- France

- /

- Other Utilities

- /

- ENXTPA:VIE

Does Veolia's Digital Push and Global Expansion Reshape Its Long-Term Story (ENXTPA:VIE)?

Reviewed by Sasha Jovanovic

- Veolia recently opened its first Hubgrade Center in North America, combining digital, AI, and remote monitoring technologies to enhance water and wastewater management for municipal partners across the western United States.

- The company also joined a consortium with Marafiq and Lamar, signing an agreement with SATORP to develop the Middle East's largest industrial effluent recycling plant in Saudi Arabia, highlighting Veolia's expanding influence in advanced water management worldwide.

- Now, we'll examine how Veolia's investment in digital water solutions and international expansion could impact its long-term investment outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Veolia Environnement Investment Narrative Recap

To invest in Veolia, you need to believe in the ongoing global shift toward sustainable water and waste management, driven by tightening regulations and demand for advanced technology solutions. While Veolia’s recent Hubgrade Center launch in North America and the Saudi water recycling agreement showcase operational innovation and global reach, the most material short-term catalyst remains sustained growth in high-value water technologies; meanwhile, integration risks from recent M&A activity and cost containment in mature European markets remain key risks, with the latest news not materially altering this outlook.

Among recent announcements, Veolia's new partnership with ADNOC to optimize water management in the UAE stands out as most aligned with the current expansion into digital monitoring and international operations. This collaboration reinforces Veolia’s engagement in regions where resource scarcity and infrastructure need are acute, directly supporting catalysts such as higher-value service contracts and international diversification, while balancing exposure to market-specific risks.

However, against these catalysts, investors should be aware that cost pressures and margin risks in mature European markets could still impact overall profitability if...

Read the full narrative on Veolia Environnement (it's free!)

Veolia Environnement's narrative projects €51.5 billion in revenue and €1.9 billion in earnings by 2028. This requires 4.9% annual revenue growth and a €0.7 billion increase in earnings from the current €1.2 billion level.

Uncover how Veolia Environnement's forecasts yield a €35.07 fair value, a 21% upside to its current price.

Exploring Other Perspectives

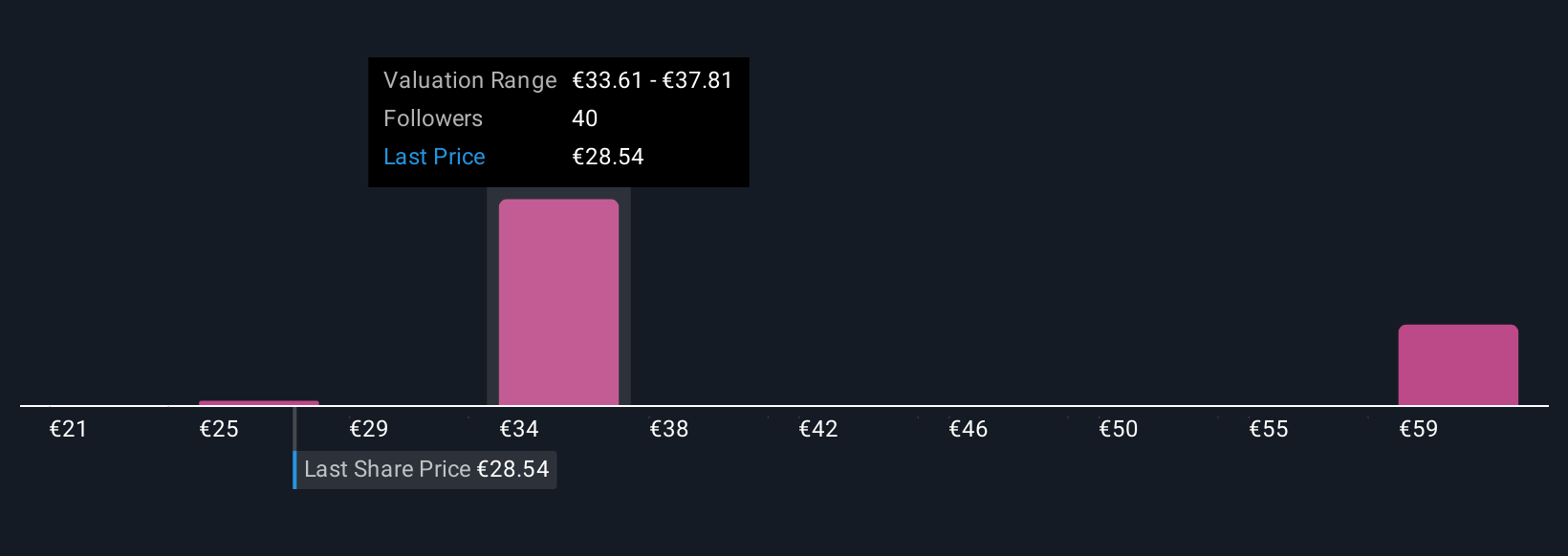

Nine private investors in the Simply Wall St Community estimate Veolia’s fair value ranges widely from €21.01 to €63.65 per share. While forecasts for international growth are optimistic, these varied opinions highlight how market conditions and regional pressures can shape different views on potential upside or caution.

Explore 9 other fair value estimates on Veolia Environnement - why the stock might be worth 28% less than the current price!

Build Your Own Veolia Environnement Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veolia Environnement research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Veolia Environnement research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veolia Environnement's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIE

Veolia Environnement

Designs and provides water, waste, and energy management solutions.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives