- United Kingdom

- /

- Banks

- /

- LSE:BARC

Is Barclays a Bargain After Its 61% Surge and New Fintech Partnerships?

Reviewed by Bailey Pemberton

- Curious if Barclays is the bargain you’ve been looking for? The stock’s value is getting renewed attention as both investors and market watchers eye the numbers for signs of opportunity.

- After a robust run, Barclays' share price is up 8.1% over the last week, 61.1% year-to-date, and has delivered a staggering 66.5% return over the past year, far outpacing many peers.

- Momentum is not coming out of nowhere. Recent news about Barclays’ expansion of its fintech partnerships and strategic cost-cutting initiatives have played a big part, fueling optimism and fresh debate about the bank’s future prospects.

- When we break down the fundamentals, Barclays scores a 4 out of 6 on our valuation checks, putting it in the spotlight for potential value seekers. We’ll unpack how this score is calculated and explore the popular valuation methods next. An even smarter way to size up Barclays’ true worth will be discussed toward the end of the article.

Approach 1: Barclays Excess Returns Analysis

The Excess Returns valuation model estimates a company's intrinsic value by considering its ability to generate returns above its cost of equity. This approach focuses on how effectively Barclays can turn its invested capital into profits that go beyond what shareholders could earn elsewhere. This provides a clearer picture of its true value for long-term investors.

For Barclays, analysts estimate a Book Value of £4.50 per share, supported by stable future earnings per share (EPS) of £0.59. These forecasts rely on weighted future Return on Equity estimates from 11 analysts, highlighting an average return on equity (ROE) of 10.95%. In context, Barclays’ stable Book Value is projected to reach £5.39 per share, based on consensus from 8 analysts. The cost of equity stands at £0.46 per share, meaning the bank generates an Excess Return of £0.14 per share on shareholder capital. This is a notable signal of value creation.

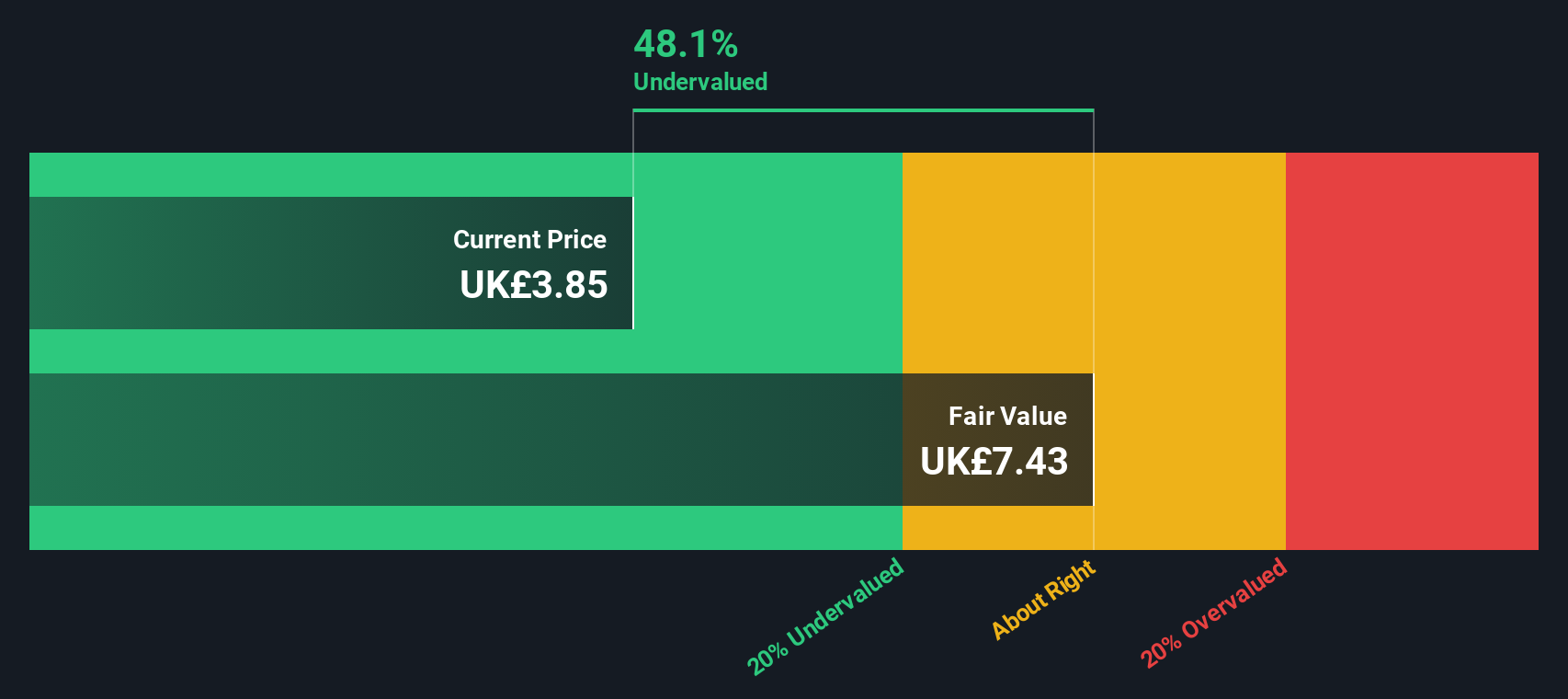

Based on this model, the intrinsic value implied by Excess Returns shows Barclays is trading at a 45.4% discount relative to its estimated fair value. The combination of healthy ROE and a consistent premium over its cost of equity supports a strong value case for the stock.

Result: UNDERVALUED

Our Excess Returns analysis suggests Barclays is undervalued by 45.4%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Barclays Price vs Earnings

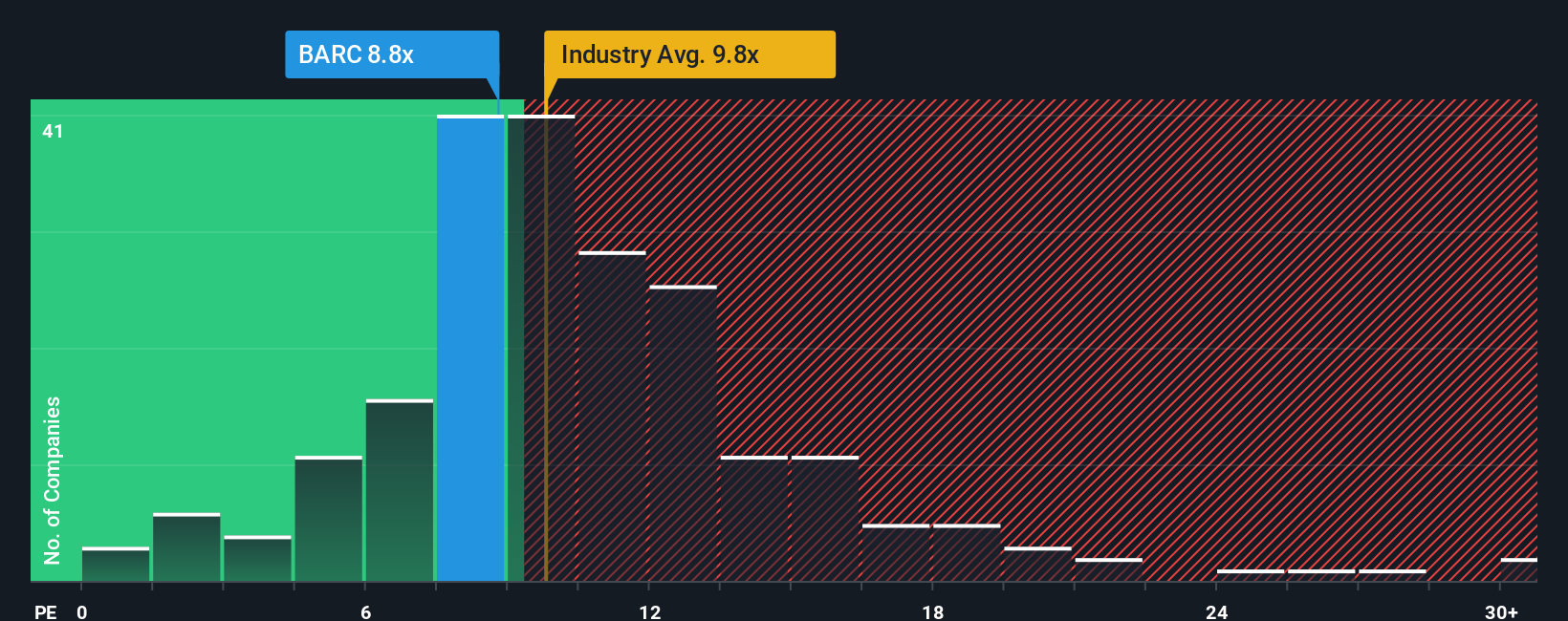

For established, profitable companies like Barclays, the Price-to-Earnings (PE) ratio offers a reliable and widely used valuation metric. The PE ratio gives investors a snapshot of how much they are paying for each pound of the company's earnings, making it a go-to benchmark for banks and other steady profit generators.

Determining what counts as a "fair" PE ratio depends on several factors, including a company's future growth prospects and the level of uncertainty or risk surrounding its earnings. Typically, firms with stronger expected growth or more stable operations are associated with a higher PE, while riskier or slower-growing companies tend to trade at lower multiples.

As of the latest figures, Barclays trades at a PE of 9.99x. This is slightly below both the Banks industry average of 10.36x and the average among peer companies at 12.89x. To provide a more tailored signal, Simply Wall St calculates a proprietary "Fair Ratio," which for Barclays is 8.70x. This metric incorporates Barclays’ unique growth outlook, profit margins, market size, and specific business risks, offering a more comprehensive valuation than those made by comparing with broad industry or peer averages alone.

With Barclays’ current PE at 9.99x and the Fair Ratio at 8.70x, the stock appears modestly above its optimal valuation based on the company’s fundamentals and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Barclays Narrative

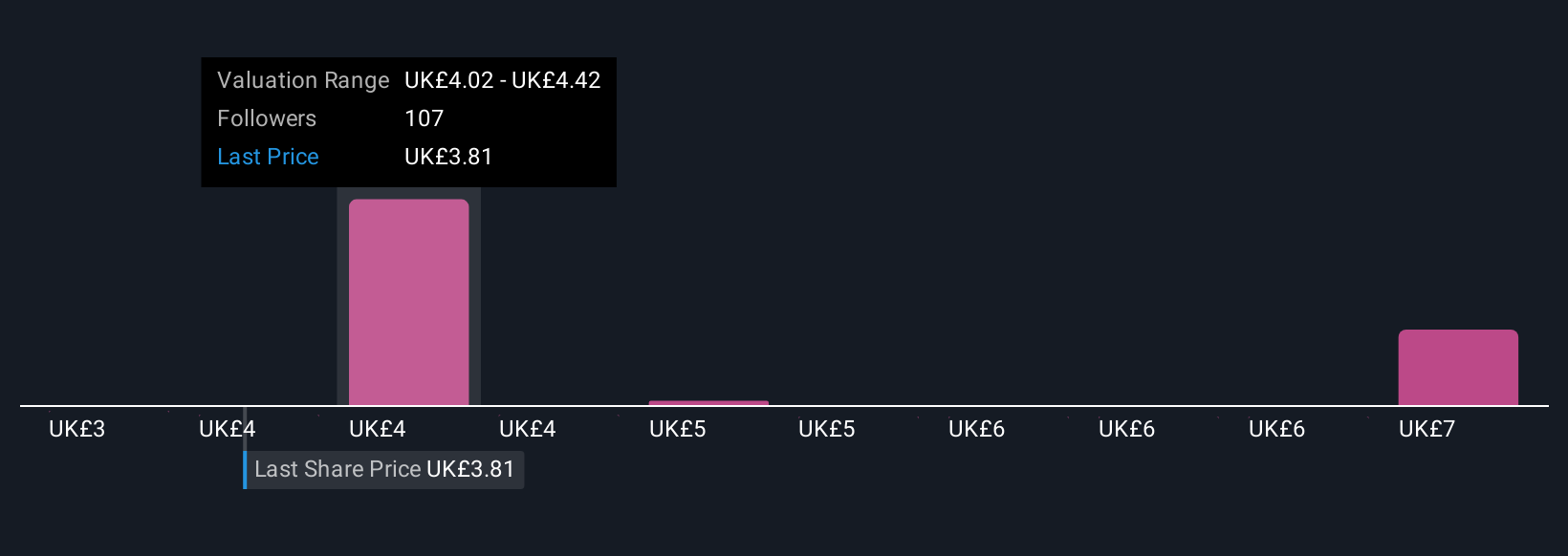

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story and perspective on a company, blending your views on its future revenue, earnings, and profit margins with your own estimate of what it's truly worth.

Narratives provide a bridge from the company's story to a financial forecast and finally to a fair value, making investment decisions much more personal and transparent. On Simply Wall St’s Community page, millions of investors can quickly build, share, and update their own Narratives for Barclays based on real facts and evolving insight.

This tool empowers you to compare your Fair Value to the market price, guiding clear decisions on whether to buy, hold, or sell at any moment. Most importantly, Narratives update automatically as new news or earnings emerge, so your perspective is always current and relevant.

For example, some investors see Barclays’ strategic investments and efficiency gains supporting long-term earnings growth and therefore assign a bullish price target as high as £4.55, while others, concerned about regulatory challenges or execution risks, see just £3.06 as fair. Both views can be explored within the platform to help inform your own stance.

Do you think there's more to the story for Barclays? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barclays might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BARC

Barclays

Provides various financial services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success