- United Kingdom

- /

- Banks

- /

- LSE:HSBA

Is HSBC (LSE:HSBA) Overvalued After Its Recent Share Price Climb? A Deep Dive into Current Valuation

Reviewed by Kshitija Bhandaru

See our latest analysis for HSBC Holdings.

HSBC Holdings' strong upward momentum this month comes after a robust year, with its 1-year total shareholder return at 61.3% and several resilient earnings updates supporting positive investor sentiment. The steady climb in recent weeks is sparking new interest in its long-term growth potential, as the company continues to demonstrate both solid fundamentals and growing appeal among investors.

If HSBC's sustained gains have you wondering what else is moving, now is a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

But with shares trading above analyst price targets, investors are left to ponder: is HSBC Holdings undervalued based on its fundamentals, or has the market already factored in its future growth potential, leaving limited room for upside?

Most Popular Narrative: 8% Overvalued

HSBC Holdings' most widely followed narrative puts its fair value at £9.65, just below the last close price of £10.44. This signals that, while momentum is strong, numbers may already be pricing in much of HSBC's future growth story.

The strategic shift away from underperforming and non-core businesses in Europe and the Americas, along with redeployment of capital into high-return businesses in Asia and the Middle East, is expected to improve overall net interest margins and boost group return on equity through better allocation of resources. Disproportionate investment in digital transformation, including AI-driven efficiency gains and digital onboarding, will generate structural cost reductions (organizational simplification savings), directly improving the cost-to-income ratio and lifting long-term operating leverage and net margins.

Behind this calculated fair value lies a bold bet on HSBC's regional strategy and a radical transformation of its operating model. Want to see which future performance triggers are counted on to justify this price? Dive in to unlock the key assumptions driving the narrative and uncover the growth levers at play.

Result: Fair Value of £9.65 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, market volatility in Asia or ongoing challenges in the Hong Kong real estate sector could quickly undermine these optimistic projections.

Find out about the key risks to this HSBC Holdings narrative.

Another View: What Does the SWS DCF Model Suggest?

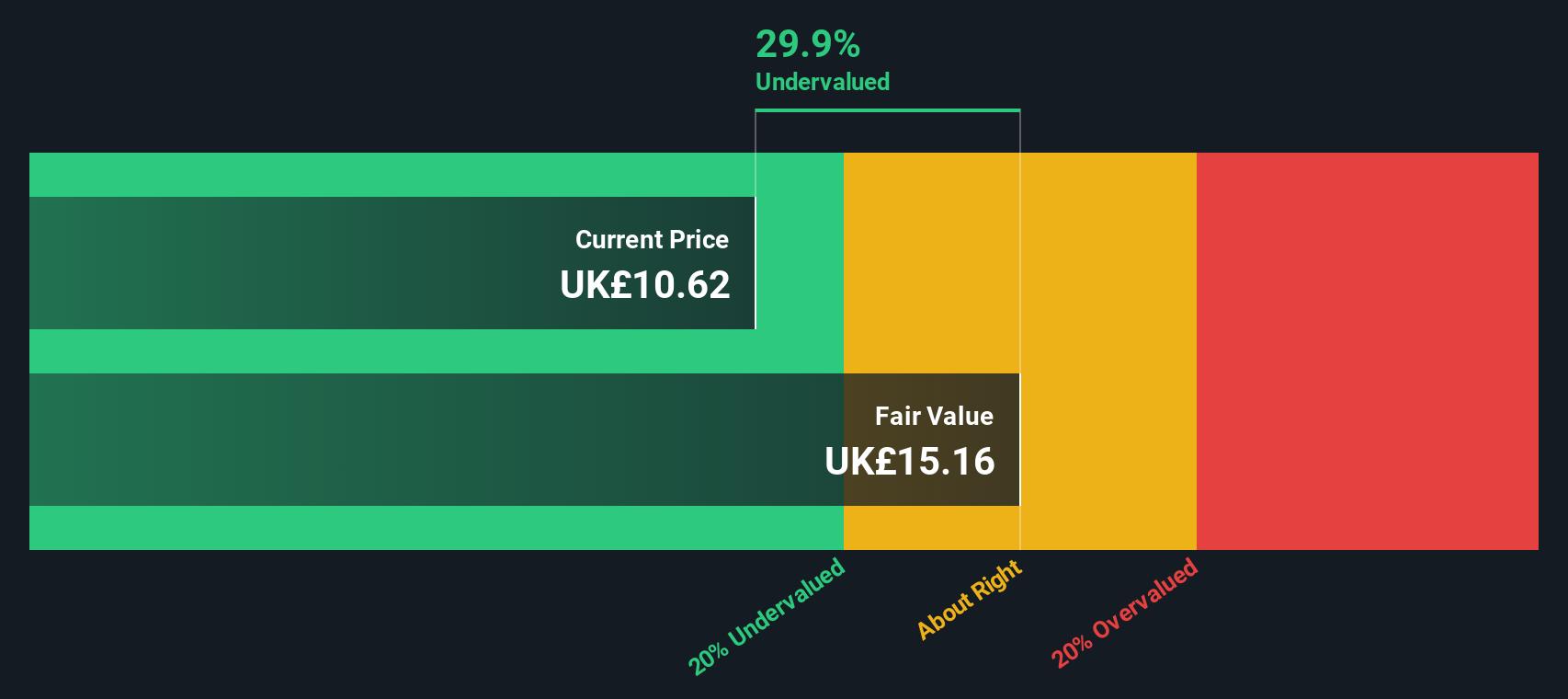

While the consensus view sees HSBC Holdings as fairly valued or even expensive based on analyst forecasts, our DCF model tells a different story. It suggests the shares are actually trading about 31% below their estimated fair value. This opens up the possibility that the market is underestimating long-term growth. Which side will prove right as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HSBC Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HSBC Holdings Narrative

If you see the story differently or want to test your own ideas, it only takes a few minutes to build your own view and Do it your way.

A great starting point for your HSBC Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop with just one opportunity. Expand your portfolio with stocks making waves across emerging trends and resilient sectors by using the Simply Wall St Screener.

- Supercharge your hunt for future growth by targeting these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs and rapid sector expansion.

- Tap into income potential by tracking these 19 dividend stocks with yields > 3% that deliver consistent yields above 3 percent, adding stability to your strategy.

- Ride the shift toward decentralized technology by scouting these 78 cryptocurrency and blockchain stocks focused on blockchain innovation and the evolution of digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

HSBC Holdings

Engages in the provision of banking and financial products and services worldwide.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success