- United Kingdom

- /

- Banks

- /

- LSE:HSBA

HSBC (LSE:HSBA): Examining Valuation After Recent Flat Trading and 3% Monthly Dip

Reviewed by Simply Wall St

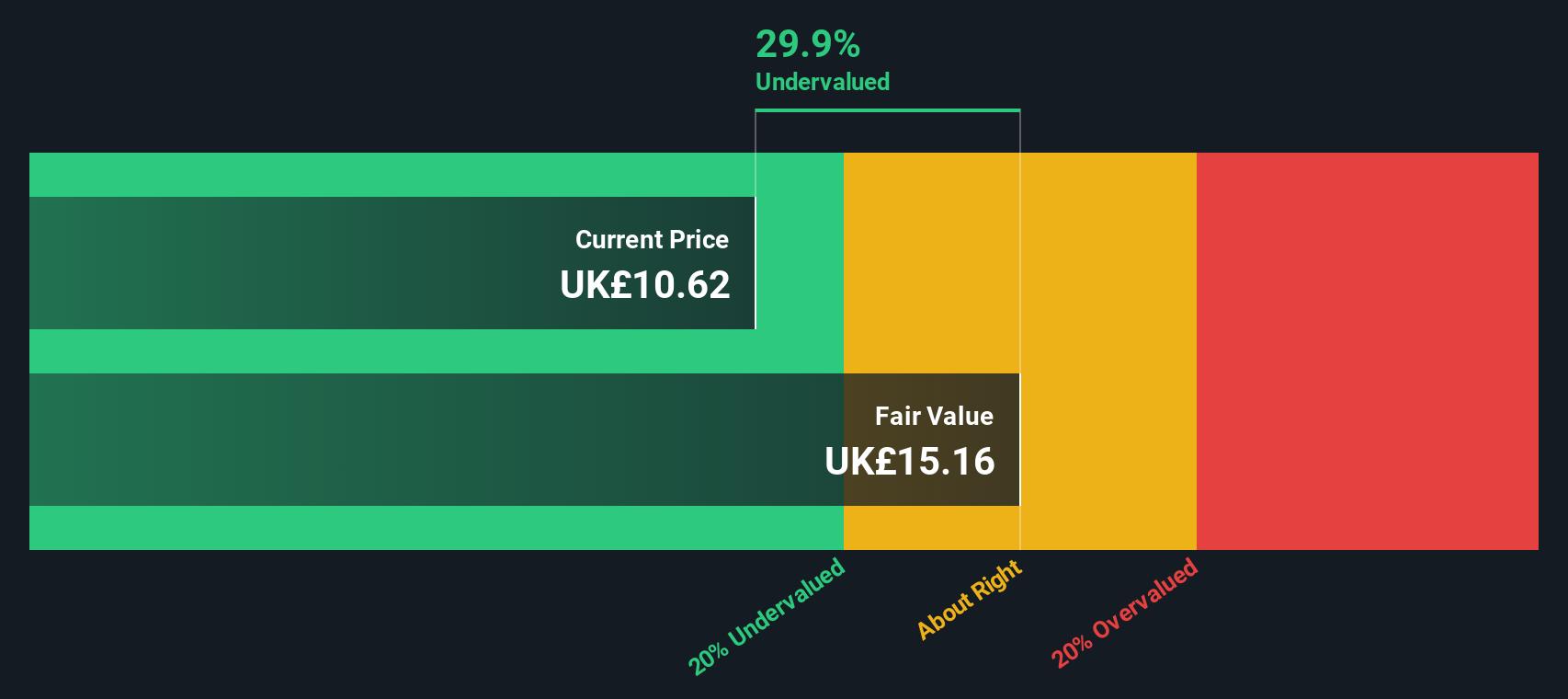

HSBC Holdings (LSE:HSBA) has seen its stock trade mostly flat in recent days, with investors watching closely for what could move shares next. Over the past month, the stock is down about 3%.

See our latest analysis for HSBC Holdings.

HSBC Holdings’ share price has been trending higher this year, with a year-to-date gain of 28.16%. While the stock dipped around 3% this past month, longer-term shareholders have seen a strong 53.61% total return over the past twelve months. This reflects renewed optimism and solid dividend performance.

If you are keeping an eye on financial stocks, it is a great time to broaden your radar and discover fast growing stocks with high insider ownership.

With HSBC’s impressive returns and solid growth, some investors might wonder if the share price now reflects all that future potential or whether there are still undervalued opportunities waiting to be seized.

Most Popular Narrative: Fairly Valued

HSBC's most followed narrative prices the bank at nearly the same level as the latest close, suggesting the market is broadly aligned with this fair value estimate. With only a fractional discount of less than 1%, there is little divide between consensus and the current trading price.

The bank is intensifying investment in Asian wealth management and private banking, leveraging a strong brand and local presence in fast-growing wealth markets like Hong Kong, mainland China, and Southeast Asia. This positions HSBC to capture rising affluence and middle class expansion, fueling future growth in fee income and supporting more resilient earnings and higher margins.

What is really behind this razor-thin fair value gap? The methodology hints at a projected profit surge, margin expansion and peer-beating business focus embedded in the numbers. Want to uncover the bold growth assumptions and crucial earnings multiples that set this narrative apart? Only the full narrative reveals the details driving the consensus fair value call.

Result: Fair Value of $9.96 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several factors could disrupt this narrative, such as prolonged weakness in Hong Kong’s property market or unexpected volatility in global interest rates.

Find out about the key risks to this HSBC Holdings narrative.

Another View: Discounted Cash Flow Perspective

Looking at HSBC Holdings through the lens of our DCF model, the result is strikingly different. The SWS DCF model suggests shares are trading at a significant discount, about 37% below our estimate of fair value. This highlights a possible hidden value not captured by analyst consensus or market multiples. Could the market be underestimating HSBC's long-term earnings power?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HSBC Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HSBC Holdings Narrative

If you see the story differently or enjoy doing your own digging, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your HSBC Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not wait on tomorrow’s trends. Find your next smart move now with other compelling stocks that could transform your portfolio beyond HSBC Holdings.

- Unlock high-yield opportunities and see which top payers stand out by checking out these 19 dividend stocks with yields > 3% for reliable income streams.

- Tap into the next tech surge and uncover companies powering artificial intelligence breakthroughs with these 27 AI penny stocks.

- Get ahead of the valuation curve and target shares trading well below their potential by reviewing these 870 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

HSBC Holdings

Engages in the provision of banking and financial products and services worldwide.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives