- United Kingdom

- /

- Banks

- /

- LSE:LLOY

Group Chief Executive & Executive Director António de Sousa Horta-Osório Just Bought Shares In Lloyds Banking Group plc (LON:LLOY)

Whilst it may not be a huge deal, we thought it was good to see that the Lloyds Banking Group plc (LON:LLOY) Group Chief Executive & Executive Director, António de Sousa Horta-Osório, recently bought UK£40k worth of stock, for UK£0.63 per share. That might not be a big purchase but it only increased their holding by 0.3%, and could be interpreted as a good sign.

View our latest analysis for Lloyds Banking Group

The Last 12 Months Of Insider Transactions At Lloyds Banking Group

Notably, that recent purchase by Group Chief Executive & Executive Director António de Sousa Horta-Osório was not the only time they traded Lloyds Banking Group shares this year. They previously made a sale of -UK£3.6m worth of shares at a price of UK£0.53 per share. That means that even when the share price was below the current price of UK£0.63, an insider wanted to cash in some shares. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 24% of António de Sousa Horta-Osório's stake.

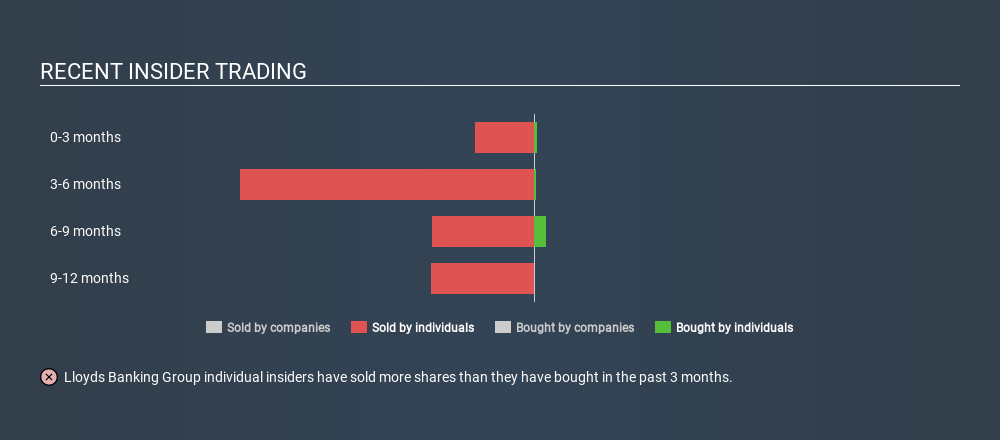

Happily, we note that in the last year insiders paid UK£315k for 522.08k shares. On the other hand they divested 17160183 shares, for UK£9.7m. In total, Lloyds Banking Group insiders sold more than they bought over the last year. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of Lloyds Banking Group

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. Lloyds Banking Group insiders own about UK£41m worth of shares. That equates to 0.09% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At Lloyds Banking Group Tell Us?

The insider sales have outweighed the insider buying, at Lloyds Banking Group, in the last three months. Zooming out, the longer term picture doesn't give us much comfort. While insiders do own shares, they don't own a heap, and they have been selling. We'd think twice before buying! Of course, the future is what matters most. So if you are interested in Lloyds Banking Group, you should check out this free report on analyst forecasts for the company.

But note: Lloyds Banking Group may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:LLOY

Lloyds Banking Group

Provides a range of banking and financial products and services in the United Kingdom and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives