Shareholders Can Be Confident That ID Logistics Group's (EPA:IDL) Earnings Are High Quality

Even though ID Logistics Group SA's (EPA:IDL) recent earnings release was robust, the market didn't seem to notice. Our analysis suggests that investors might be missing some promising details.

Check out our latest analysis for ID Logistics Group

A Closer Look At ID Logistics Group's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

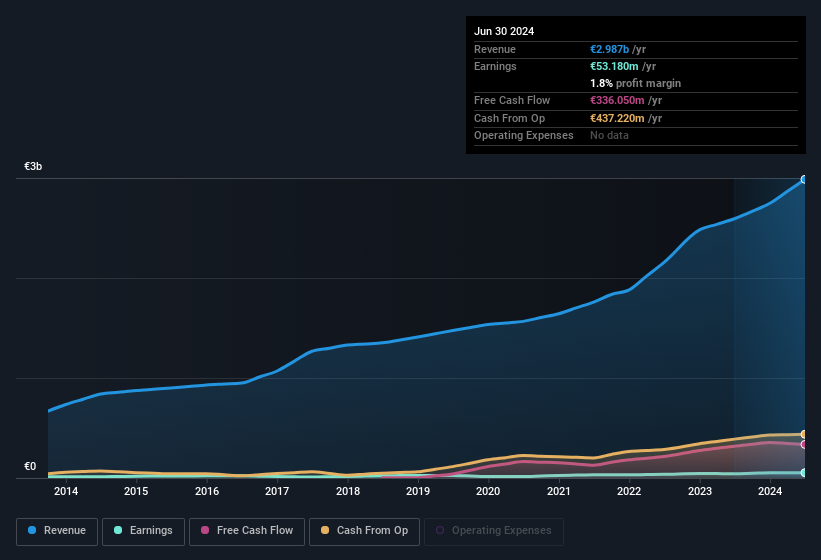

Over the twelve months to June 2024, ID Logistics Group recorded an accrual ratio of -0.38. That indicates that its free cash flow quite significantly exceeded its statutory profit. To wit, it produced free cash flow of €336m during the period, dwarfing its reported profit of €53.2m. ID Logistics Group shareholders are no doubt pleased that free cash flow improved over the last twelve months. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, ID Logistics Group issued 6.3% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out ID Logistics Group's historical EPS growth by clicking on this link.

A Look At The Impact Of ID Logistics Group's Dilution On Its Earnings Per Share (EPS)

ID Logistics Group has improved its profit over the last three years, with an annualized gain of 63% in that time. In comparison, earnings per share only gained 49% over the same period. And the 25% profit boost in the last year certainly seems impressive at first glance. On the other hand, earnings per share are only up 16% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So ID Logistics Group shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On ID Logistics Group's Profit Performance

In conclusion, ID Logistics Group has strong cashflow relative to earnings, which indicates good quality earnings, but the dilution means its earnings per share growth is weaker than its profit growth. Based on these factors, we think that ID Logistics Group's profits are a reasonably conservative guide to its underlying profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Case in point: We've spotted 2 warning signs for ID Logistics Group you should be mindful of and 1 of these is a bit concerning.

Our examination of ID Logistics Group has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:IDL

ID Logistics Group

Provides contract logistics services in France and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026