- United Kingdom

- /

- Banks

- /

- LSE:BARC

Barclays (LSE:BARC) Strengthens Market Position with Strategic Appointments and Tesco Acquisition Progress

Reviewed by Simply Wall St

Barclays (LSE:BARC) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include growth in its Smart Investor program and strategic acquisitions, juxtaposed against rising impairment charges and regulatory risks. In the discussion that follows, we will explore Barclays' unique capabilities, strategic gaps, emerging market opportunities, and external threats to provide a comprehensive overview of the bank's current business situation.

See the full analysis report here for a deeper understanding of Barclays.

Unique Capabilities Enhancing Barclays' Market Position

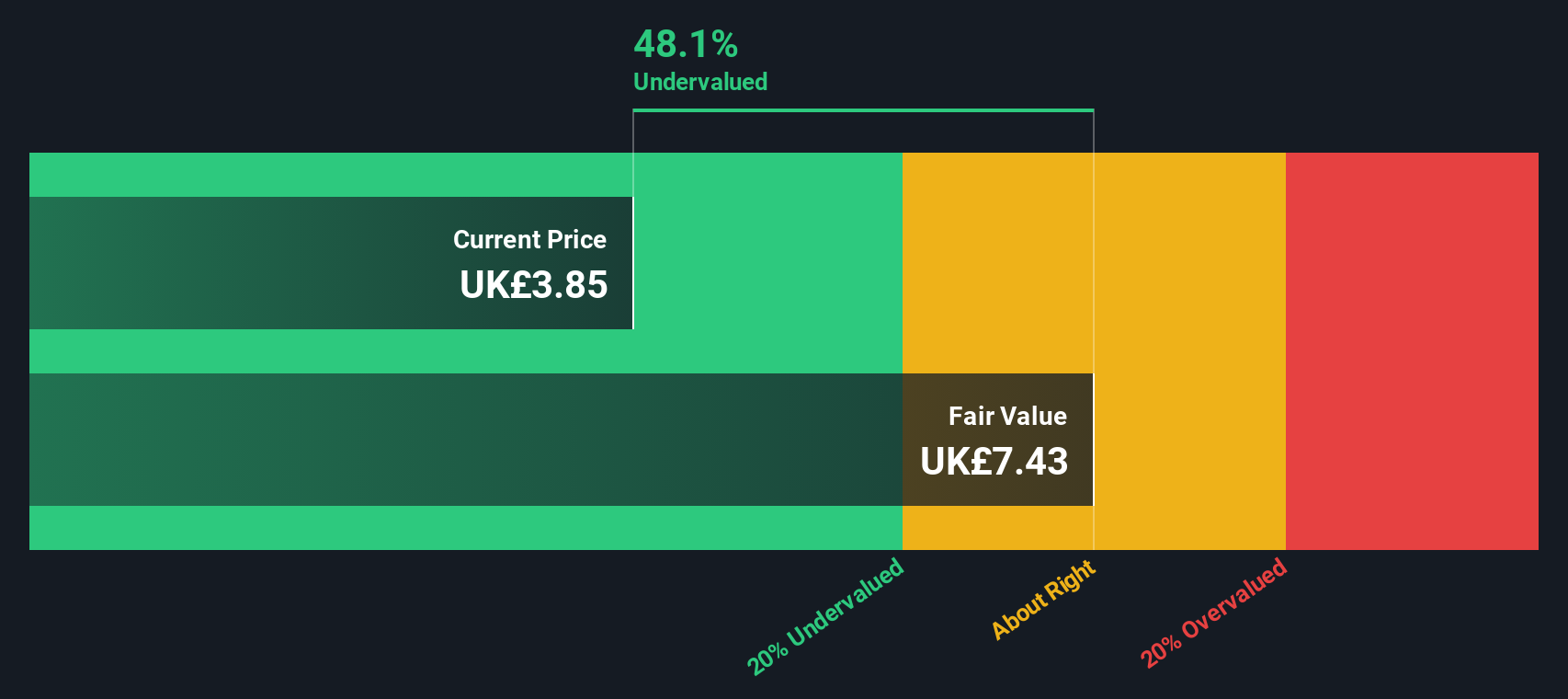

Barclays has demonstrated growth and profitability, with its second quarter and first half performance aligning with its 2024 and 2026 financial targets. The return on tangible equity (RoTE) was 9.9% in Q2 and 11.1% in H1, on track for the 2024 target of above 10%. Effective cost control measures have been beneficial, as highlighted by Group Chief Executive C.S. Venkatakrishnan. The CET1 ratio at 13.6% is comfortably within the target range of 13% to 14%, indicating strong capital positioning. Additionally, the bank has seen a meaningful increase in new customers signing onto its Smart Investor digital program. Barclays is currently trading below its estimated fair value (£6.16) but is considered expensive based on its Price-To-Earnings Ratio (8.1x) compared to industry and peer averages.

Strategic Gaps That Could Affect Barclays

The bank faces challenges with impairment charges, as evidenced by the GBP 384 million charge, equating to a loan loss rate of 38 basis points, which is below the through-the-cycle guidance of 50 to 60. The U.S. Consumer Bank's RoTE improved to 9.2% for the quarter, but operational improvements are still needed. Loans were flat quarter-on-quarter due to muted demand from corporate clients, as noted by Group Finance Director Angela Cross. Barclays' earnings growth forecast of 12.8% per year is slower than the UK market's 14.3% per year. Moreover, the bank's return on equity is forecasted to be low at 9.4% in three years, and it has a high level of bad loans (2.1%) with a low allowance for bad loans (80%).

Emerging Markets Or Trends for Barclays

The opportunity to grow its share of lending in the U.K. corporate market through deepening client relationships is significant. The acquisition of Tesco's Retail Banking business is progressing well, with completion expected in November 2024. Barclays has also increased its net interest income guidance for 2024 from GBP 10.7 billion to approximately GBP 11 billion. Cost efficiency initiatives are on track, with GBP 200 million of gross cost savings delivered this quarter, aiming for GBP 1 billion by the end of 2024. The recent strategic appointments, such as Brad Rogoff as Global Head of Research and Greg Petit as Head of Infrastructure, Power, and Utilities for Canada, further bolster Barclays' market position and expertise.

External Factors Threatening Barclays

Regulatory risks remain a concern, with ongoing monitoring and updates required. Competition continues to be a challenge, with the need for sustainable improvements highlighted by Angela Cross. Economic factors, such as the Fed's shifting concerns from inflation to employment softness, pose potential risks. Market risks are also evident, with expectations for the U.S. Consumer Bank impairment charge to improve in the second half compared to the first. Disagreements over the valuation of its UK merchant payments business have led to complications in the sale process, further adding to the external pressures facing Barclays.

Conclusion

Barclays' strong capital positioning, effective cost control, and alignment with its financial targets for 2024 and 2026 underscore its ability to sustain growth and profitability. However, challenges such as impairment charges and slower earnings growth compared to the UK market may impede its performance. The strategic acquisition of Tesco's Retail Banking business and increased net interest income guidance highlight potential growth avenues, but regulatory and market risks remain significant. Although Barclays is trading below its estimated fair value of £6.16, its Price-To-Earnings Ratio of 8.1x suggests it is expensive compared to industry peers, indicating that while the bank has strong fundamentals, investor caution is warranted given the external pressures and strategic gaps.

Turning Ideas Into Actions

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Barclays might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:BARC

Barclays

Provides various financial services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia.

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives