- France

- /

- Infrastructure

- /

- ENXTPA:ALTPC

We're Not Counting On Société Marseillaise du Tunnel Prado Carénage (EPA:SMTPC) To Sustain Its Statutory Profitability

As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding Société Marseillaise du Tunnel Prado Carénage (EPA:SMTPC).

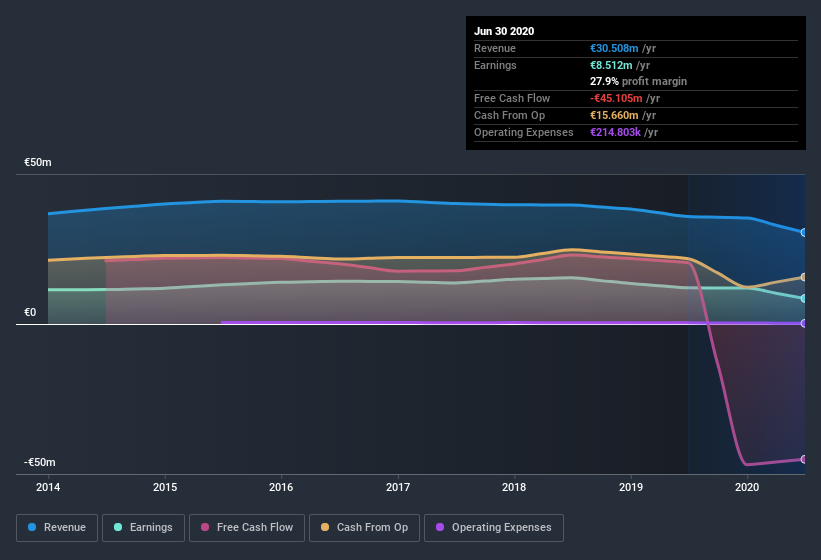

It's good to see that over the last twelve months Société Marseillaise du Tunnel Prado Carénage made a profit of €8.51m on revenue of €30.5m. The chart below shows that both revenue and profit have declined over the last three years.

View our latest analysis for Société Marseillaise du Tunnel Prado Carénage

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. Today, we'll discuss Société Marseillaise du Tunnel Prado Carénage's free cashflow relative to its earnings, and consider what that tells us about the company. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

A Closer Look At Société Marseillaise du Tunnel Prado Carénage's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Over the twelve months to June 2020, Société Marseillaise du Tunnel Prado Carénage recorded an accrual ratio of 0.95. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. In the last twelve months it actually had negative free cash flow, with an outflow of €45m despite its profit of €8.51m, mentioned above. It's worth noting that Société Marseillaise du Tunnel Prado Carénage generated positive FCF of €20m a year ago, so at least they've done it in the past. One positive for Société Marseillaise du Tunnel Prado Carénage shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Our Take On Société Marseillaise du Tunnel Prado Carénage's Profit Performance

As we have made quite clear, we're a bit worried that Société Marseillaise du Tunnel Prado Carénage didn't back up the last year's profit with free cashflow. For this reason, we think that Société Marseillaise du Tunnel Prado Carénage's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. Sadly, its EPS was down over the last twelve months. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. If you'd like to know more about Société Marseillaise du Tunnel Prado Carénage as a business, it's important to be aware of any risks it's facing. Every company has risks, and we've spotted 2 warning signs for Société Marseillaise du Tunnel Prado Carénage (of which 1 is potentially serious!) you should know about.

Today we've zoomed in on a single data point to better understand the nature of Société Marseillaise du Tunnel Prado Carénage's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Société Marseillaise du Tunnel Prado Carénage, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ALTPC

Société Marseillaise du Tunnel Prado Carénage

Société Marseillaise du Tunnel Prado Carénage constructs and operates tunnels in France.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives