- United Kingdom

- /

- Infrastructure

- /

- LSE:OCN

3 Top UK Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the UK market navigates challenges stemming from weak trade data from China, the FTSE 100 and FTSE 250 indices have recently experienced declines, reflecting global economic uncertainties. In such a fluctuating environment, dividend stocks can offer investors a degree of stability and income potential, making them an attractive consideration for those looking to bolster their portfolios amidst market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.07% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.50% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.31% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.55% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 8.19% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.10% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.67% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.70% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.04% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.75% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

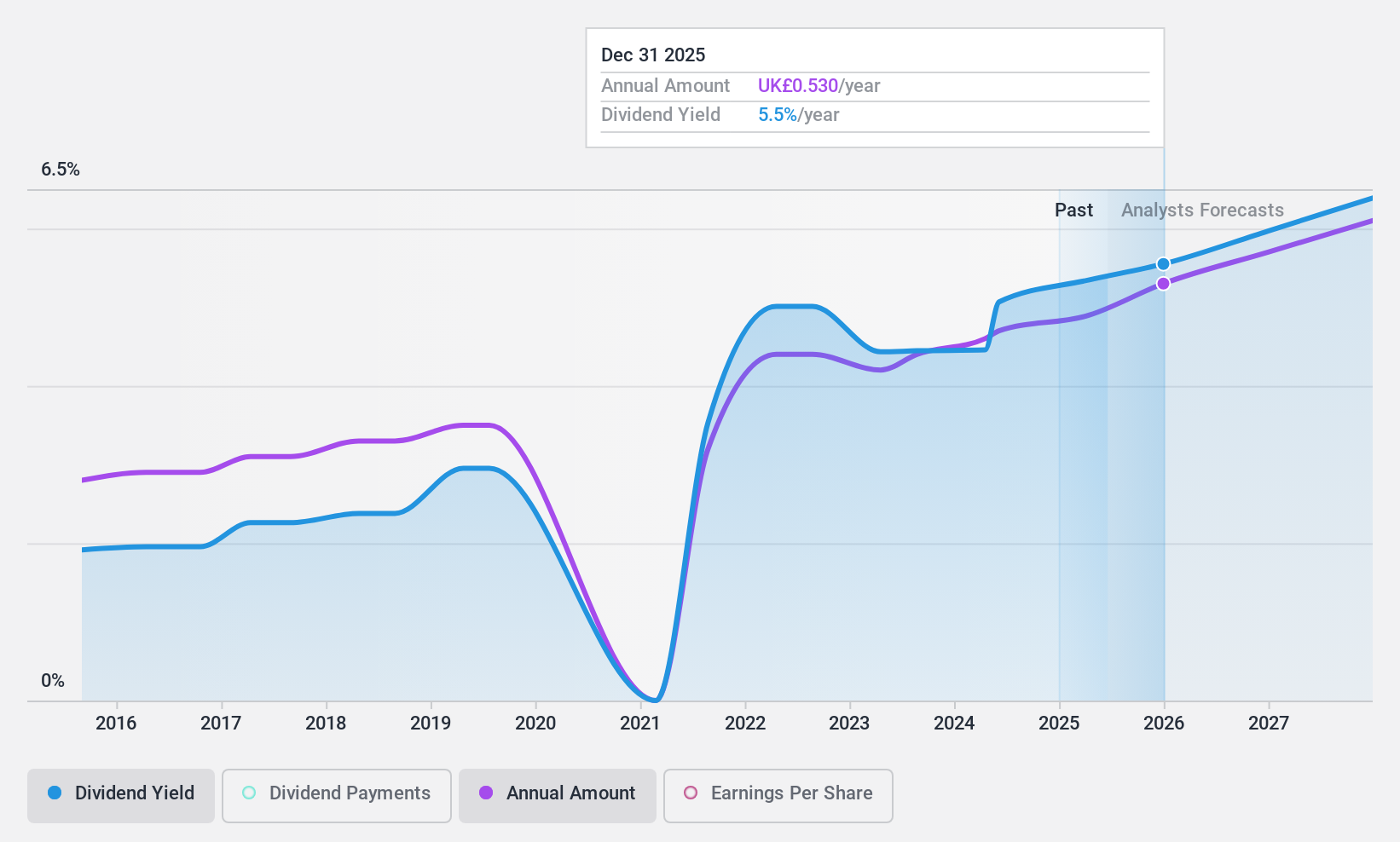

Arbuthnot Banking Group (AIM:ARBB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arbuthnot Banking Group PLC, along with its subsidiaries, offers private and commercial banking products and services in the United Kingdom and has a market cap of £141.73 million.

Operations: Arbuthnot Banking Group PLC generates revenue through several segments, including Wealth Management (£12.32 million), Asset Alliance Group (AAG) (£14.81 million), Renaissance Asset Finance (RAF) (£9.59 million), and Arbuthnot Commercial Asset Based Lending (ACABL) (£16.03 million).

Dividend Yield: 5.4%

Arbuthnot Banking Group's dividend yield of 5.4% is below the top tier in the UK market, and its dividend history has been volatile, indicating unreliability. However, dividends are well covered by earnings with a low payout ratio of 24.9%, expected to remain sustainable at 37.2% in three years. Despite trading at a discount to its estimated fair value, concerns include a high level of bad loans (4.2%) and an insufficient allowance for these loans (8%).

- Delve into the full analysis dividend report here for a deeper understanding of Arbuthnot Banking Group.

- Upon reviewing our latest valuation report, Arbuthnot Banking Group's share price might be too pessimistic.

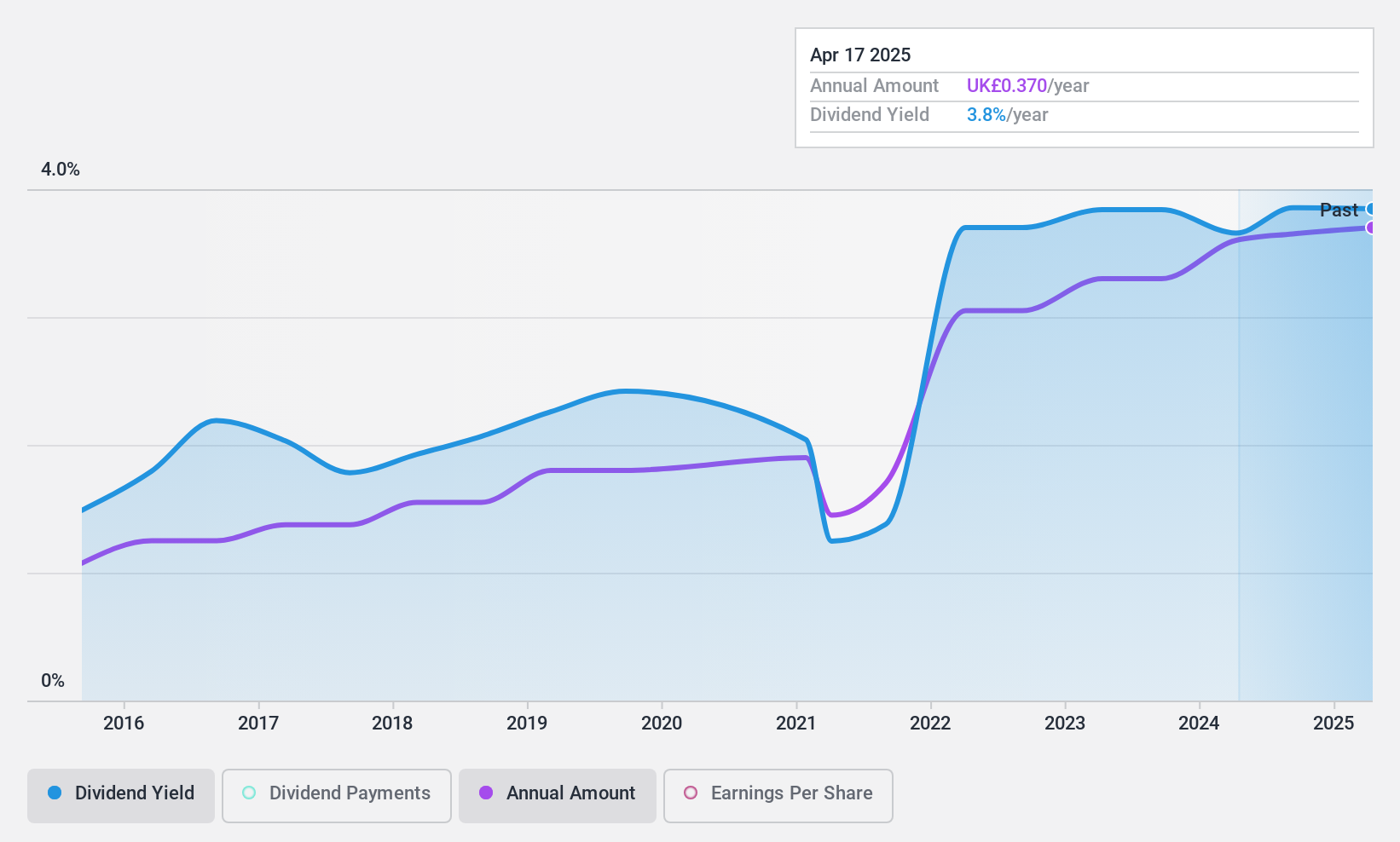

Grafton Group (LSE:GFTU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Grafton Group plc operates in the distribution, retailing, and manufacturing sectors across Ireland, the Netherlands, Finland, and the United Kingdom with a market cap of £1.78 billion.

Operations: Grafton Group plc's revenue segments are comprised of Retailing (£257.64 million), Manufacturing (£123.80 million), UK Distribution (£793.17 million), Finland Distribution (£134.42 million), Ireland Distribution (£630.06 million), and Netherlands Distribution (£342.09 million).

Dividend Yield: 4%

Grafton Group's dividend history is stable and reliable, with a payout ratio of 57.1% covered by earnings and a cash payout ratio of 36.7%. Despite recent revenue decline to £2.28 billion due to currency impacts, dividends remain well-covered. The yield of 4.04% is lower than top-tier UK dividend stocks but offers consistent growth over the past decade. Trading below analyst targets, it presents good value with a P/E ratio of 13.6x compared to the market average.

- Get an in-depth perspective on Grafton Group's performance by reading our dividend report here.

- According our valuation report, there's an indication that Grafton Group's share price might be on the cheaper side.

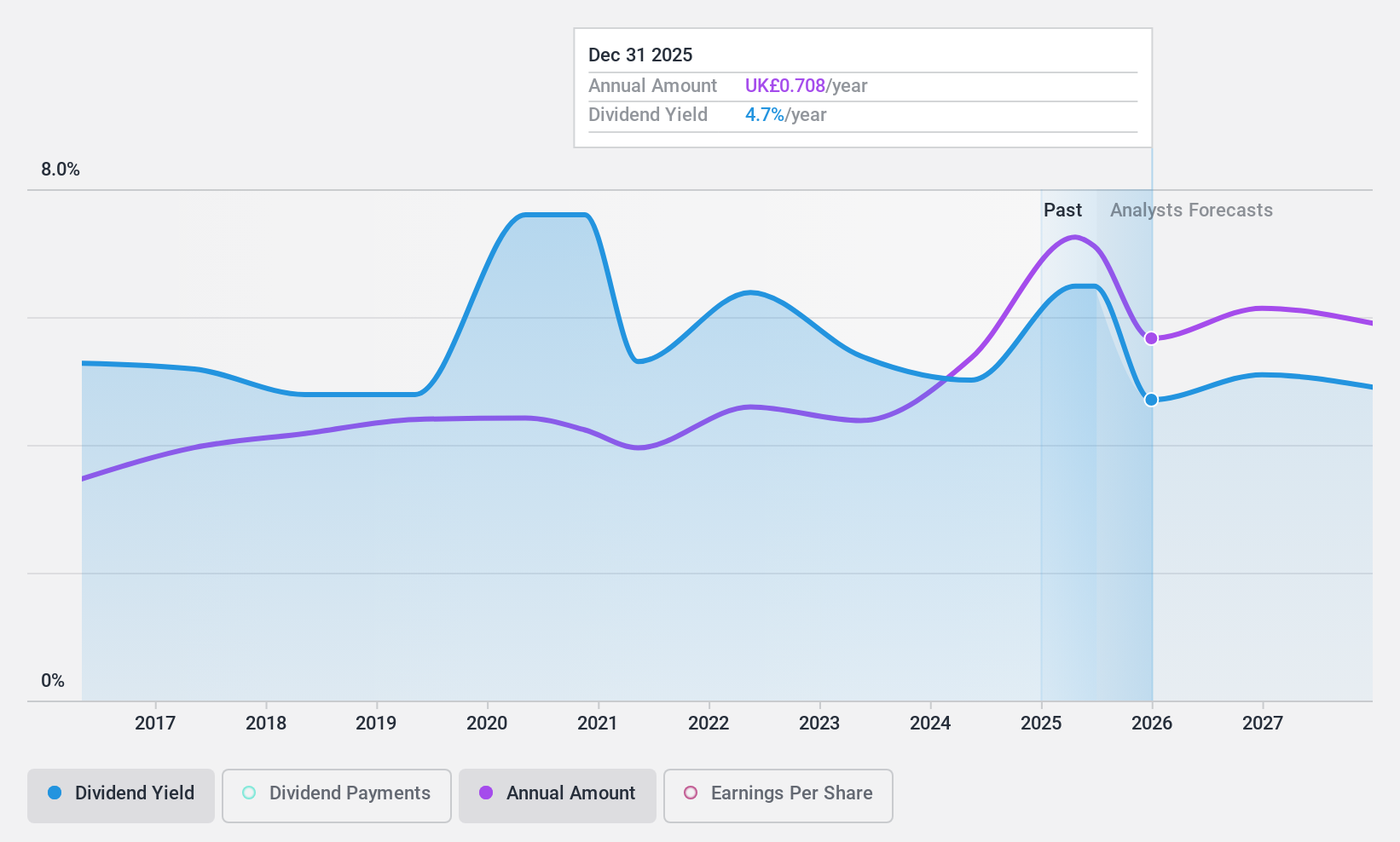

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ocean Wilsons Holdings Limited is an investment holding company that provides maritime and logistics services in Brazil, with a market cap of £463.26 million.

Operations: Ocean Wilsons Holdings Limited generates revenue of $519.35 million from its maritime services in Brazil.

Dividend Yield: 5.2%

Ocean Wilsons Holdings has maintained stable and growing dividends over the past decade, with a payout ratio of 48.7% well-covered by earnings and a cash payout ratio of 26.6%. The dividend yield stands at 5.2%, below the top UK payers but reliable. Its P/E ratio of 9.4x suggests undervaluation compared to the UK market average, while recent earnings growth of £32 million supports its dividend sustainability despite large one-off items impacting results.

- Unlock comprehensive insights into our analysis of Ocean Wilsons Holdings stock in this dividend report.

- In light of our recent valuation report, it seems possible that Ocean Wilsons Holdings is trading beyond its estimated value.

Make It Happen

- Embark on your investment journey to our 62 Top UK Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OCN

Ocean Wilsons Holdings

An investment holding company, engages in the management of a global investment portfolio.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives