- United Kingdom

- /

- Oil and Gas

- /

- LSE:PHAR

Begbies Traynor Group Leads The Charge With These 3 UK Penny Stocks

Reviewed by Simply Wall St

The UK stock market has been experiencing turbulence, with the FTSE 100 index closing lower due to weak trade data from China, highlighting challenges in global economic recovery. Amidst these broader market fluctuations, investors often seek opportunities in smaller companies that exhibit strong financial health and growth potential. Penny stocks, though an older term, still capture attention for their affordability and promise when backed by solid fundamentals. In this context, we'll explore some standout penny stocks in the UK that demonstrate robust financial strength and potential for growth.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.55 | £519.77M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.13 | £172.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.945 | £14.27M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5625 | $327M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.49 | £255.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.465 | £70.76M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Braemar (LSE:BMS) | £2.49 | £75.87M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 293 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Begbies Traynor Group (AIM:BEG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Begbies Traynor Group plc offers business recovery, financial advisory, and property services consultancy in the UK with a market cap of £178.75 million.

Operations: The company generates revenue from two primary segments: Property Advisory (£46.4 million) and Business Recovery and Advisory (£107.3 million).

Market Cap: £178.75M

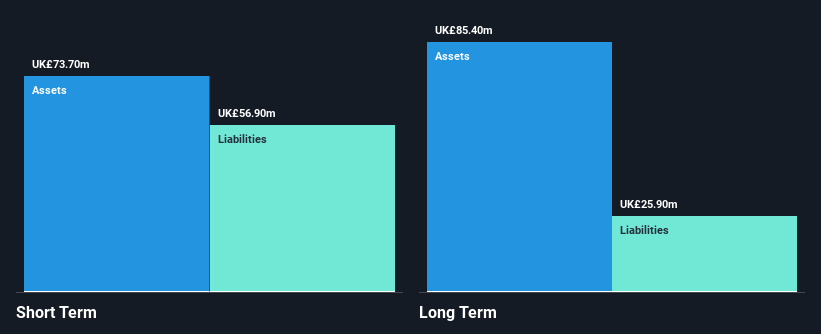

Begbies Traynor Group, with a market cap of £178.75 million, has shown strong earnings growth of 320% over the past year, outpacing the Professional Services industry. The company has a seasoned management team and board, with average tenures of 5.8 and 11.3 years respectively. Its short-term assets exceed both short- and long-term liabilities, indicating solid financial health. Despite low return on equity at 7.7%, debt levels are well-managed with cash exceeding total debt and operating cash flow covering debt by a large margin (220%). Recent executive changes include Mark Fry's appointment as CEO to drive growth strategy execution further.

- Click here to discover the nuances of Begbies Traynor Group with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Begbies Traynor Group's future.

Journeo (AIM:JNEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Journeo plc offers solutions for capturing, processing, and displaying essential information to enhance transport journeys in the UK and internationally, with a market cap of £88.12 million.

Operations: The company's revenue is derived from Infotec (£7.50 million), Fleet Systems (£27.94 million), Journeo Denmark (£2.79 million), and Passenger Systems (£10.38 million).

Market Cap: £88.12M

Journeo plc, with a market cap of £88.12 million, demonstrates financial stability and growth potential in the transport display technology sector. The company maintains a strong balance sheet with more cash than debt and short-term assets significantly exceeding both short- and long-term liabilities. Its Return on Equity is high at 21.5%, supported by well-covered interest payments and operating cash flow that vastly surpasses debt levels. Despite recent earnings showing slight declines compared to last year, Journeo continues to secure substantial contracts, such as a £1.5 million order from a Northern Transport Partnership, enhancing its market position in sustainable transport solutions across the UK.

- Click to explore a detailed breakdown of our findings in Journeo's financial health report.

- Gain insights into Journeo's outlook and expected performance with our report on the company's earnings estimates.

Pharos Energy (LSE:PHAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pharos Energy plc is an independent energy company engaged in the exploration, development, and production of oil and gas properties in Vietnam and Egypt, with a market cap of £91.99 million.

Operations: The company generates revenue from its operations in Egypt, contributing $20.8 million, and Southeast Asia, which accounts for $115.8 million.

Market Cap: £92M

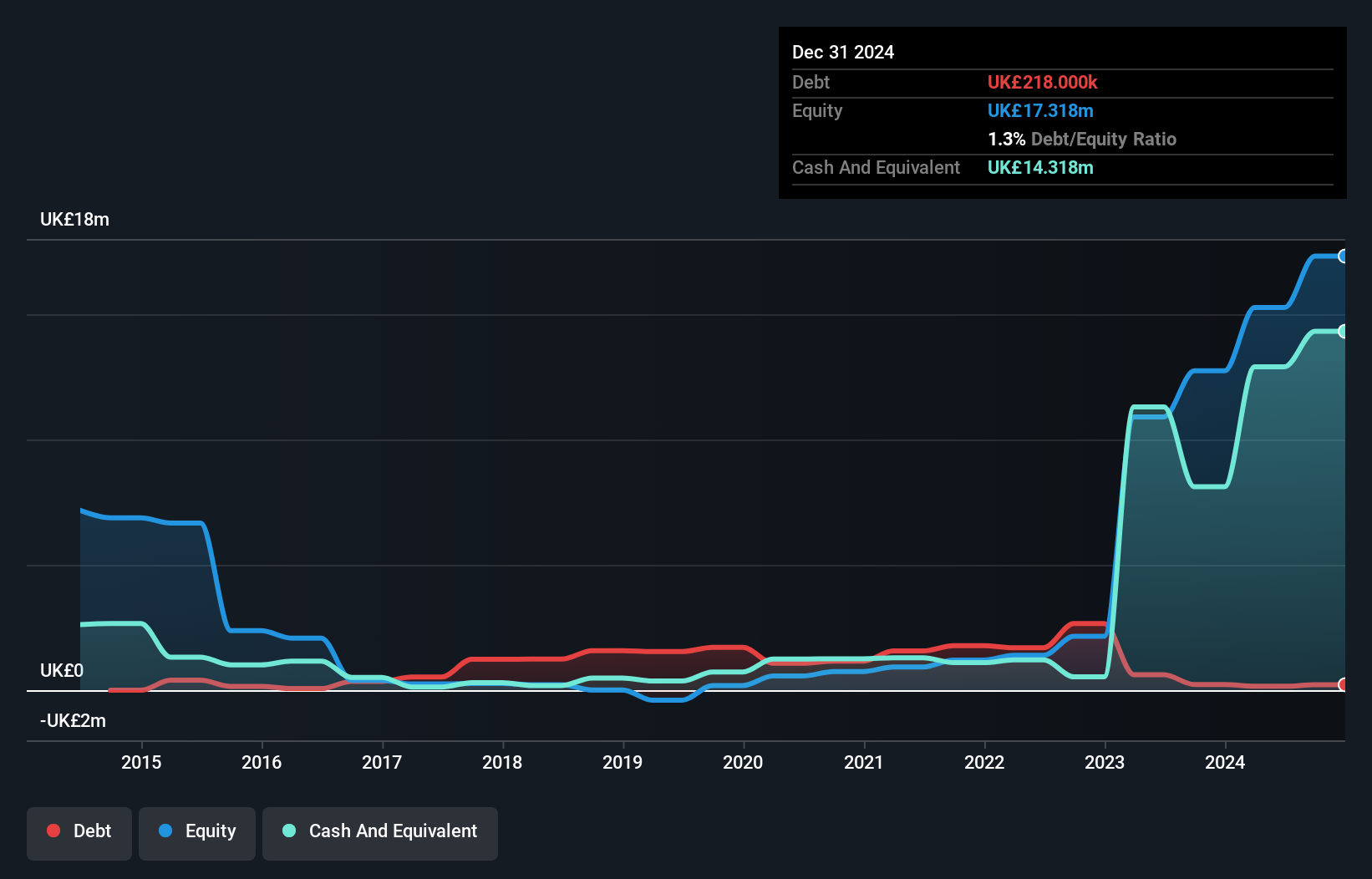

Pharos Energy plc, with a market cap of £91.99 million, has shown resilience in the oil and gas sector through its operations in Vietnam and Egypt. Recent updates reveal the commencement of a six-well drilling program in Vietnam, fully funded by its balance sheet strength. Despite reporting a net loss of US$2.8 million for H1 2025, Pharos has turned profitable over the past five years with significant earnings growth. The company is debt-free, though short-term assets do not cover long-term liabilities. Analysts expect substantial stock price appreciation as it trades significantly below estimated fair value.

- Get an in-depth perspective on Pharos Energy's performance by reading our balance sheet health report here.

- Learn about Pharos Energy's future growth trajectory here.

Summing It All Up

- Unlock more gems! Our UK Penny Stocks screener has unearthed 290 more companies for you to explore.Click here to unveil our expertly curated list of 293 UK Penny Stocks.

- Seeking Other Investments? AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PHAR

Pharos Energy

An independent energy company, explores, develops, and produces oil and gas properties in Vietnam and Egypt.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives