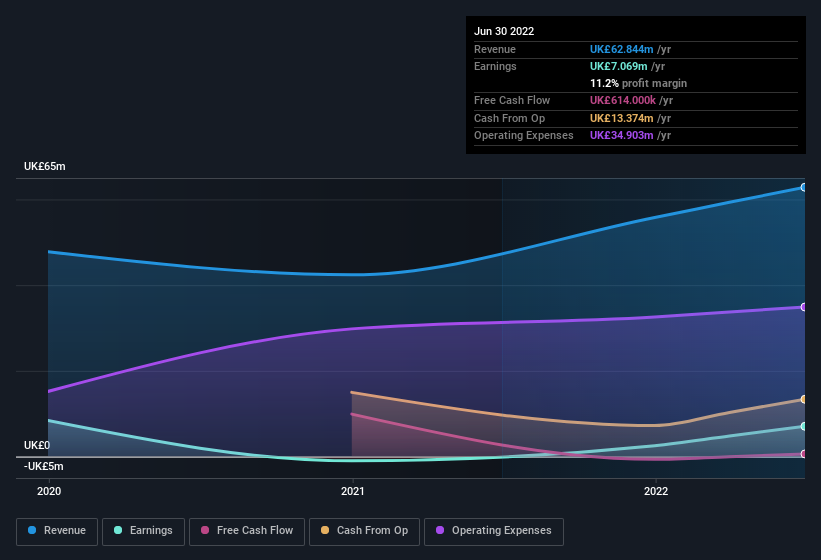

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Ashtead Technology Holdings shareholders can take confidence from the fact that EBIT margins are up from 3.7% to 17%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Ashtead Technology Holdings' future profits.

Are Ashtead Technology Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's nice to see that there have been no reports of any insiders selling shares in Ashtead Technology Holdings in the previous 12 months. So it's definitely nice that Independent Non-Executive Director Anthony R. Durrant bought UK£32k worth of shares at an average price of around UK£3.17. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

It's commendable to see that insiders have been buying shares in Ashtead Technology Holdings, but there is more evidence of shareholder friendly management. Namely, Ashtead Technology Holdings has a very reasonable level of CEO pay. The median total compensation for CEOs of companies similar in size to Ashtead Technology Holdings, with market caps between UK£83m and UK£332m, is around UK£626k.

The Ashtead Technology Holdings CEO received UK£320k in compensation for the year ending December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Ashtead Technology Holdings Deserve A Spot On Your Watchlist?

Ashtead Technology Holdings' earnings per share growth have been climbing higher at an appreciable rate. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests Ashtead Technology Holdings may be at an inflection point. If so, then its potential for further gains probably merit a spot on your watchlist. Now, you could try to make up your mind on Ashtead Technology Holdings by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that Ashtead Technology Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AT.

Ashtead Technology Holdings

Provides subsea equipment rental solutions for the offshore energy sector in Europe, the Americas, the Asia-Pacific, and the Middle East.

Very undervalued with moderate growth potential.

Market Insights

Community Narratives