- United Kingdom

- /

- Banks

- /

- LSE:HSBA

HSBC (LSE:HSBA): Exploring Valuation Following Recent Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for HSBC Holdings.

Momentum has definitely been building for HSBC Holdings, with a sharp 12% share price return over the past month, adding to an already impressive 43% gain year-to-date. In addition, the company’s total shareholder return of 67% over the last twelve months and nearly 190% across three years highlights a compelling track record that continues to catch investors’ attention.

If you’re interested in what other banks could show similar strength, you can check out our curated financials with a fast growing stocks with high insider ownership.

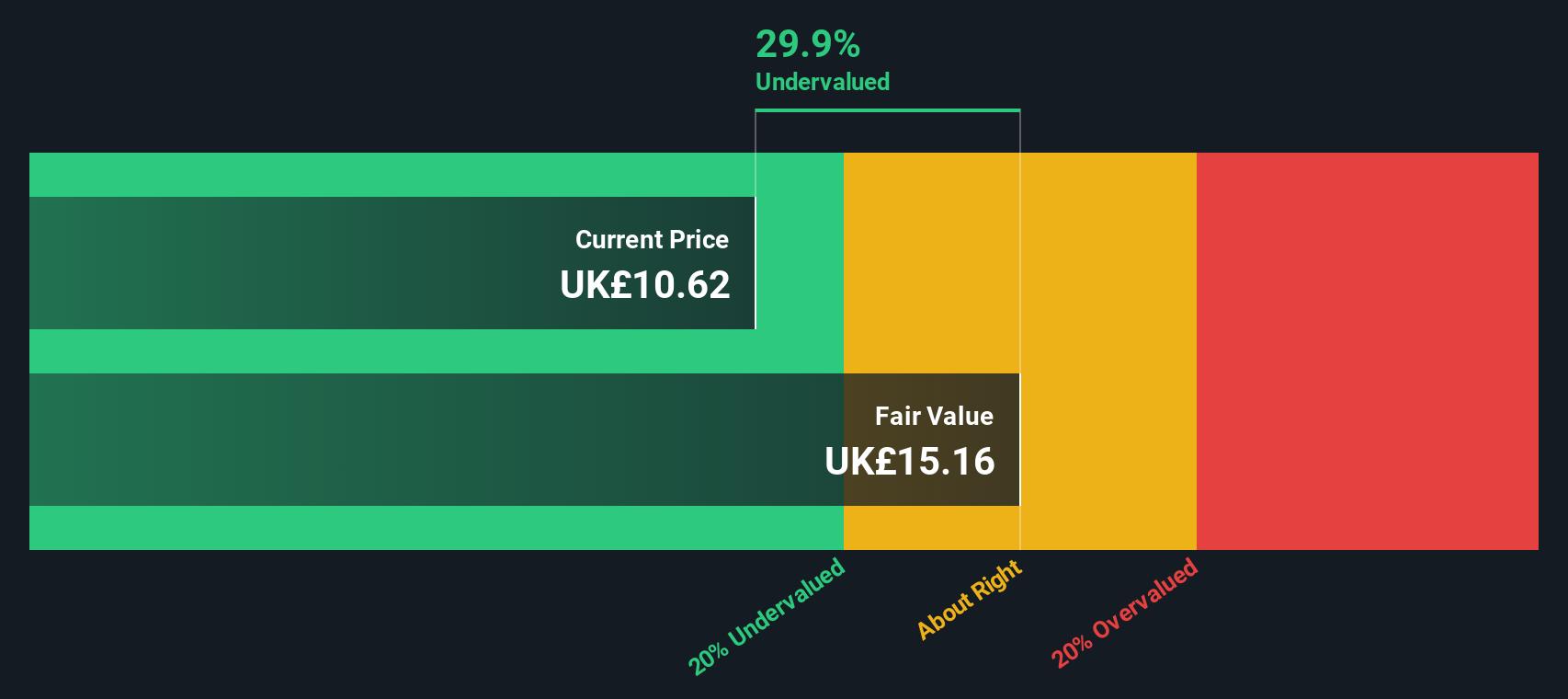

With shares surging and the company’s fundamentals improving, the key question now is whether HSBC still trades at a discount or if the market has already priced in future growth, leaving little room for upside.

Most Popular Narrative: 5% Overvalued

HSBC Holdings recently closed at £11.20, while the most popular narrative places fair value at £10.66. This suggests current optimism has pushed the price above what analysts expect, and sets up a clash between recent performance and long-term expectations.

The strategic shift away from underperforming and non-core businesses in Europe and the Americas, and redeployment of capital into high-return businesses in Asia and the Middle East is expected to improve overall net interest margins and boost group return on equity through better allocation of resources. Disproportionate investment in digital transformation, including AI-driven efficiency gains and digital onboarding, will generate structural cost reductions (organizational simplification savings), directly improving the cost-to-income ratio and lifting long-term operating leverage and net margins.

Want to know what calculated bets underlie this bold price call? The linchpin is a projected transformation in profitability, led by management’s geographic pivot and ambitious tech upgrades. If you are curious about the earnings and margin leaps that support this outlook, take a closer look at the numbers that drive this narrative’s fair value.

Result: Fair Value of £10.66 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent volatility in Asian markets and mounting commercial real estate risks could quickly undermine the current optimism surrounding HSBC's growth outlook.

Find out about the key risks to this HSBC Holdings narrative.

Another View: Discounted Cash Flow Says Undervalued

Taking a contrasting approach, our SWS DCF model values HSBC at £16.60 per share. This is well above the current price and suggests the market might be overlooking long-term cash flow potential, even as other metrics flag overvaluation. Could this signal an opportunity beneath the recent optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HSBC Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HSBC Holdings Narrative

If you'd rather dig into the numbers and shape your own perspective, you can easily build a personalized narrative in just a few minutes. Do it your way.

A great starting point for your HSBC Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know the next opportunity is never far away. Act now and expand your horizons with tailored stock ideas. Don’t let new winners slip by.

- Boost your income potential and scan for high-yielding shares through these 15 dividend stocks with yields > 3% with reliable returns above 3%.

- Seize the tech revolution by tapping into these 27 AI penny stocks that power breakthroughs in automation, machine learning, and future-focused industries.

- Catch undervalued gems before others by targeting these 874 undervalued stocks based on cash flows that show promise based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

HSBC Holdings

Engages in the provision of banking and financial products and services worldwide.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives