ID Logistics Group's (EPA:IDL) Solid Profits Have Weak Fundamentals

ID Logistics Group SA's (EPA:IDL) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that shareholders have noticed something concerning in the numbers.

Check out our latest analysis for ID Logistics Group

Zooming In On ID Logistics Group's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

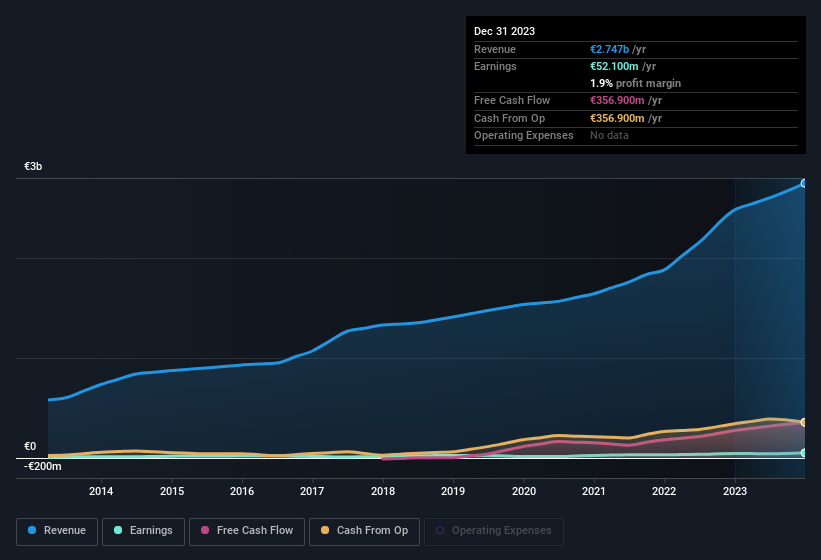

Over the twelve months to December 2023, ID Logistics Group recorded an accrual ratio of -0.44. Therefore, its statutory earnings were very significantly less than its free cashflow. To wit, it produced free cash flow of €357m during the period, dwarfing its reported profit of €52.1m. ID Logistics Group shareholders are no doubt pleased that free cash flow improved over the last twelve months. Having said that, there is more to consider. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, ID Logistics Group issued 8.4% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of ID Logistics Group's EPS by clicking here.

How Is Dilution Impacting ID Logistics Group's Earnings Per Share (EPS)?

ID Logistics Group has improved its profit over the last three years, with an annualized gain of 107% in that time. And in the last year the company managed to bump profit up by 15%. On the other hand, earnings per share are only up 14% in that time. So you can see that the dilution has had a bit of an impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So ID Logistics Group shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

How Do Unusual Items Influence Profit?

While the accrual ratio might bode well, we also note that ID Logistics Group's profit was boosted by unusual items worth €7.1m in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On ID Logistics Group's Profit Performance

In conclusion, ID Logistics Group's accrual ratio suggests its earnings are well backed by cash but its boost from unusual items is probably not going to be repeated consistently. Meanwhile, the dilution was a negative for shareholders. Given the contrasting considerations, we don't have a strong view as to whether ID Logistics Group's profits are an apt reflection of its underlying potential for profit. If you'd like to know more about ID Logistics Group as a business, it's important to be aware of any risks it's facing. Our analysis shows 3 warning signs for ID Logistics Group (1 is a bit unpleasant!) and we strongly recommend you look at these bad boys before investing.

Our examination of ID Logistics Group has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:IDL

ID Logistics Group

Provides contract logistics services in France and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026