- United Kingdom

- /

- Trade Distributors

- /

- AIM:ASY

Exploring May 2025's Undiscovered Gems in the United Kingdom

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces headwinds from weak trade data out of China, reflecting broader global economic challenges, investors are increasingly turning their attention to smaller, potentially undervalued opportunities. In this environment, identifying stocks with strong fundamentals and resilience in the face of external pressures becomes crucial for those seeking hidden gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| MS INTERNATIONAL | NA | 13.42% | 56.55% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

| Law Debenture | 17.80% | 11.81% | 7.59% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Andrews Sykes Group (AIM:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Andrews Sykes Group plc is an investment holding company involved in the hire, sale, and installation of environmental control equipment across the UK, Europe, the Middle East, Africa, and internationally with a market cap of £220.80 million.

Operations: The company generates revenue primarily from the hire and sale of environmental control equipment, with significant contributions from the UK (£43.10 million) and Europe excluding the UK (£23.60 million), followed by operations in the Middle East (£7.70 million). The installation and maintenance segment contributes £1.60 million to revenue.

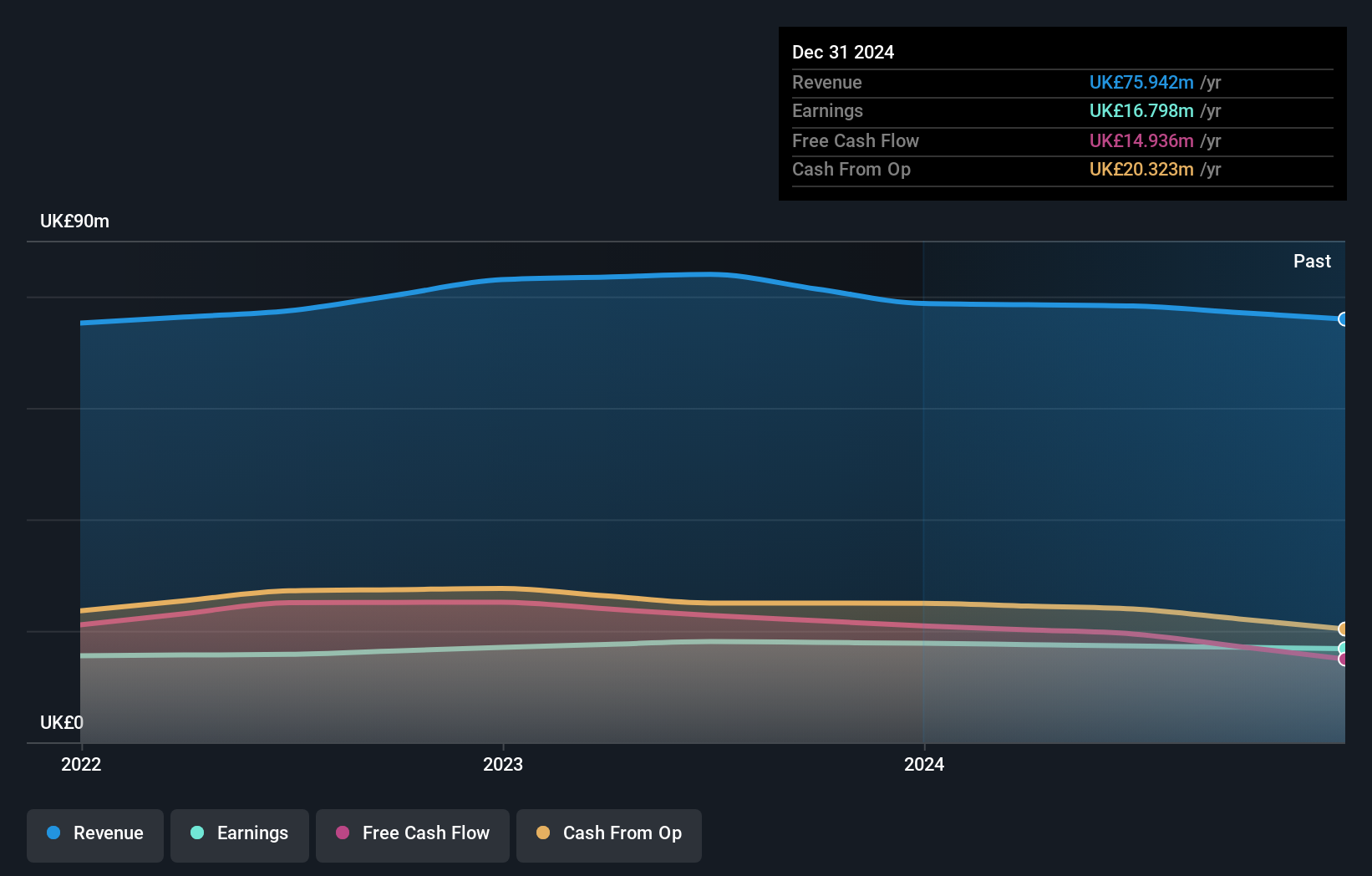

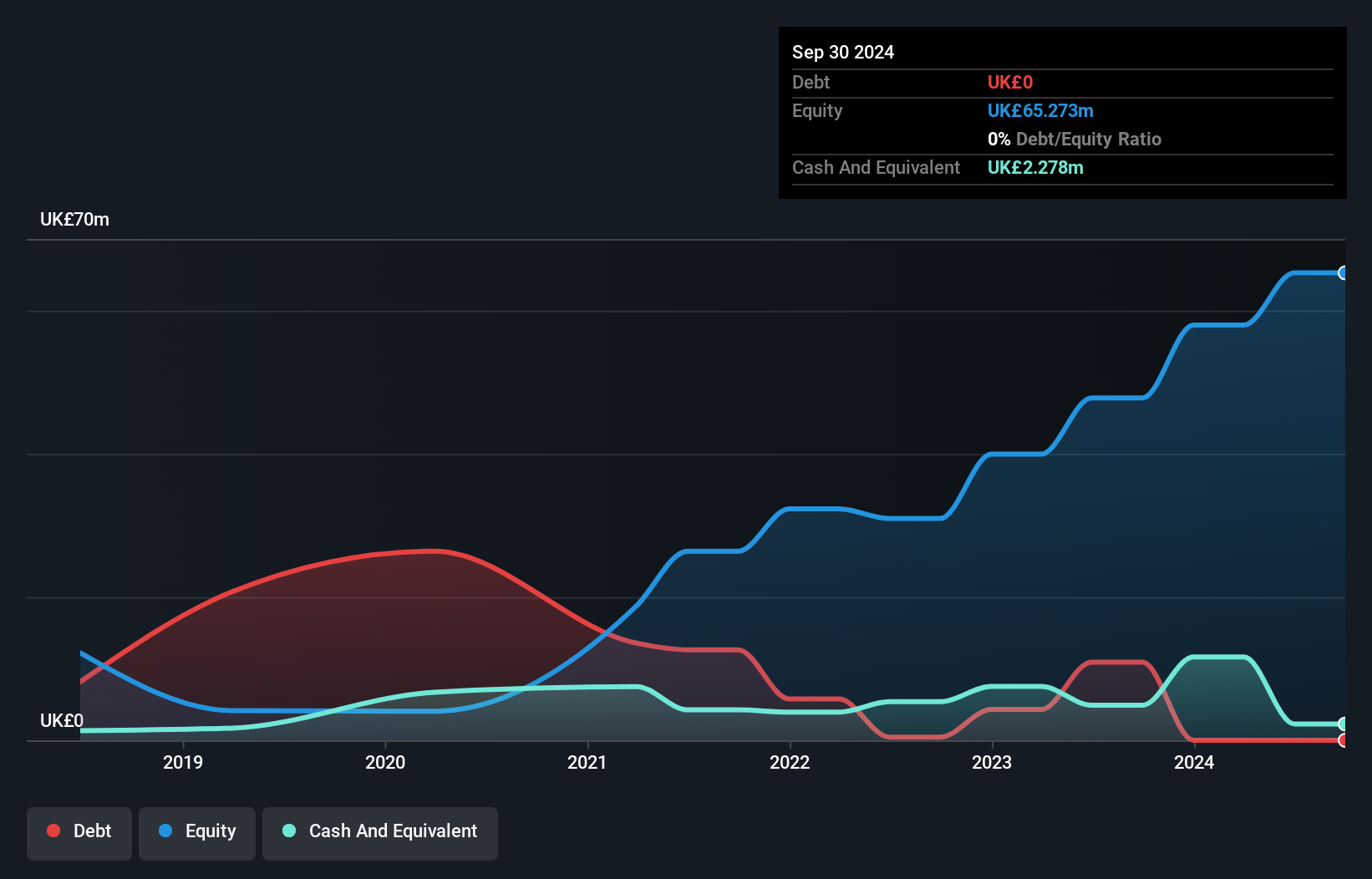

Andrews Sykes Group, a nimble player in the UK market, showcases financial resilience with no debt on its books, a notable improvement from a 6.3% debt-to-equity ratio five years ago. Despite facing negative earnings growth of -5.4%, slightly underperforming the Trade Distributors industry average of -4.9%, the company remains profitable and boasts high-quality earnings. Its price-to-earnings ratio stands at 13.1x, below the UK market's 16.5x, indicating potential value for investors. Recently reported annual sales were £75.94 million with net income at £16.8 million, reflecting slight decreases from previous figures but maintaining solid profitability overall.

- Get an in-depth perspective on Andrews Sykes Group's performance by reading our health report here.

Understand Andrews Sykes Group's track record by examining our Past report.

Supreme (AIM:SUP)

Simply Wall St Value Rating: ★★★★★★

Overview: Supreme Plc is a company that owns, manufactures, and distributes a range of products including batteries, lighting, vaping items, sports nutrition and wellness products, and branded household consumer goods across various regions such as the United Kingdom and internationally; it has a market cap of £187.70 million.

Operations: Supreme Plc generates revenue primarily from its vaping segment (£77.29 million) and branded household consumer goods (£67.25 million), with batteries contributing £42.00 million. The net profit margin shows a notable trend, reflecting the company's financial efficiency in managing its diverse product portfolio across multiple regions.

Supreme's recent acquisition of Clearly Drinks opens doors for revenue and profit margin improvements in the Soft Drinks sector, leveraging operational synergies. With a strategic pivot in the vaping market, the company is focusing on higher-margin products to counter potential regulatory impacts. Supreme's centralized facility aims to boost net margins through cost efficiencies, while its robust cash position supports future M&A activities. Despite projected earnings declines of 9.2% annually over three years, analysts see potential value with a price target of £2.25 per share against a current £1.54, suggesting possible undervaluation amidst anticipated industry challenges and modest revenue growth expectations at £235 million for 2025.

ME Group International (LSE:MEGP)

Simply Wall St Value Rating: ★★★★★★

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market capitalization of £772.55 million.

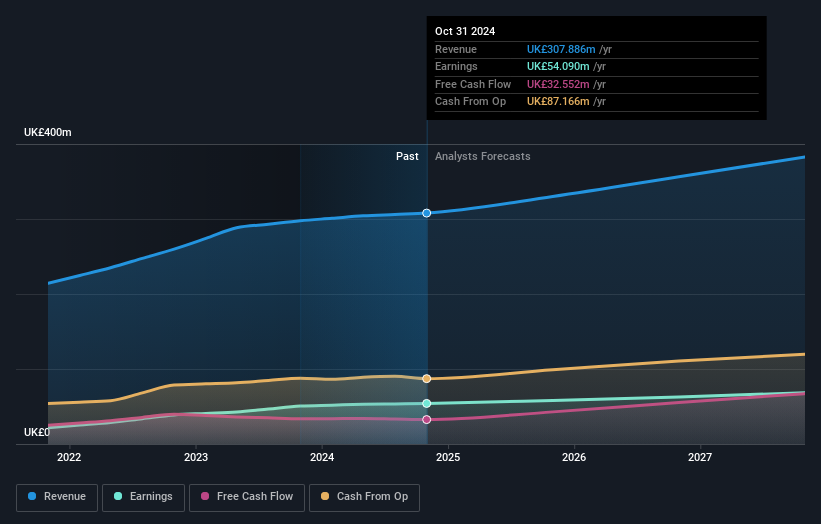

Operations: Revenue for ME Group International primarily comes from its personal services segment, totaling £307.89 million.

ME Group International, a smaller player in the UK market, shows promise with its recent financial performance and strategic moves. The company reported sales of £307.89 million for the year ending October 2024, up from £297.66 million previously, and net income rose to £54.09 million from £50.67 million. Earnings per share increased to GBP 0.1436 from GBP 0.134, reflecting solid growth alongside a reduced debt-to-equity ratio from 44.8% to 26.7% over five years, indicating effective debt management strategies in place while maintaining more cash than total debt obligations which is a positive sign for financial stability moving forward amidst expansion plans into new services like automated key cutting and enhanced printing kiosks that could drive further revenue growth despite potential risks such as currency fluctuations or declines in mature markets like photobooths that may impact overall performance but still offer significant upside potential given current trading valuation at about half of estimated fair value according to analyst projections suggesting careful consideration by investors when evaluating this stock's prospects within their portfolios especially considering recent dividend increases approved at the annual general meeting signaling confidence among stakeholders regarding future earnings capabilities supported by strategic partnerships with high-traffic site owners providing visibility on cash flows ahead as technology upgrades aim toward improved operational efficiency boosting net margins slightly projected between 17.6% and 17.9%.

Where To Now?

- Discover the full array of 58 UK Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ASY

Andrews Sykes Group

An investment holding company, engages in the hire, sale, and installation of environmental control equipment in the United Kingdom, rest of Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives