- United Kingdom

- /

- Trade Distributors

- /

- AIM:ASY

Andrews Sykes Group Leads The Charge Among 3 UK Penny Stocks

Reviewed by Simply Wall St

The United Kingdom's stock market has been experiencing turbulence, as evidenced by the recent decline in the FTSE 100 and FTSE 250 indices, largely influenced by weak trade data from China. Despite these broader market challenges, certain investment opportunities remain attractive, particularly in areas often overlooked. Penny stocks—though sometimes seen as a niche investment—can offer substantial growth potential when backed by strong financials. In this article, we explore three UK penny stocks that demonstrate both balance sheet strength and promising long-term prospects for investors seeking hidden value.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.928 | £146.39M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.055 | £774.25M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.65M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.20 | £102.52M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.445 | £312.41M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.43 | $249.97M | ★★★★★★ |

Click here to see the full list of 471 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Andrews Sykes Group (AIM:ASY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Andrews Sykes Group plc is an investment holding company that specializes in the hire, sale, and installation of environmental control equipment across the United Kingdom, Europe, the Middle East, Africa, and other international markets with a market cap of £208.88 million.

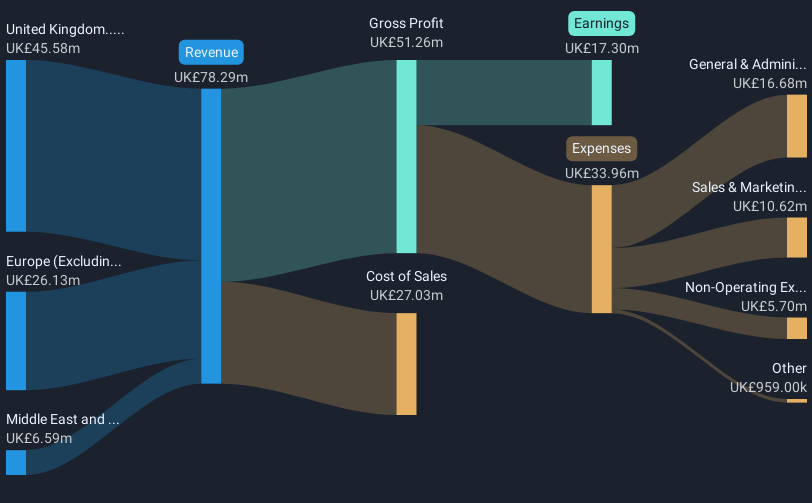

Operations: The company's revenue is primarily generated from the United Kingdom (£45.58 million), followed by Europe excluding the UK (£26.13 million), and the Middle East and Africa (£6.59 million).

Market Cap: £208.88M

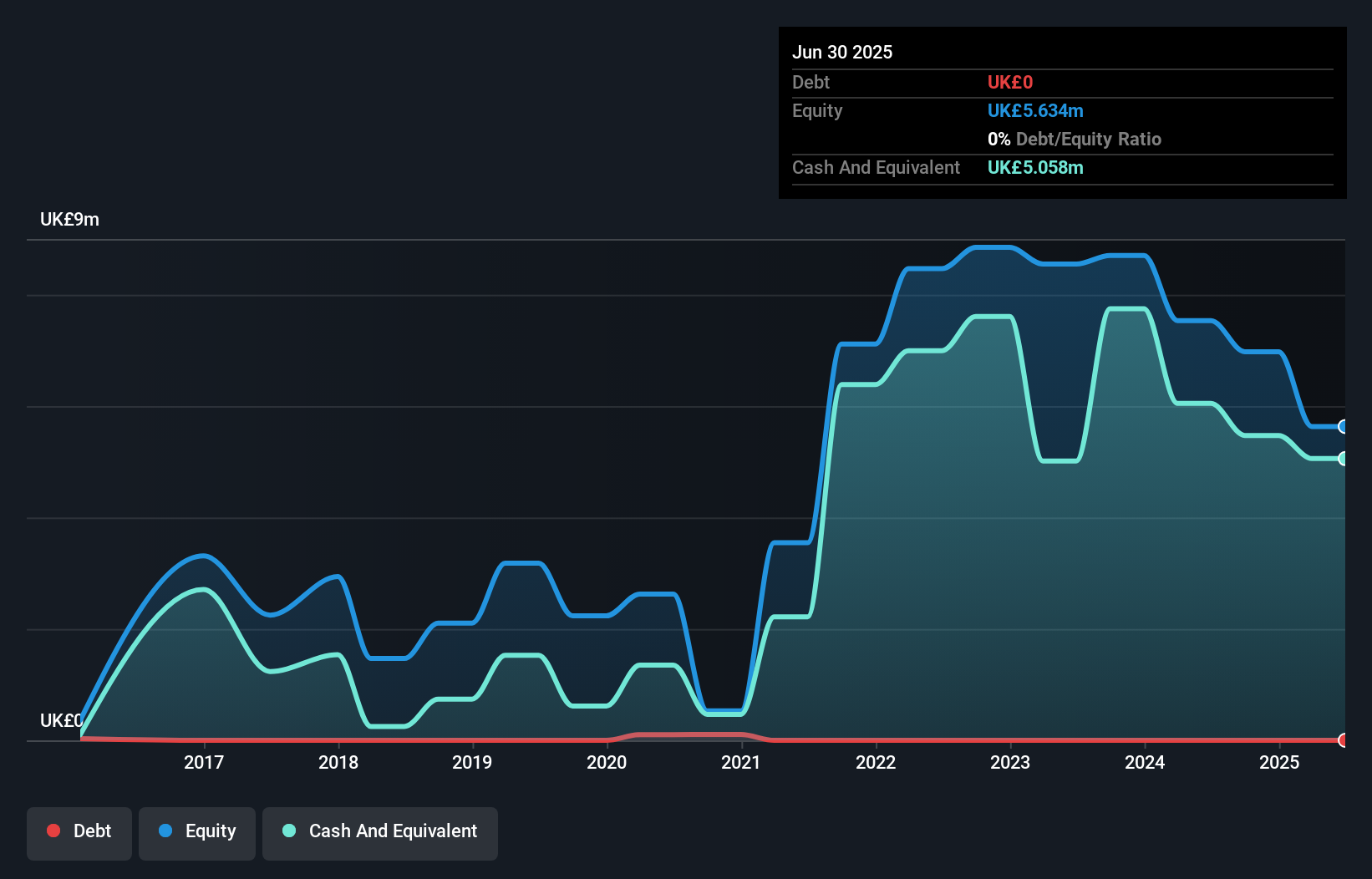

Andrews Sykes Group plc, trading significantly below its estimated fair value, presents an intriguing option among penny stocks. The company is debt-free and boasts a seasoned board with high-quality earnings. Its return on equity is outstanding at 41.6%, and its short-term assets comfortably cover both short- and long-term liabilities. Despite experiencing negative earnings growth of -4.3% over the past year, the company's net profit margin has improved slightly to 22.1%. While dividends have been unstable, shareholders have not faced significant dilution recently, maintaining their investment's integrity amidst market fluctuations.

- Get an in-depth perspective on Andrews Sykes Group's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Andrews Sykes Group's track record.

MyHealthChecked (AIM:MHC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MyHealthChecked PLC develops, distributes, and commercializes at-home healthcare and wellness tests in the United Kingdom with a market cap of £6.50 million.

Operations: The company generates revenue of £9.39 million from its diagnostic healthcare products segment.

Market Cap: £6.5M

MyHealthChecked PLC, with a market cap of £6.50 million and generating £9.39 million in revenue, remains unprofitable but has shown a significant reduction in losses over the past five years at 41.6% annually. The seasoned management team and board, each averaging 5.1 years of tenure, contribute to stability despite the lack of profitability. The company is debt-free with short-term assets exceeding liabilities (£536K), ensuring financial health alongside a sufficient cash runway for over three years due to positive free cash flow growth. Shareholders have not experienced meaningful dilution recently, maintaining investment value amidst volatility.

- Click to explore a detailed breakdown of our findings in MyHealthChecked's financial health report.

- Gain insights into MyHealthChecked's historical outcomes by reviewing our past performance report.

Made Tech Group (AIM:MTEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Made Tech Group Plc, with a market cap of £37.53 million, provides digital, data, and technology services to the public sector in the United Kingdom through its subsidiaries.

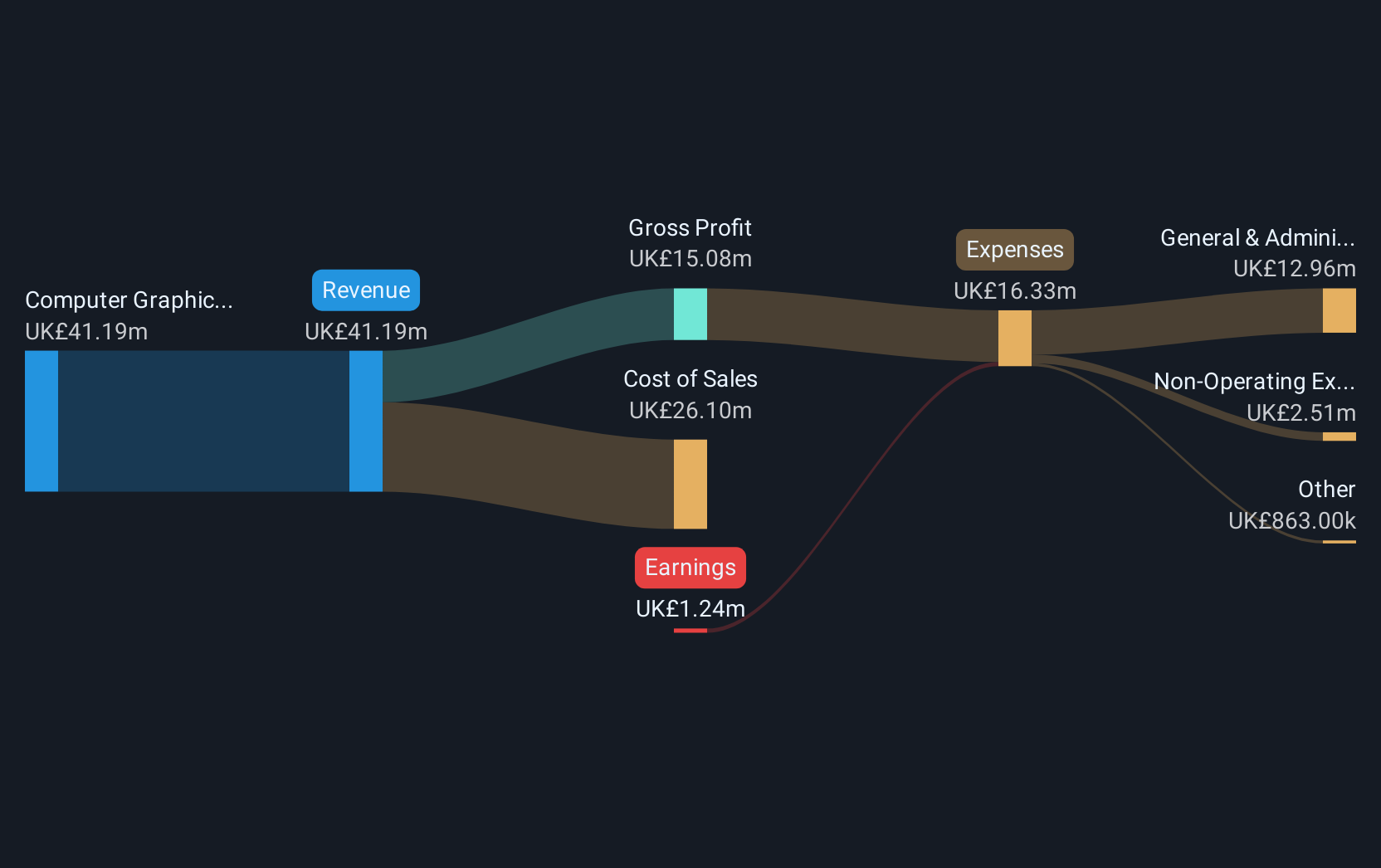

Operations: The company's revenue is primarily derived from its Computer Graphics segment, which generated £38.57 million.

Market Cap: £37.53M

Made Tech Group Plc, with a market cap of £37.53 million, is navigating the challenges typical of penny stocks. The company has no debt and its short-term assets (£14.3M) comfortably cover both short-term (£3.1M) and long-term liabilities (£50K), indicating financial stability despite being unprofitable with a negative return on equity (-19.64%). Recent earnings guidance suggests revenue for FY25 will surpass market expectations, offering a positive outlook amidst declining earnings over the past five years at 49.4% annually. The board's experience contrasts with a less seasoned management team, adding complexity to its operational dynamics.

- Navigate through the intricacies of Made Tech Group with our comprehensive balance sheet health report here.

- Examine Made Tech Group's earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Reveal the 471 hidden gems among our UK Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ASY

Andrews Sykes Group

An investment holding company, engages in the hire, sale, and installation of environmental control equipment in the United Kingdom, Rest of Europe, the Middle East, Africa, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives