- United Kingdom

- /

- Banks

- /

- LSE:LLOY

How Might Lloyds Shares Be Priced After a 73% Rally in 2025?

Reviewed by Bailey Pemberton

- Thinking Lloyds Banking Group might be hiding in plain sight as an undervalued gem? You are not alone, as there is plenty of buzz from investors interested in what their shares could really be worth.

- The stock has been on quite a run, climbing 4.9% over the last week, up 7.0% for the past month, and an impressive 73.4% in the last year.

- Much of this momentum has been fueled by broader optimism in UK banking alongside headlines about potential shifts in UK monetary policy and sector-wide cost reforms. Other news, like increased home lending activity and digital banking initiatives, has also kept Lloyds in the spotlight for growth and adaptability.

- Despite these gains, Lloyds Banking Group currently scores a 2 out of 6 on our valuation checks, suggesting there is more to uncover. Next, we will break down the conventional valuation methods used and at the end, reveal one approach that could give you an even clearer view of what the stock is really worth.

Lloyds Banking Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lloyds Banking Group Excess Returns Analysis

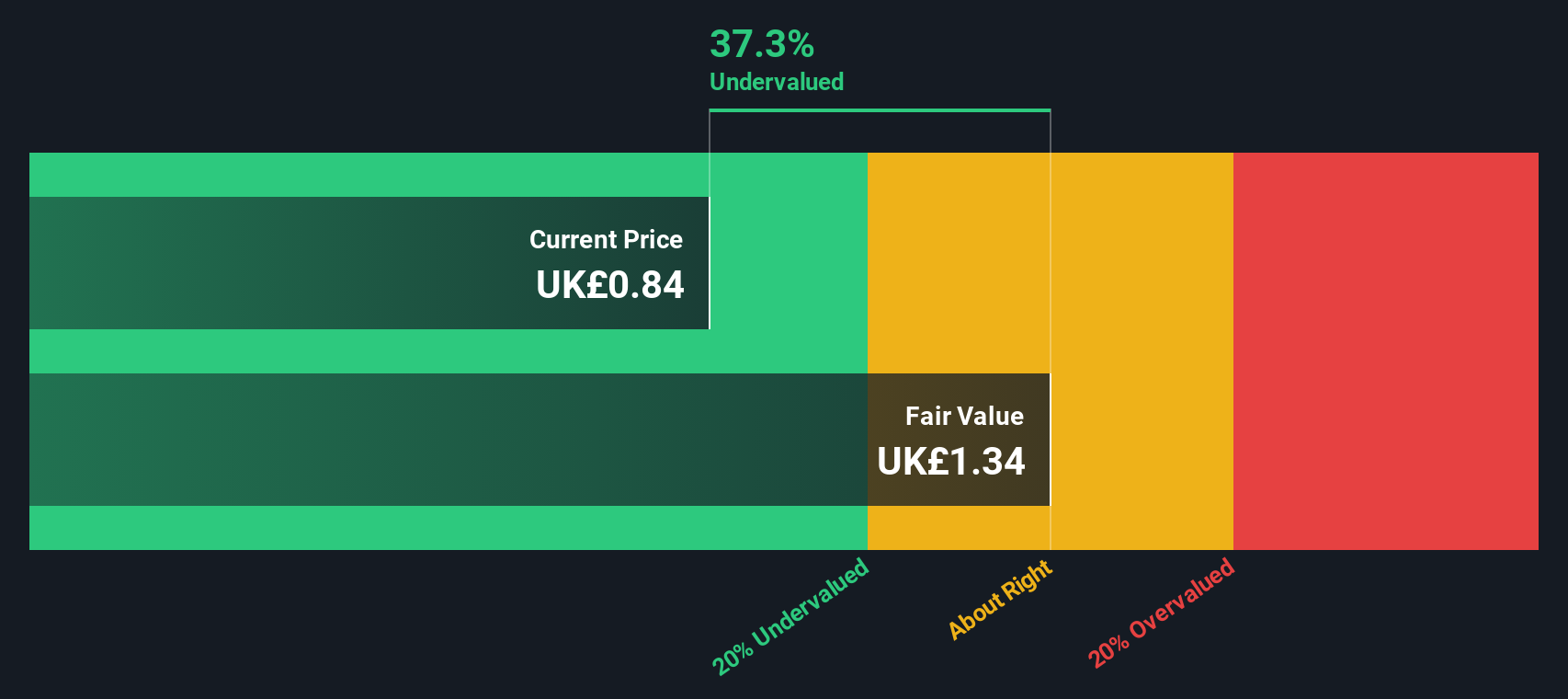

The Excess Returns valuation approach focuses on how efficiently a company puts its capital to work, measuring the profits generated over and above its cost of equity. For Lloyds Banking Group, this model tells us whether the bank is achieving returns that justify holding the stock for the long term.

According to the latest estimates, Lloyds has a Book Value of £0.77 per share and a Stable EPS of £0.10 per share, based on weighted future Return on Equity (ROE) projections from 14 analysts. Its average ROE stands at a robust 12.93%, far outpacing its calculated Cost of Equity of £0.06 per share. The resulting Excess Return is £0.03 per share. This shows that, after covering the cost of capital, Lloyds is still adding value for shareholders. The Stable Book Value remains steady at £0.77 per share, based on expectations from 9 analysts.

When these figures are factored into the Excess Returns model, the resulting intrinsic value estimate for Lloyds Banking Group implies the shares are trading at a 35.6% discount to fair value. This indicates that the stock is currently undervalued relative to its potential returns.

Result: UNDERVALUED

Our Excess Returns analysis suggests Lloyds Banking Group is undervalued by 35.6%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

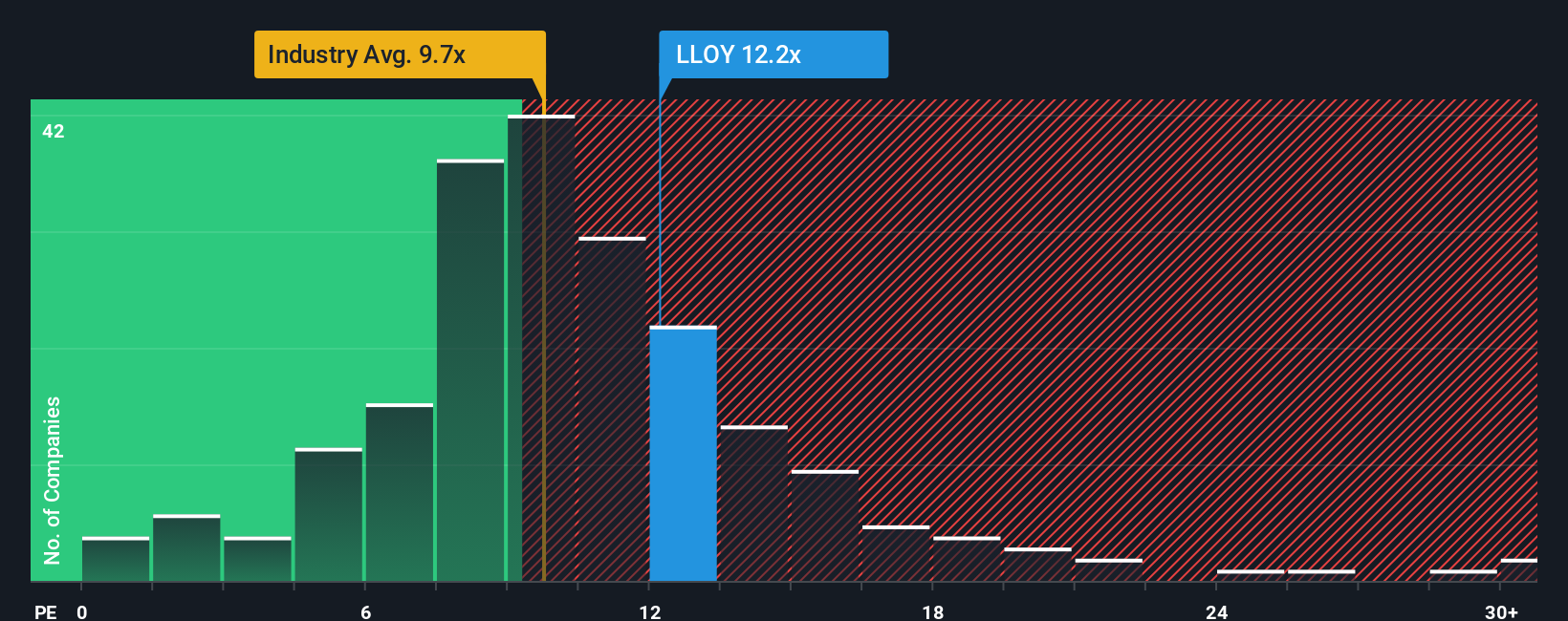

Approach 2: Lloyds Banking Group Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies because it directly compares a company’s share price to its earnings. This offers an accessible snapshot of how much investors are willing to pay for each pound of profit. This makes it especially relevant for established banks like Lloyds Banking Group, which have consistent earnings streams.

Growth expectations and risk appetite both play a big role in determining what level of PE ratio is considered “normal” or “fair.” If investors anticipate faster growth or see the company as less risky, they are often happy to pay a higher multiple. Slower growth or greater perceived risk leads to a lower fair PE ratio.

Lloyds currently trades at a PE ratio of 15.1x, which stands above both its peer average of 10.5x and the broader UK banking industry average of 10.2x. However, Simply Wall St calculates a “Fair Ratio” for Lloyds at 9.6x. The Fair Ratio is designed to go beyond the basic comparison. It customizes the benchmark for Lloyds by weighing its own earnings growth outlook, risk profile, profit margins, its place within the industry, and even its market cap. This provides a more precise, relevant, and dynamic way to judge value than using broad industry figures or simple peer comparisons.

Comparing Lloyds’ actual PE ratio of 15.1x to its Fair Ratio of 9.6x suggests the stock is trading at a meaningful premium based on its specific fundamentals and risk factors.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1380 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lloyds Banking Group Narrative

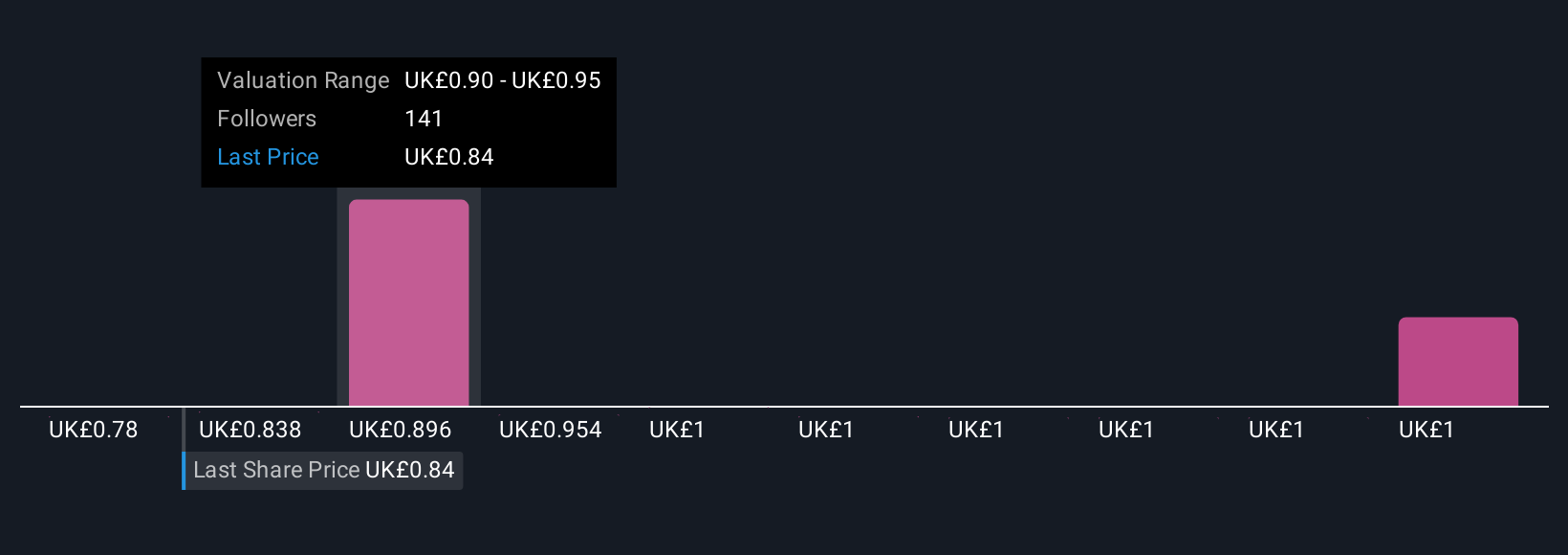

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or perspective on a company, built on your assumptions about its fair value, future revenue, earnings, and profit margins. Rather than just relying on the numbers, Narratives help link Lloyds Banking Group’s financials to the specific reasons you believe the stock will succeed or struggle, whether that’s based on digital transformation, regulatory shifts, or competitive pressures.

Narratives on the Simply Wall St Community page turn your financial view into an actionable investment scenario. By combining your forecast with a fair value estimate, you get clarity on where Lloyds stands and what might drive its share price over time. Narratives are easy to use and are updated automatically whenever new results or news are released, so your investment case evolves with the facts. For example, some investors think Lloyds could be worth as much as £1.03 if digital innovation succeeds and non-lending growth stays strong, while others set their fair value closer to £0.53 if economic risks and margin pressures dominate. Narratives make it simple to judge how your fair value compares to the market price, supporting smarter, more dynamic investment decisions.

Do you think there's more to the story for Lloyds Banking Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LLOY

Lloyds Banking Group

Provides a range of banking and financial products and services in the United Kingdom and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives