- France

- /

- Other Utilities

- /

- ENXTPA:VIE

Will Veolia Environnement’s (ENXTPA:VIE) Alliance with TotalEnergies Reinvent Its Decarbonization and Growth Strategy?

Reviewed by Sasha Jovanovic

- In recent news, Veolia Environnement and TotalEnergies announced a broad cooperation agreement to accelerate decarbonization, enhance circular economy initiatives, and implement innovative methane detection technology at Veolia’s landfills. This collaboration aims to reduce greenhouse gas emissions, expand water reuse, and integrate renewable energy into desalination, supporting Veolia’s leadership in sustainable resource solutions.

- By leveraging both companies' expertise in water resource management and low-carbon technologies, Veolia positions itself to capture new growth and advance climate adaptation solutions for industrial and municipal clients globally.

- We’ll explore how the integration of TotalEnergies’ methane detection technology may influence Veolia’s outlook for emissions reduction and business expansion.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Veolia Environnement Investment Narrative Recap

Veolia’s investment case rests on its capacity to harness regulatory-driven demand for advanced water and waste solutions, while offsetting mature market headwinds with strategic innovation and sustainability partnerships. The latest agreement with TotalEnergies stands to reinforce Veolia’s role in circular economy leadership, but is unlikely to materially alter the near-term catalyst of integration efficiency from past acquisitions or curb exposure to operational complexity, an ongoing key risk for margin growth.

Of recent developments, the appointment of Nadège Petit as CEO of the North America Zone aligns directly with Veolia’s ambitions to expand its presence in the US, enhancing its growth platform outside mature European markets and supporting international diversification, which remains central to the group’s medium-term upside.

Yet, in contrast, investors should be aware that persistent cost pressures and flat tariff indexation in key segments could limit margin expansion if...

Read the full narrative on Veolia Environnement (it's free!)

Veolia Environnement's outlook anticipates €51.5 billion in revenue and €1.9 billion in earnings by 2028. This scenario assumes annual revenue growth of 4.9% and a €0.7 billion increase in earnings from the current €1.2 billion.

Uncover how Veolia Environnement's forecasts yield a €35.07 fair value, a 23% upside to its current price.

Exploring Other Perspectives

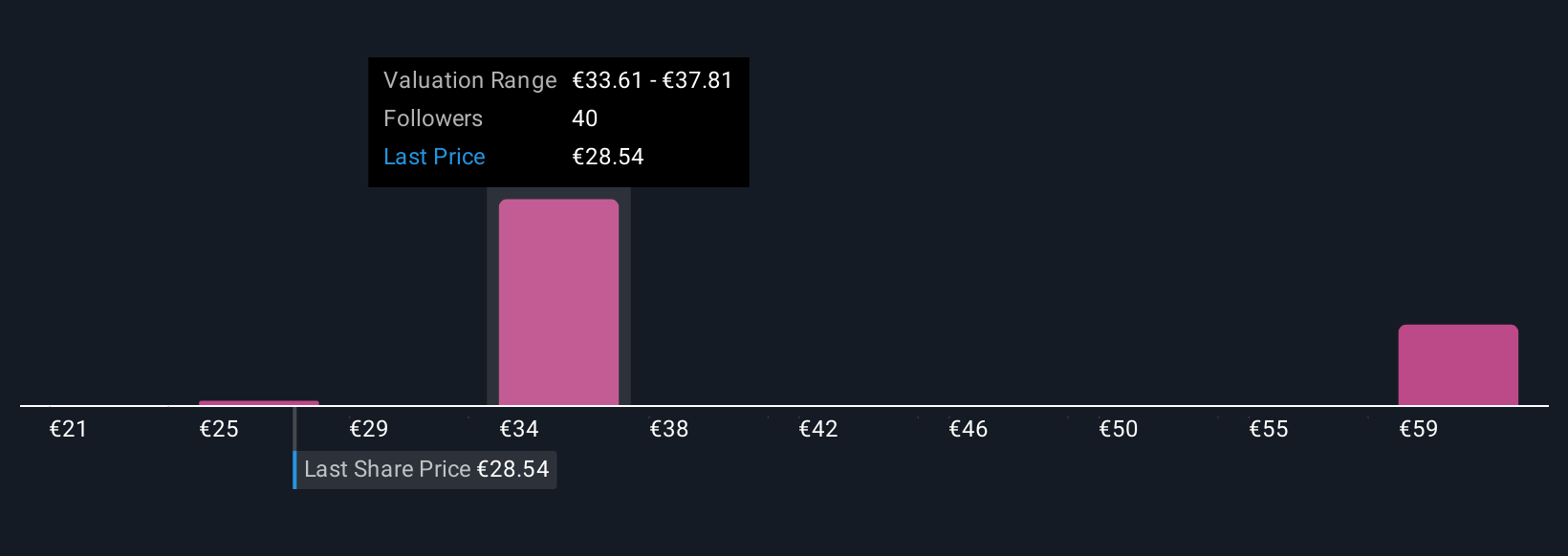

Ten investors in the Simply Wall St Community placed Veolia’s fair value anywhere between €21.01 and €63.01 per share. While you weigh this wide spectrum of opinions, remember that operational complexity from Veolia’s recent wave of large acquisitions remains a point of uncertainty for future profitability. Explore these varied viewpoints to better understand different risk and reward profiles.

Explore 10 other fair value estimates on Veolia Environnement - why the stock might be worth 26% less than the current price!

Build Your Own Veolia Environnement Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veolia Environnement research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Veolia Environnement research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veolia Environnement's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIE

Veolia Environnement

Designs and provides water, waste, and energy management solutions.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives