- France

- /

- Renewable Energy

- /

- ENXTPA:VLTSA

Should Voltalia's New IFC Partnership and Plant Launches Prompt a Rethink by ENXTPA:VLTSA Investors?

Reviewed by Sasha Jovanovic

- Voltalia recently announced a collaboration with IFC, a member of the World Bank Group, to develop renewable energy solutions for mining operations across Africa, alongside the commissioning of a major 10.5-megawatt biomass plant in French Guiana and the operational launch of the 45-megawatt Clifton Solar power plant in the UK.

- These developments highlight Voltalia's increasing capacity to deliver turnkey clean energy projects globally, positioning the company as a growing force in helping industries reduce carbon reliance and advance local energy transition efforts.

- We'll explore how this IFC partnership could shape Voltalia’s investment outlook by opening new Power-to-Mine opportunities in Africa.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Voltalia Investment Narrative Recap

Investors considering Voltalia are buying into the vision of energy transition and the global shift towards renewables, with ongoing expansion of turnkey solutions and landmark partnerships like the recent deal with IFC in Africa. While the IFC collaboration demonstrates Voltalia’s ability to secure major institutional allies and expand its project pipeline, the impact on short-term catalysts, such as margin improvement and PPA wins, remains limited as it will take time for the benefits to flow through; high leverage and recent losses continue to stand out as key risks.

The commissioning of the 10.5-megawatt biomass plant in French Guiana stands out, underscoring Voltalia’s capability to execute complex projects and contribute directly to local decarbonization, attributes that feed into longer-term catalysts for growth and cash generation, but execution and return profiles on new assets will be closely watched.

Yet, high debt levels and increased borrowing costs remain factors investors should not ignore, especially if growth …

Read the full narrative on Voltalia (it's free!)

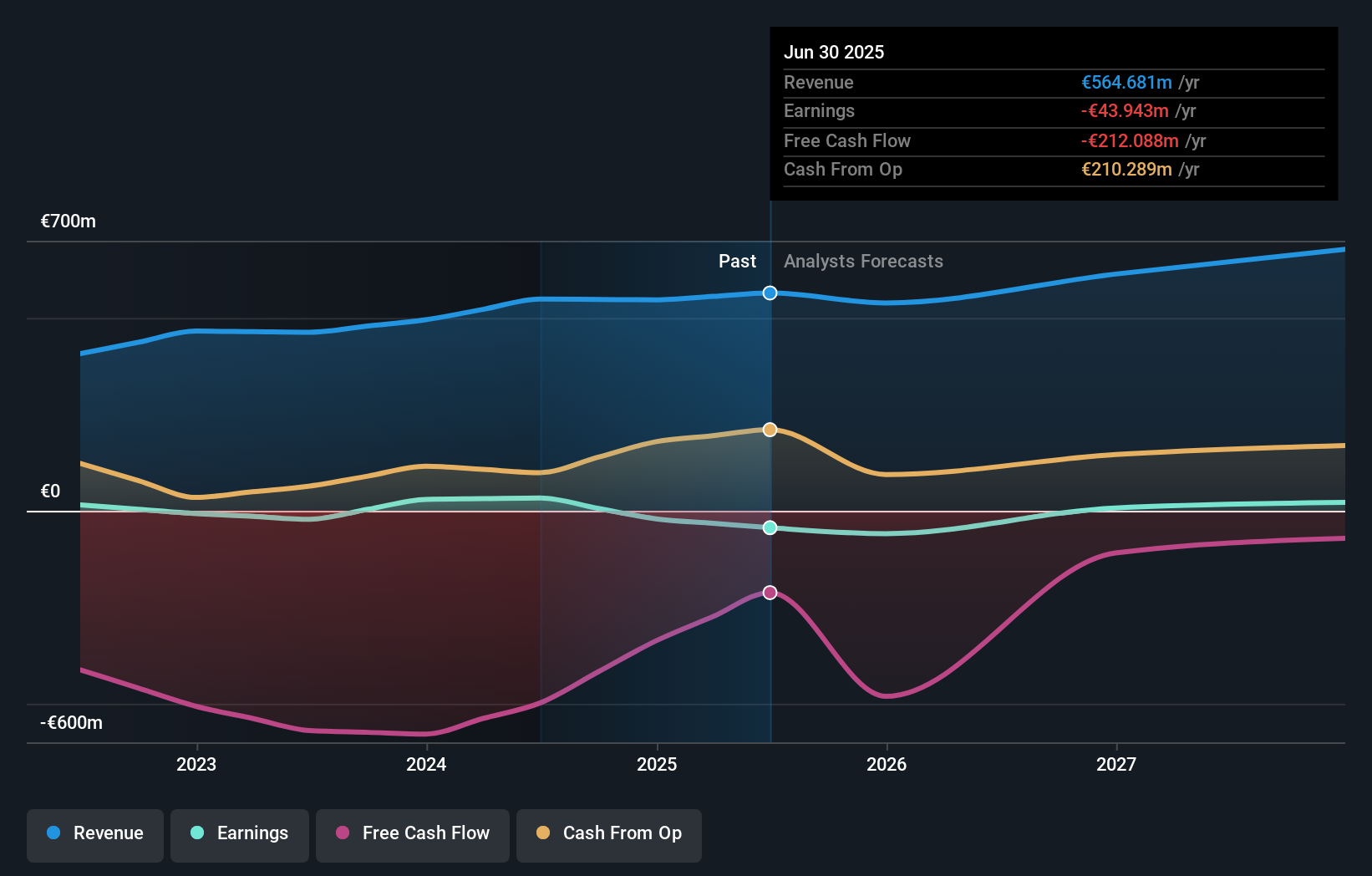

Voltalia's narrative projects €741.2 million revenue and €29.2 million earnings by 2028. This requires 10.7% yearly revenue growth and a €50.2 million earnings increase from €-21.0 million today.

Uncover how Voltalia's forecasts yield a €10.99 fair value, a 33% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community reports a single fair value estimate of €10.99 for Voltalia shares, showing a tightly clustered retail view. This consensus comes as margin pressure and elevated net debt remain live issues for the company’s performance, inviting you to compare different investor perspectives.

Explore another fair value estimate on Voltalia - why the stock might be worth just €10.99!

Build Your Own Voltalia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Voltalia research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Voltalia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Voltalia's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VLTSA

Voltalia

Engages in the production and sale of energy generated by the wind, solar, hydropower, biomass, and storage plants.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion