3 UK Dividend Stocks Yielding Up To 6.6%

In recent days, the UK market has faced challenges, with the FTSE 100 index experiencing declines amid weak trade data from China and global economic uncertainties. Despite these headwinds, dividend stocks remain an attractive option for investors seeking steady income streams, as they can provide a buffer against market volatility through regular payouts.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.97% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.79% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.89% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 5.84% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.66% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.20% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 15.48% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.14% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.62% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.59% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our Top UK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

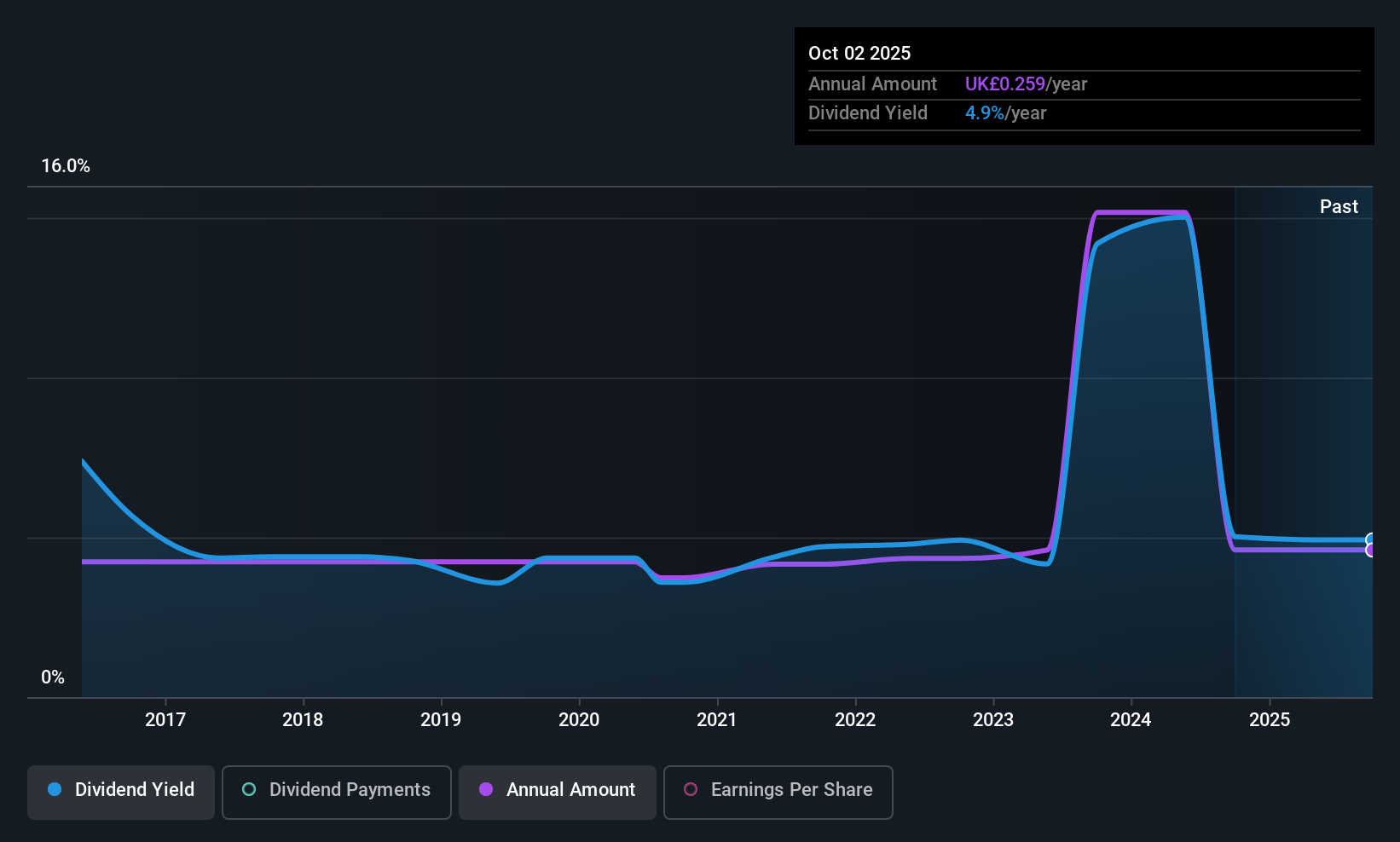

Andrews Sykes Group (AIM:ASY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Andrews Sykes Group plc is an investment holding company that specializes in the hire, sale, and installation of environmental control equipment across the UK, Europe, the Middle East, Africa, and internationally with a market cap of £209.29 million.

Operations: Andrews Sykes Group plc generates revenue through its operations in hiring, selling, and installing environmental control equipment across various regions including the UK, Europe, the Middle East, Africa, and other international markets.

Dividend Yield: 5.2%

Andrews Sykes Group's dividend payments have grown over the past decade, yet they remain volatile and unreliable due to significant annual drops. Despite this, dividends are sustainably covered by both earnings (63.2% payout ratio) and cash flows (74.8% cash payout ratio). The stock trades below its estimated fair value but offers a lower yield than top UK dividend payers. Recent interim dividends were maintained at 11.90 pence per share, totaling £5 million for payment on October 31, 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Andrews Sykes Group.

- Our valuation report here indicates Andrews Sykes Group may be undervalued.

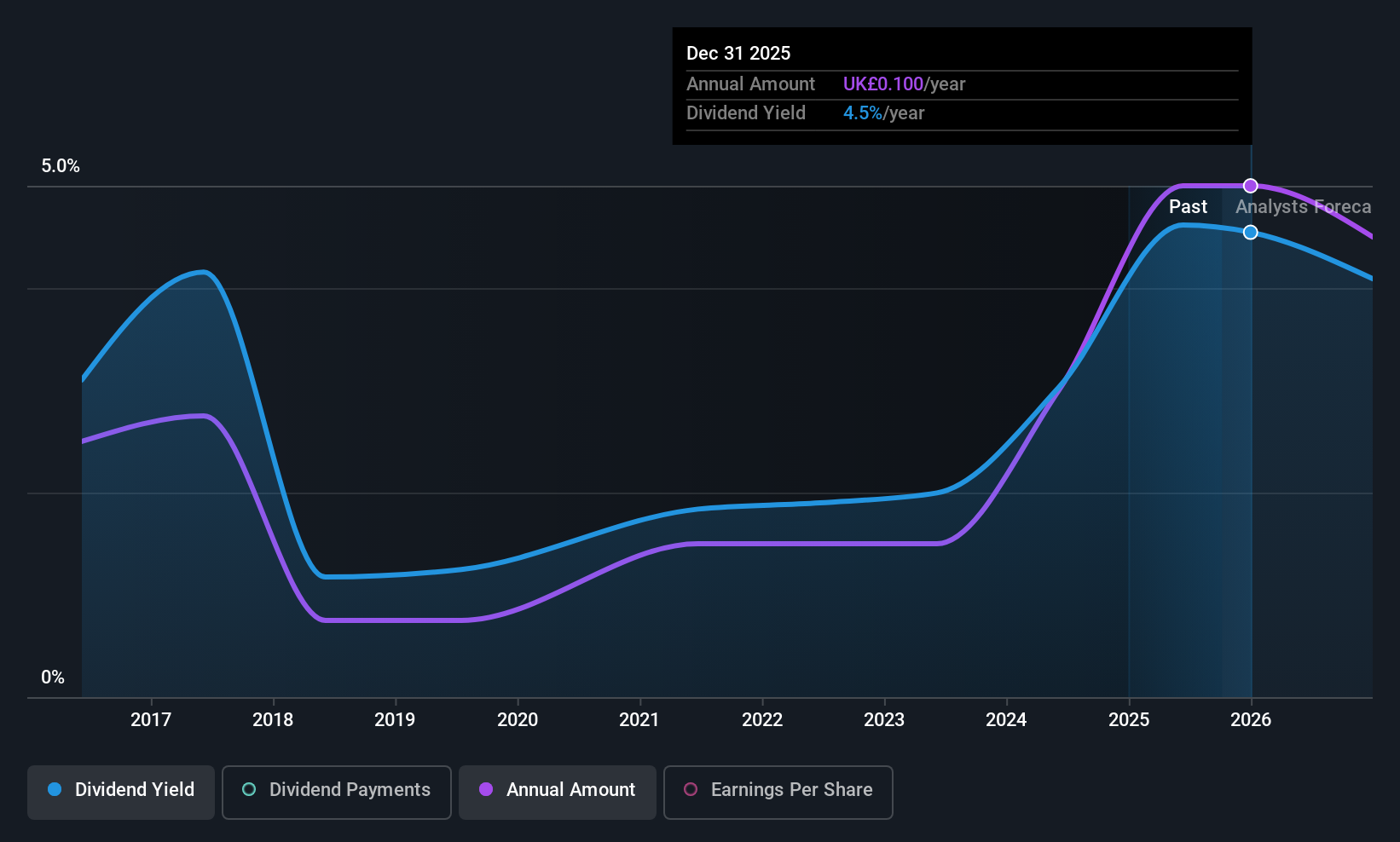

Helios Underwriting (AIM:HUW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Helios Underwriting plc, with a market cap of £150.36 million, offers limited liability investment opportunities for shareholders in the Lloyd’s insurance market in the United Kingdom through its subsidiaries.

Operations: Helios Underwriting plc operates within the Lloyd’s insurance market in the United Kingdom, providing shareholders with investment opportunities through its subsidiaries.

Dividend Yield: 4.8%

Helios Underwriting's dividend payments have been volatile over the past decade, despite being well-covered by earnings (29.8% payout ratio) and cash flows (32.3% cash payout ratio). The stock trades at a good value compared to peers, though its dividend yield of 4.83% is lower than the top UK market payers. Recent executive changes include appointing Louis Tucker as CEO and Joanna Parsons as an Independent Non-Executive Director, potentially impacting future strategic directions.

- Take a closer look at Helios Underwriting's potential here in our dividend report.

- Upon reviewing our latest valuation report, Helios Underwriting's share price might be too pessimistic.

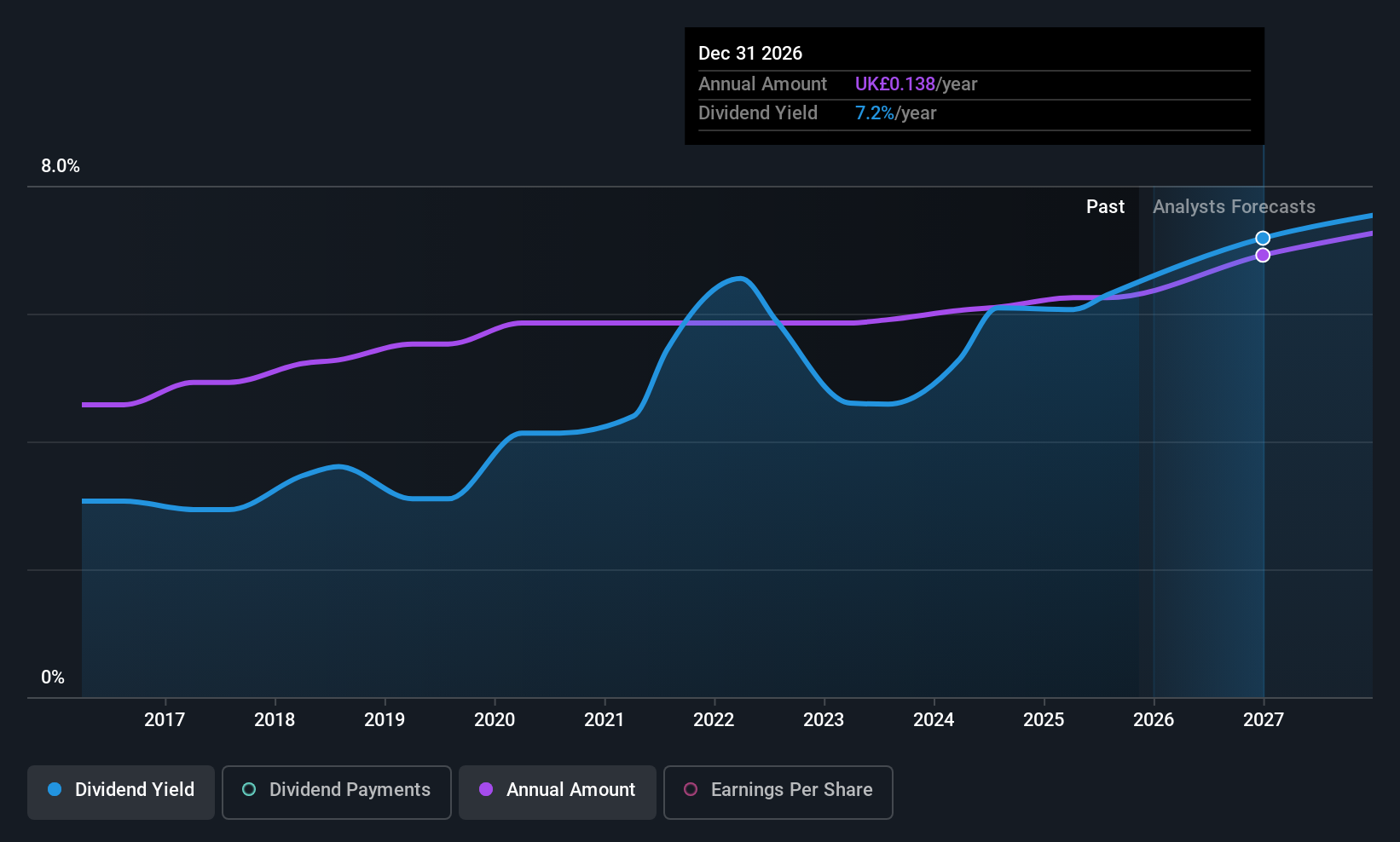

MONY Group (LSE:MONY)

Simply Wall St Dividend Rating: ★★★★★★

Overview: MONY Group plc operates in the United Kingdom, offering price comparison and lead generation services through its websites and applications, with a market cap of £983.97 million.

Operations: MONY Group plc generates its revenue from several segments, including Money (£99.70 million), Travel (£19.30 million), Cashback (£58.20 million), Insurance (£233.40 million), and Home Services (£41 million).

Dividend Yield: 6.7%

MONY Group offers a high and reliable dividend yield of 6.66%, placing it in the top 25% of UK dividend payers. Its dividends are well-covered by earnings (81.4% payout ratio) and cash flows (70.2% cash payout ratio), ensuring sustainability. Dividends have been stable and growing over the past decade, supported by an 8% earnings growth last year. Recent changes include a competitive tender process for its external audit contract, following regulatory requirements to replace KPMG by year-end 2025.

- Click here to discover the nuances of MONY Group with our detailed analytical dividend report.

- According our valuation report, there's an indication that MONY Group's share price might be on the cheaper side.

Next Steps

- Unlock our comprehensive list of 46 Top UK Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MONY

MONY Group

Engages in the provision of price comparison and lead generation services through its websites and applications in the United Kingdom.

Outstanding track record 6 star dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.