- United Kingdom

- /

- Banks

- /

- LSE:HSBA

Is HSBC a Bargain After 53% Stock Rally and Asia Expansion News?

Reviewed by Bailey Pemberton

- Curious whether HSBC Holdings is actually good value right now? You are not alone, especially with all the price action we have seen lately.

- The stock has been on a tear, with gains of 1.6% in the past week, 6.0% this month, and an impressive 53.4% over the past year. These movements highlight both growth potential and possible shifts in risk appetite among investors.

- Major headlines continue to shape market sentiment, most recently focused on HSBC's expansion in Asian markets and its ongoing cost-reduction efforts in Europe. These moves aim to reposition the bank for long-term profitability while responding to global economic uncertainty.

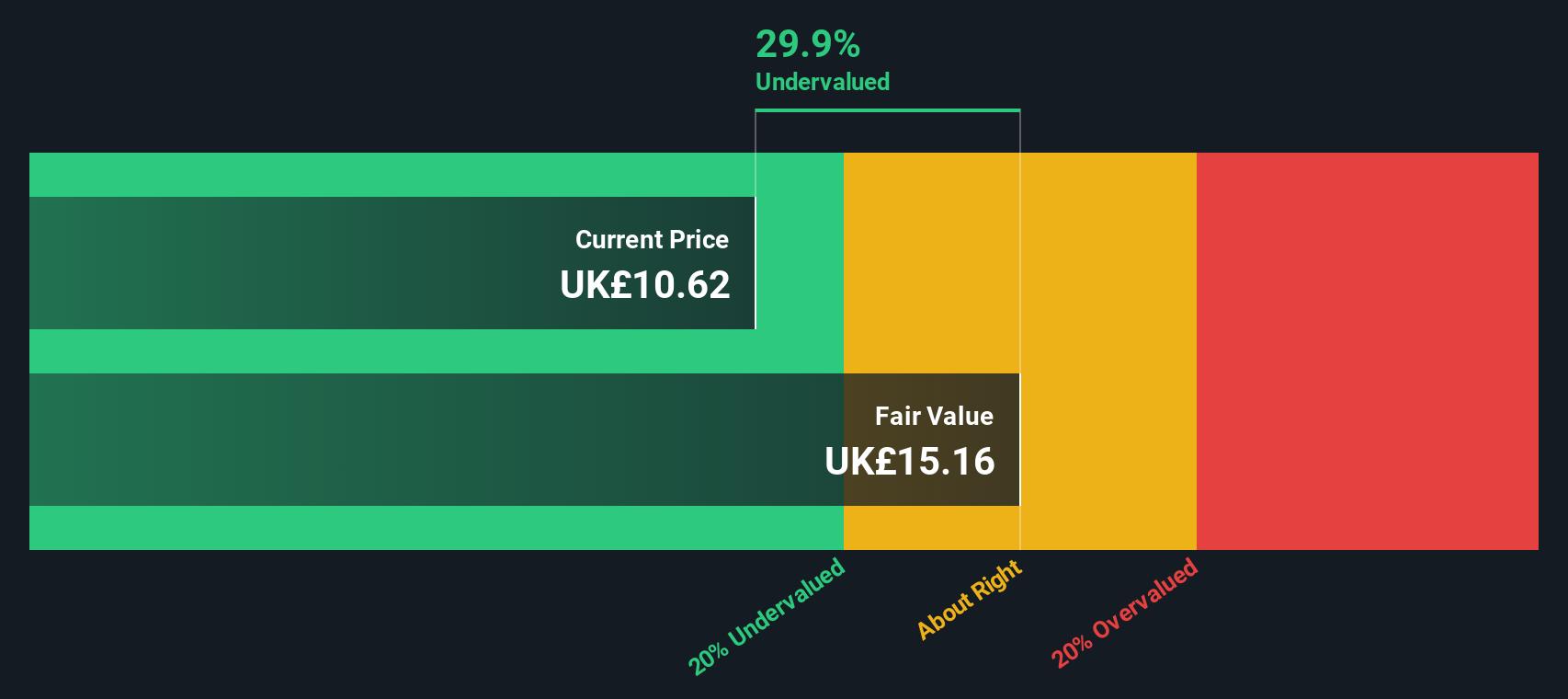

- Despite these developments, HSBC Holdings scores just 2 out of 6 on our basic valuation checks, so it is well worth digging past the surface. Let’s unpack the main valuation tools, plus stick around to the end for a fresh perspective you will not want to miss.

HSBC Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: HSBC Holdings Excess Returns Analysis

The Excess Returns model evaluates how efficiently a company generates profits above its cost of equity. This highlights HSBC Holdings’ ability to create value for shareholders over time. Essentially, this approach looks at whether the company’s returns on invested capital exceed what shareholders expect, using forward-looking estimates and analyst projections.

For HSBC Holdings, key metrics include a Book Value of £9.94 per share and a Stable EPS of £1.54 per share, based on weighted future Return on Equity estimates from 17 analysts. The bank’s Cost of Equity stands at £0.92 per share, resulting in an Excess Return of £0.62 per share. HSBC’s Average Return on Equity is a solid 14.14%, with a projected Stable Book Value of £10.88 per share, drawn from analyst forecasts. These figures indicate that the company is generating positive returns above its equity costs.

According to the Excess Returns valuation, HSBC Holdings is intrinsically valued at £16.83 per share, which implies the stock is trading at a 36.8% discount to its fair value. This suggests the market may be underestimating HSBC’s true earnings power and growth prospects.

Result: UNDERVALUED

Our Excess Returns analysis suggests HSBC Holdings is undervalued by 36.8%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

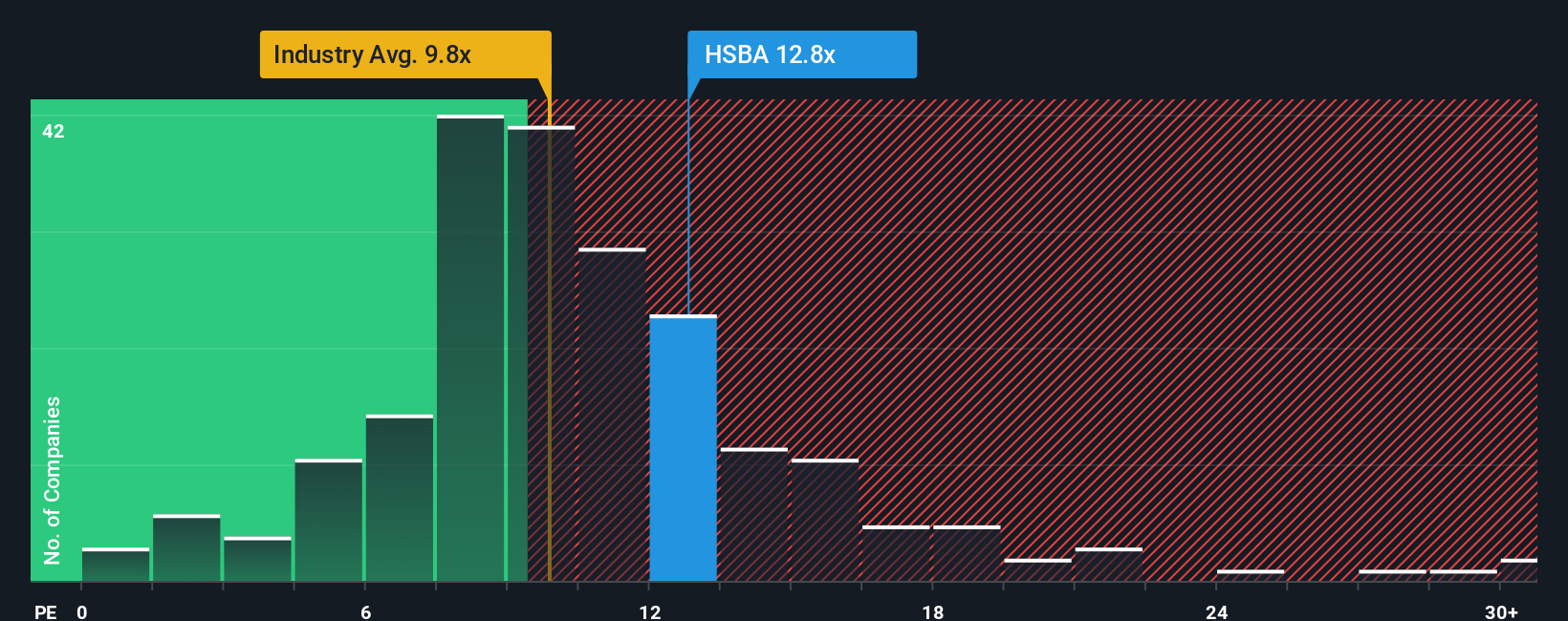

Approach 2: HSBC Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies, since it directly relates the market price of a stock to its underlying earnings power. This makes it particularly suitable for established banks like HSBC Holdings, which consistently generate profits and offer clear visibility on future income streams.

Growth expectations and perceived risks both influence what investors consider a “normal” or “fair” PE ratio. If investors expect higher earnings growth or lower risk, they are generally willing to pay a higher multiple. Conversely, muted growth prospects or increased uncertainty can depress the appropriate PE multiple.

HSBC Holdings currently trades at a PE ratio of 14.6x. This is notably higher than the average PE for the Banks industry at 10.4x and above the peer average of 11.5x. At first glance, this premium could signal overvaluation. However, Simply Wall St’s Fair Ratio, a proprietary measure that incorporates key factors such as HSBC’s profit margins, growth outlook, risk profile, industry dynamics, and market cap, suggests a fair PE ratio of 9.9x for HSBC.

Unlike simple peer or industry comparisons, the Fair Ratio provides a more nuanced view because it tailors expectations to HSBC’s specific strengths and challenges. This helps you cut through market noise and focus on what really matters for long-term value creation.

Comparing HSBC’s current PE ratio (14.6x) to its Fair Ratio (9.9x), the shares appear to be trading at a notable premium, signaling that the market expects either greater growth or is willing to pay up for perceived stability. Based on this analysis, HSBC Holdings looks overvalued at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

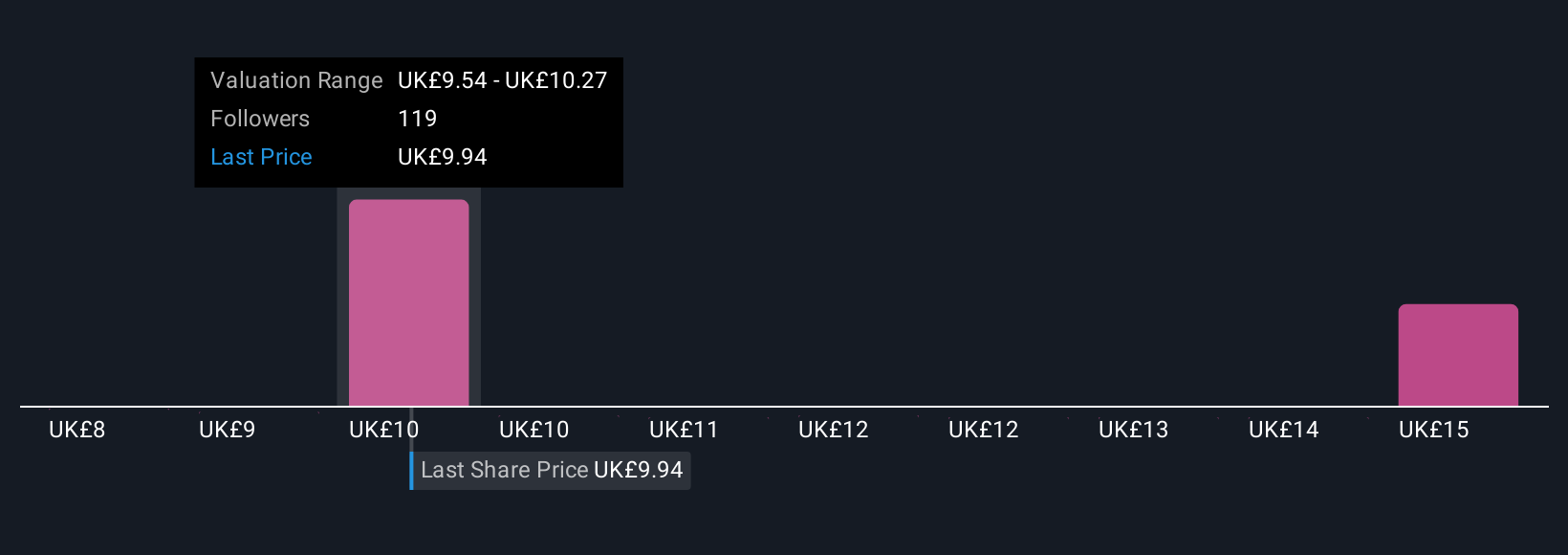

Upgrade Your Decision Making: Choose your HSBC Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple and powerful tool that connects the story you believe about a company — your perspective on its strategy, future revenue, earnings, and margins — with the numbers used to calculate fair value.

Instead of relying only on formulas or analyst averages, a Narrative allows you to map out your own forecast, see the logic behind each number, and clearly link your view of HSBC Holdings to a fair value estimate. Narratives are easy to create and update right on Simply Wall St’s Community page, which is trusted by millions of investors. This platform enables you to put your ideas into action faster than ever.

When real news or earnings updates emerge, Narratives are refreshed automatically. This helps you see instantly how new events impact your investment story and your decisions by comparing your Fair Value to the current share price.

For example, on HSBC Holdings, some investors think the bank’s Asia expansion will boost revenue and set a fair value as high as £11.29. Others are more cautious and see only £7.93 as justified, reflecting different Narratives built from the same set of facts.

Do you think there's more to the story for HSBC Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

HSBC Holdings

Engages in the provision of banking and financial products and services worldwide.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success