- France

- /

- Other Utilities

- /

- ENXTPA:ENGI

Is Engie Still Attractive After 16% Share Price Rally in 2025?

Reviewed by Simply Wall St

If you are holding Engie stock or considering adding it to your portfolio, you are not alone in wondering where it stands right now. Over the past five years, Engie shares have surged by 135.0%, and even over the last twelve months, the stock is up 24.2%. That kind of long-term momentum can make anyone pause and ask whether most of the upside is already factored in, or if there is still room for further growth.

More recently, things have quieted down a bit. This past month, Engie slipped by 3.8%, but over the last week, shares essentially treaded water with a 0.1% rise. Still, the stock is up an impressive 16.3% since the start of the year. These modest dips and steady long-term trends reflect how the market is digesting both global energy sector changes and the company’s strategic moves toward sustainable solutions.

When it comes to valuation, Engie currently earns a value score of 5 out of 6, meaning it is considered undervalued according to nearly every major metric investors tend to check. In the next section, we will break down the different valuation methods that produce that score, as well as where Engie stands on each. Additionally, we will discuss why understanding valuation is more than just ticking boxes; it involves seeing the bigger picture.

Engie delivered 24.2% returns over the last year. See how this stacks up to the rest of the Integrated Utilities industry.Approach 1: Engie Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's fair value by projecting its future cash flows and discounting them back to today's value. This approach captures both current performance and anticipated growth. For Engie, analysts start with the latest free cash flow figure, which presently stands at negative €6.6 billion. While this recent number is in the red, the model projects strong improvement over time. Analyst consensus and subsequent extrapolations forecast an annual free cash flow of €2.4 billion by 2029 and €2.9 billion in 2035.

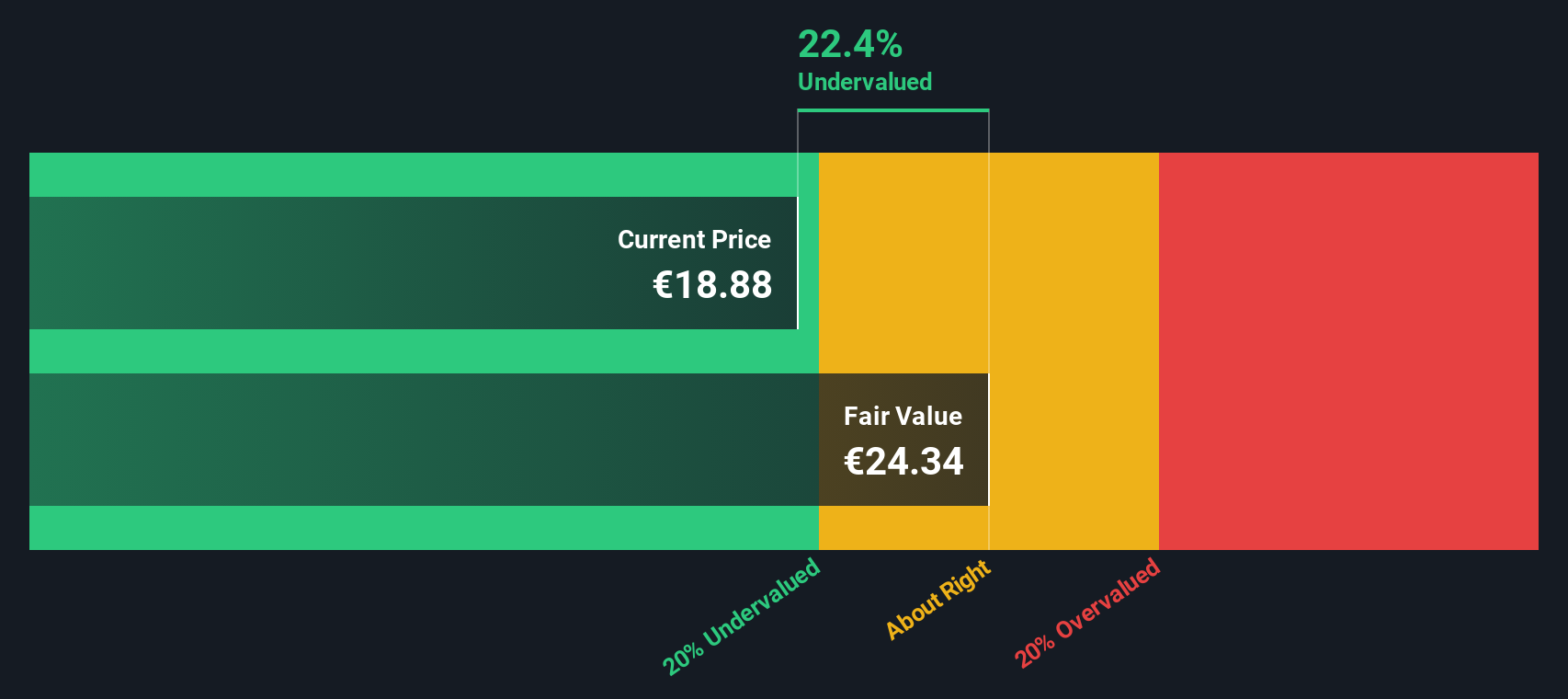

Cash flow estimates from 2026 onward are partly based on analyst reports and are then gradually extrapolated for later years. This results in a robust 10-year recovery outlook for Engie, emphasizing an eventual turnaround after a challenging year for free cash generation. With these projections, the DCF model calculates Engie's intrinsic value at €24.34 per share.

Compared to its current market price, this fair value estimate suggests Engie stock is trading at a 25.8% discount, which indicates the shares are significantly undervalued according to the DCF analysis.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Engie.

Approach 2: Engie Price vs Earnings

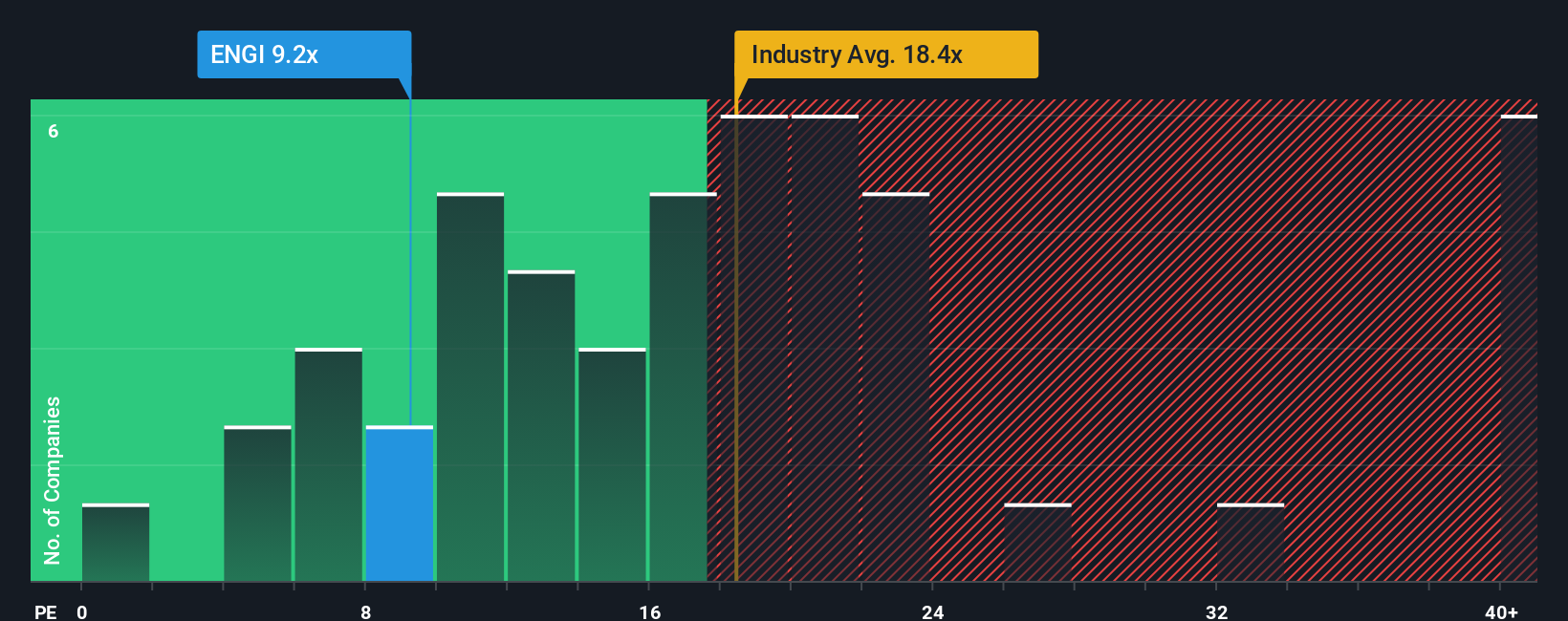

The price-to-earnings (PE) ratio is often regarded as the gold standard for valuing profitable companies like Engie because it directly ties a company’s share price to its bottom-line earnings. Investors use this metric to gauge how much they are paying for each euro of profit, making it especially useful when a company is consistently generating positive earnings.

It's important to remember that what constitutes a "normal" or "fair" PE ratio depends on a mix of factors. A higher growth outlook typically commands a higher PE, while bigger risks or slower growth should lead to a lower PE. Engie currently trades at a PE ratio of 8.8x, which is well below both the Integrated Utilities industry average of 18.1x and the peer group average of 17.7x. At first glance, this could signal an attractive buying opportunity.

However, a more tailored approach is to use Simply Wall St’s Fair Ratio, a metric designed to reflect Engie’s unique combination of earnings growth prospects, profit margins, industry context, market cap and risk profile. This Fair Ratio for Engie stands at 16.1x, offering a benchmark that is more relevant than a broad-brush peer comparison. Since Engie's actual PE is considerably lower than its Fair Ratio, this suggests the stock is undervalued on an earnings basis.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Engie Narrative

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story: the set of assumptions and perspectives you have about Engie, combined with your own view of future revenue, earnings, and margins, all connected to a fair value you believe is justified.

Unlike traditional valuation models, Narratives let you see how your thinking, or that of others in the Community, links the company’s story directly to projected financials and what the stock should be worth. Narratives are easy to build and explore directly on the Simply Wall St Community page, where millions of investors share and refine their investment stories in real time.

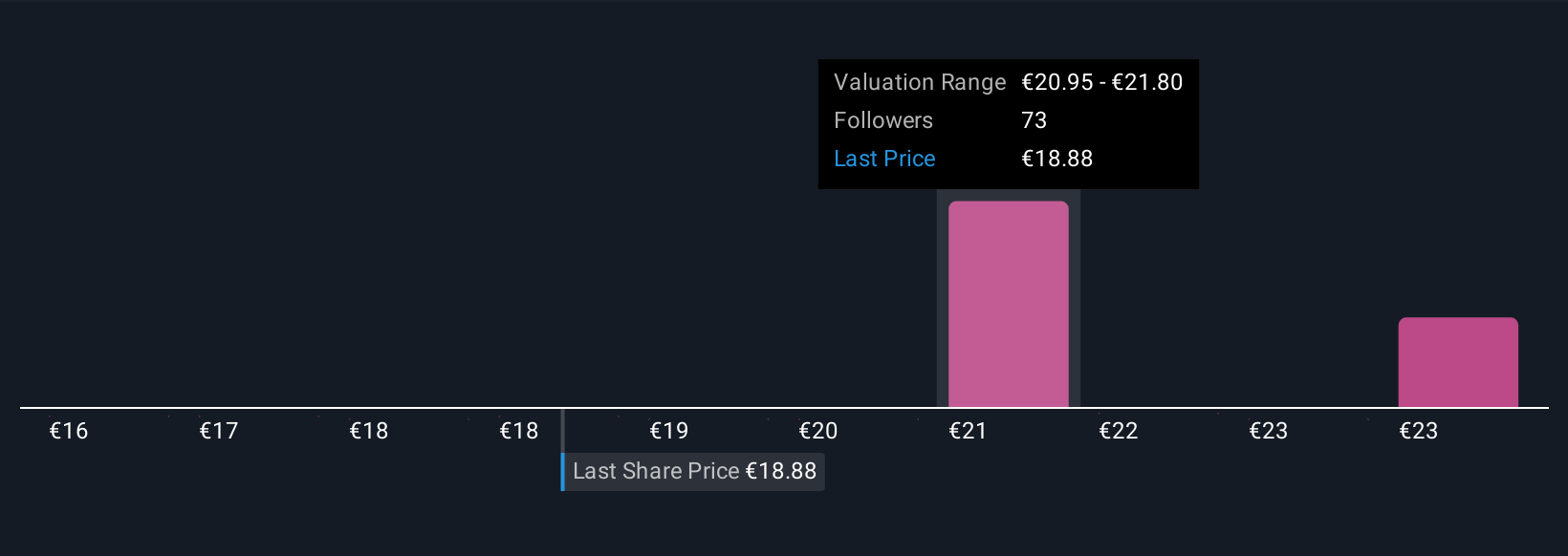

This approach empowers you to decide when to buy or sell by comparing your Narrative’s Fair Value to the live market Price, and every Narrative stays up to date as new information, like company news or earnings, is published. For example, one investor might see Engie’s accelerating renewables business and set a high fair value close to €24, while another focuses on near-term earnings risks and prefers a more cautious target value near €17.5.

Do you think there's more to the story for Engie? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Engie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ENGI

Engie

Operates as an energy company, engages in the renewables and decentralized, low-carbon energy networks, and energy services businesses in France, Europe, North America, Asia, the Middle East, Oceania, South America, Africa, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives